In a March 11 op-ed for the Connecticut Post, Sen. Christine Cohen, D-Guilford, wrote that “All proceeds from [Transportation and Climate Initiative] will be deposited in the Special Transportation Fund lockbox to be invested in reducing transportation emissions.”

Similarly, Department of Energy and Environmental Protection Commissioner Katie Dykes said she believed TCI funds would be protected from legislative raids by the STF’s constitutional lockbox in an interview with CT Mirror.

However, these claims are not entirely accurate based on the legislative language or the governor’s budget proposal.

The Transportation and Climate Initiative would require gasoline producers and wholesalers to purchase carbon credits at auction. The proceeds of the auction will be forwarded to participating states to invest in green energy, climate justice and public transportation.

The state expects the program to bring in between $80 million and $110 million per year, but the funds will not be placed into the Special Transportation Fund, according to the governor’s proposed budget and the legislative language.

TCI funds will be deposited into a separate dedicated fund created under the umbrella of the Transportation Grants and Restricted Funds Account.

According to the authorizing bill, TCI funds will be deposited into a Transportation and Climate account “established by the Comptroller as a separate nonlapsing account within the Transportation Grants and Restricted Accounts Fund.”

According to state statute, the Transportation Grants and Restricted Accounts Fund “shall contain all transportation moneys that are restricted, not available for general use and previously accounted for in the Special Transportation Fund as ‘Federal and Other Grants’. The Comptroller is authorized to make such transfers as are necessary to provide that, notwithstanding any provision of the general statutes, all transportation moneys that are restricted and not available for general use are in the Transportation Grants and Restricted Accounts Fund.”

The enabling legislation — Governor’s Bill 884 — specifically indicates that proceeds from TCI auction sales “shall not be considered pledged revenue” to the STF.

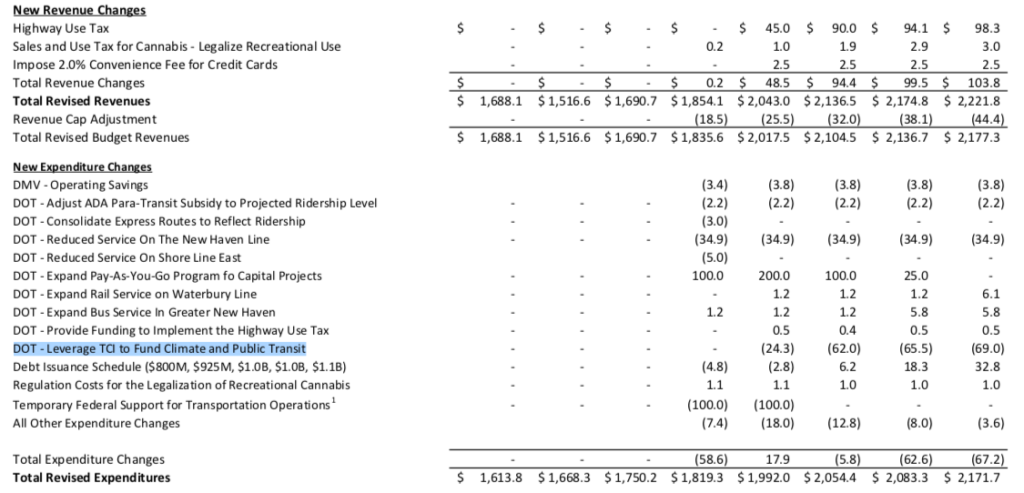

The governor’s transportation budget does not list TCI funds as revenue into the Special Transportation Fund, but rather as an expense reduction because TCI funds would be used to supplement public transportation costs.

Starting in 2023, Lamont’s budget shows an expenditure reduction of $24.3 million, growing to $69 million by 2026. There are no listed revenue changes in the STF from the inclusion of TCI funds.

TCI revenue will be invested by both the Department of Transportation and the Department of Energy and Environmental Protection with the approval of the Office of Policy and Management.

Thirty-five percent of the TCI funds will be “invested in a manner designed to ensure communities that are overburdened by air pollution or underserved by the transportation system,” under the advisement of an Equity Advisory Board. The equity board will be made up by stakeholders chosen by the commissioners of DOT and DEEP.

The legislation also allows for a maximum of 5 percent of the proceeds to go toward state agency administrative costs for Connecticut to reach its goal of reducing emissions to 80 percent less than 2001 emissions levels by 2050.

Why It Matters

Claims that TCI revenue will go into the Special Transportation Fund are meant to reassure the public that the money they pay in higher gasoline costs will actually go toward the intended purpose of lowering vehicle emissions and other climate initiatives.

Money in the Special Transportation Fund is protected by the constitutional lockbox, which was approved by voters in 2018 and prevents the legislature from sweeping funds out of the STF to close General Fund budget gaps, ensuring the money is spent on roads, bridges and transportation infrastructure.

However, the lockbox does not prevent the redirection of funds meant to go into the STF, as demonstrated by Gov. Lamont’s diversion of sales tax revenue from the STF in 2019 and 2020.

Connecticut’s long history of sweeping money from dedicated funds to bridge budget gaps is well documented and creates concern that TCI funds would likewise be used for things outside its intended purpose.

Conclusion

TCI revenue will not be pledged revenue to the Special Transportation Fund and instead will be placed in a new dedicated account. A sizable portion of the revenue will be used for environmental and climate justice goals with the remaining funds will off-set public transportation costs.

Money in the STF, according to state statute, “shall be expended solely for transportation purposes.” Since TCI revenue will not be used solely for transportation purposes the funds will have their own dedicated account. The Connecticut Department of Transportation says the Transportation Grants and Restricted Funds Account enjoys the same lockbox protections as the STF.

However, as demonstrated in the past, the STF’s lockbox protection can be bypassed by a future governor or legislature through the redirection of funds. The fact that the Transportation and Climate Account will have lockbox protection also means the it is subject to the same loopholes.

James Vansicklin

March 25, 2021 @ 10:42 am

WAKE UP CONNECTICUT THIS IS JUST ANOTHER TROTH FOR THE DEMORAT’S TO STEEL FROM, THIS MUST BE STOPPED!!!!!! VOTE NO TO ANOTHER TAX ON CONNECTICUT CITIZENS !!!! TELL THE LEGISLATURE NO,NO,NO!!!

Michael Czmyr

June 14, 2021 @ 7:32 pm

So sick of Democrats, wish they would go to Venezuela already, got my butt cheeks sqeeze enough. their moto, ( never like a crisis go to waste, steal from the hard working man), what gets me, All states reveived billions since the Virus, isn’t that our tax money they got back?.

Iris Castro

June 15, 2021 @ 1:43 pm

STOP THE CT GAS TAX!!!!

Jesse J Mackin

June 15, 2021 @ 8:38 pm

This demoncratic gov is really getting old! Stop wasting taxpayer money on your special interest or should I say padding your wallets …Off ours!,we taxpayers are tiring of paying for your wants..paying for others to sit out and get paid ..while there is work out there..man up! Act like Texas and florida..take away free money ..tell em..get a job..and you..you stop wasting our taxes Mr ct gov….man up be a real man like Donald trump..act on the states peoples behalf..not your own demon wants ..pffft like talking in the wind to you !