The new year will bring another round of wage increases for state employees and a new payroll deduction for everyone else, and House Republicans are calling of Gov. Ned Lamont to suspend both in light of the pandemic.

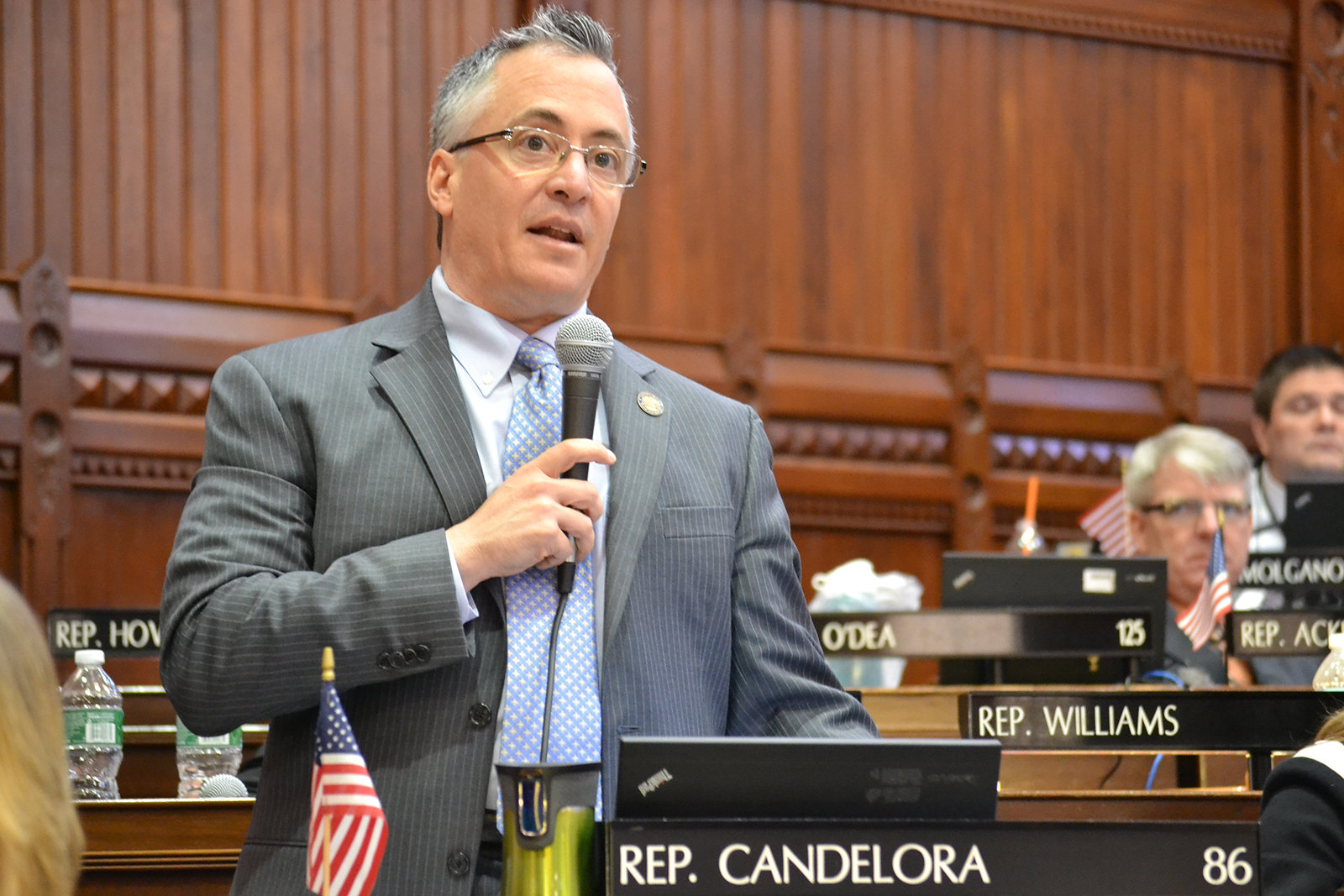

“Main street businesses are struggling under the weight of this pandemic, and their employees even more so. Meanwhile, state government chugs along unaffected—those non-frontline workers still have their jobs, they’re still collecting paychecks,” said House Minority Leader-elect Vincent Candelora, R-North Branford. “Letting these scheduled increases go through right now sends an awful message to Connecticut’s lowest wage workers and those hit hardest in this pandemic.”

The state employee wage increases in January are estimated to cost $34 million, part of an overall two-year $350 million wage increase set in place by the 2017 SEBAC agreement made between the State Employee Bargaining Agent Coalition and Gov. Dannel Malloy.

The agreement offered two general wage increases of 3.5 percent that went into effect on July 1 of 2019 and 2020, along with two step increases generally valued at 2 percent on January 1, 2020 and 2021.

In the lead up to the last general wage increase in July of 2020, Republicans called for Gov. Ned Lamont to suspend the wage increases. Lamont, at the time, said that he supported suspending the raises for non-frontline state employees but that the unions refused and there was nothing he could do because of the SEBAC contract.

Similarly, when the University of Connecticut asked unionized professors to delay their pay raises in order to save some the university’s sports programming, the union likewise refused saying they had sacrificed enough already after years of wage freezes.

The July wage increases came at a time when hundreds of thousands of Connecticut residents were put out of work due to Lamont’s executive order closing all non-essential businesses. The closures primarily affected low-wage workers in the restaurant and hospitality industry.

January will also see a new .5 percent payroll deduction for employees in Connecticut to support the state’s paid Family and Medical Leave program, although the benefits of the program won’t be available until 2022.

The deduction will apply to any employee working for a company with 2 or more employees, estimated at 1.7 million workers in Connecticut, but state employees are exempt from the payroll deduction. Lamont recently dismissed calls for delaying the FMLA payroll tax.

“It’s made worse by the fact that workers scheduled to receive the pay raises, such as unionized state lawyers, are exempt from the new payroll tax that’ll be paid by those in the private sector who worry every day about their job security,” Candelora said.

Connecticut’s job recovery from the pandemic shutdown has slowed and even slid backwards, with the last jobs report noting a loss of 1,600 jobs after months of gains.

Connecticut’s budget, on the other hand, is not quite as dire as original projections warned. Connecticut current fiscal year budget deficit declined to $640 million, bolstered, in part, by gains on Wall Street for Connecticut’s financial sector and the state’s tax on corporations.

However, the budget deficits for the future fiscal years remain hovering around $2 billion per year with Connecticut’s Rainy Day Fund balance at $3 billion.

That Rainy Day Fund balance has allowed Lamont continue to operate the state without making dramatic cuts or suspending scheduled state employee wage increases.

But the optics of state employees receiving wage increases and a new payroll tax during a time of high unemployment, business closures and the lingering threat of further business restrictions could linger for Lamont.

“Governor Lamont punted on the chance to delay pay raises in June as employers and workers came to grips with the financial impact of mandated business closures, guidelines, and restrictions,” Candelora said. “So many residents, and low wage workers in particular, need every dollar in their paycheck. We have to demonstrate to our business community and critical nonprofit providers that we grasp the gravity of the challenges faced by their employees and clients. This is an opportunity to do that—he should delay the raises and payroll tax.”

SHAWN HARDY

December 24, 2020 @ 6:56 am

The legislature should be looking into medicaid reform for residents in CT. Individuals with 6 figure assets are applying for title 19 and hiring elder law attorneys to hide their assets using loopholes. Millions of dollars of uncollected revenue from individuals who are required to pay applied income for homecare but do not but still receive medicaid services with out penalty or disruption.

Ernest P. ADDARIO

December 24, 2020 @ 10:50 am

NO WAGE I CREASE

NO FMLA

ESPECIALLY NO NEW GAS TAX OR ANYTHING ELSE You choose TO CALL IT !

Cherry

December 24, 2020 @ 1:04 pm

This governor needs to listen to this advise. Why is the private sector paying the salaries of lawyers who do nothing that benefits the connecticut citizens. THEy should also take pay cuts like the rest of us tax paying citizens. The private sector has either lost their job or has not had a pay increase due to this pandemic.

Another area of savings is to remove pensions BENEFITS for people who are not retirement age. It is ridiculous that a healthy 50 year old live off of CITIZENS of this state and then move out of the state and do not pay taxes in this state .

The CITIZENS of CT pay all of these taxes but can not retire at 50 , receive no pension and hope their 401k survives the economic upside and downs until we 65. It is outrageous the waste of money this state indulges in off the backs of the middle class citizen.

Now we have a pandemic. Every government official, including the Lamont should forgo a pay increase.

K.M Berman

May 21, 2021 @ 5:02 pm

Not advise. Advice.

James Long

December 24, 2020 @ 7:44 pm

Also he did not punt the lamont administration did not make a good enough offer to unions. So what you are saying we should work for free and not collect a check. These raised were negotiated with the Malloy administration

Kenneth

December 24, 2020 @ 9:44 pm

If state workers do not contribute to the new flma tax they should not be able to collect funds from the program. Enough with these unions, eliminate them now. Unions protect the lazy. Try running your own business in this ENVIRONMENT.

Lorenzo

December 27, 2020 @ 1:01 pm

“ So what you are saying we should work for free and not collect a check.”

James, i’m not suRe what article you read but i DIDN’T see that in this one.

(for some reason this is printing i full caps. That’s Not mY intention)

Michael Allen Riley

December 28, 2020 @ 3:57 pm

It seems to me, if the governor has the power to put it’s citizens out of business, he has the authority to override the union agreement !

Gina Blakeslee

December 28, 2020 @ 4:03 pm

Are you kidding me !!!! We have given and given for years now. I AM suffering from this pandemic also as my husband’s company went out of business (after the 600.00 stimulus to ucb ran out) so now you want to say I shouldn’t get my well earned raise just stop it now !!!!! State employees are part of the population suffering from this pandemic too.

jim flood

December 30, 2020 @ 7:54 pm

The hypocrisy of “we are all in this together” is the underlying cause for resentment by connecticut residents to state employee wage increases and guaranteed jobs at a time when private employers are closing up. Tell me which state worker lost their job because of the pandemic and i will consider retracting this statement. let me know which state employee forego raises in july and i will retract. but the greatly anticipated budget deficit in the $4 billion range due to decreased tax revenues from greatly reduced payroll taxes will come to bite all too soon. The justification that the raises were negotiated by the malloy administration has nothing to do with current pandemic economic reality

preston fletcher

January 8, 2021 @ 12:16 pm

it is remarkable to me that our supreme court has found no constitutional limits to our governor’s emergency powers used to justify the virus restrictions. On the other hand, the governor claims he simply doesn’t have the power to suspend pay raises for his employees because he is bound by a mere conract negotiated by Attorney Dannel Malloy.

It is not to be dismissive of any suffering state employees may be Enduring to point out that our government of the people is corrupted by the conflict of interest of our politicians on the receiving end of labor’s financial and organizing influence. Nor to point out that there is no guaranteed job or income for people associated with smaller businesses. Nor to point out that unless the business climate in this state is geared to facilitate private business rather than merely to tax and regulate it, there will not be resources to fund the pensions promised to the state employees by our fine elected public servants.