An initiative aimed at curbing gasoline usage and fighting climate change would cost the average Connecticut family $258 per year, according to an analysis conducted by the Ceasar Rodney Institute’s Center for Energy and Environment, based in Delaware.

That translates to $388.6 million per year in increased gasoline costs across the state.

The Transportation Climate Initiative essentially requires gasoline suppliers and distributors to buy carbon allowances for gasoline sold in participating states in the Northeast, including Connecticut.

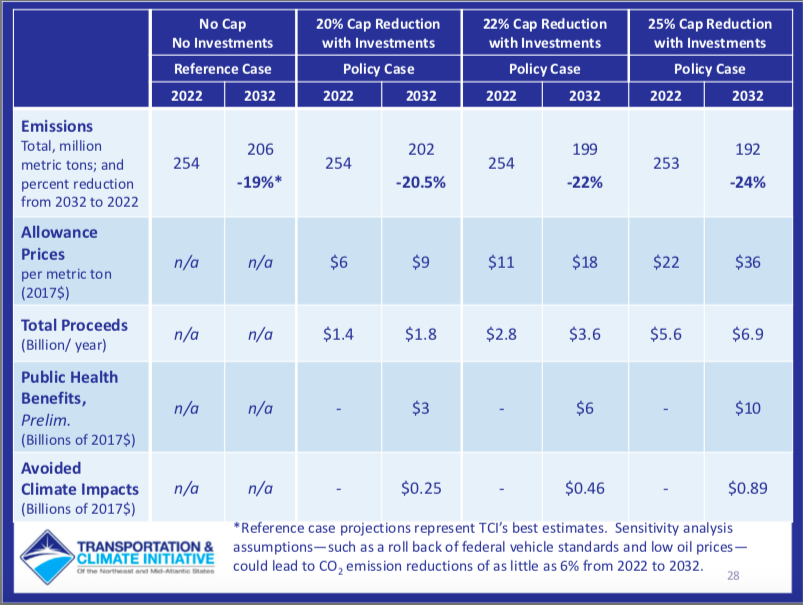

The purchase of allowances would be capped by TCI and could raise the price at the pump between 5 and 17 cents per gallon in the first year of operation, according to TCI’s own estimates. The price would then increase as TCI lowers the cap on allowances offered to gasoline distributors in the following years.

The cost to Connecticut drivers could rise to $450 per year if TCI implements the most stringent cap, according to the analysis.

According to David T. Stevenson, policy director for the Ceasar Rodney Institute, the price increase ranges between 26 and 41 cents per gallon between 2022 and 2032, with an average increase of 32 cents per gallon.

“The result is an average family cost per year across the region over the eleven-year forecast of $254 with a state range of $200 to $310,” Stevenson wrote.

Stevenson based his calculations on TCI’s cost per metric ton of carbon dioxide and estimated that over the course of eleven years, the average Connecticut family with roughly two drivers would pay an additional $2,842 in gasoline costs.

The figure was reached based on the average miles driven per household, estimated at 22,333 per year, and average gasoline consumption of 1,001 gallons per year.

New York was estimated to have the lowest impact on drivers, with an average increase of $200 per year, while Vermont had the highest cost impact of nearly $310 per year.

The Transportation and Climate Initiative was developed by numerous different policy and activist organizations and is attempting to implement a “cap and invest” system.

Under TCI, the allowances purchased by gasoline wholesalers and distributors would be used by participating states to invest in public transportation, electric vehicles, bike lanes and other climate justice initiatives aimed largely at cities.

According to TCI, carbon emissions are projected to decrease by 19 percent between now and 2032, even without further regulation or implementation of their cap and invest system.

The most stringent and expensive cap on wholesalers and distributors would decrease carbon emissions by an additional 5 percent but would also cost gasoline distributors upwards of $7 billion per year, according to TCI’s estimates.

In a September webinar presentation, TCI claimed the initiative would generate upwards of $3 billion in gross domestic product, 9,000 jobs and save between $3 and $10 billion in public health costs by lowering emissions.

Gov. Dannel Malloy signed onto the initiative in 2018 along with 12 other states.

New Hampshire has since backed out of the agreement and Vermont and Maine appear to be wavering on any kind of commitment.

Gov. Charlie Baker of Massachusetts, a long-time backer of the TCI plan, indicated that he is reconsidering his support of the proposal, according to the Boston Herald.

“We’re living at a point in time right now that’s dramatically different than the point in time we were living in when people’s expectations about miles traveled and all the rest were a lot different,” Baker said.

Road travel dropped off dramatically during the COVID-19 pandemic and some businesses are switching more heavily to work-from-home models.

Gov. Ned Lamont has not definitively said whether or not he would move forward with Connecticut’s participation in the program, and the COVID-19 pandemic largely pushed aside many other legislative and political issues over the past year.

During a press conference on Nov. 19, Lamont said “it’s something a lot of regional governors are thinking about and one of the ideas the legislature should be thinking about.”

“I’m sympathetic to realistic ways we can fix our transportation system because its key to our economic future,” Lamont said.

However, even without a regional gasoline tax through TCI, Connecticut residents could be looking at higher gasoline prices as some lawmakers have floated raising the state’s gasoline tax to bolster Connecticut’s Special Transportation Fund.

Connecticut has two taxes that apply to gasoline; one is a flat 25 cent tax on gasoline paid at the pump and another tax on oil companies based on gross receipts.

TCI indicates that its next steps include release of a final Memorandum of Understanding between participating states and that states “take any legislative steps that could be needed to implement the regional program and conduct rulemaking processes to adopt regulations.”

A coalition of 200 activist organizations issued a letter demanding governors to adopt the TCI plan on November 12 and called for the most stringent TCI cap “requiring at a minimum a 25 percent reduction in transportation carbon pollution over the next decade.”

The Ceasar Rodney Institute joined numerous other policy groups across the region in issuing an open letter opposing the Transportation Climate Initiative in December of 2019, labeling the plan as “poorly conceived, fundamentally regressive, and economically damaging.”

sandra lee oconnell

December 10, 2020 @ 2:18 pm

We cannot afford another tax. The electric rates have skyrocketted and now another tax to be able to drive to work. you will find a lot of people leaving this state. this is so out of control.

Thad Stewart

December 20, 2020 @ 4:00 am

If you voted democrat you voted for yet another crippling tax for the middle class. stop the insanity and vot libertarian and cut the glut gubment in half.

Yanil Teron

December 11, 2020 @ 11:02 am

what about the savings on medical cost due a reduction on gas emissions and protection of the environment? Isn’t the goal to protect the environment and the aggregate health of the country?

edwardjmax

December 17, 2020 @ 3:03 pm

Probably not.

Henry Karas

January 26, 2021 @ 10:25 am

The government in the state of connecticut is doing everything possible to drive people and business out of this state to other parts of the country where the cost of living is a lot more reasonable. unfortunately, they don’t have the willingness to say no when it comes to spending and are willing to sacrifice the hard fought earnings of the citizens of this state for their gross mismanagement of this state. No wonder why people want to leave.

larry

February 2, 2021 @ 8:40 am

this new gas tax, the proposed state property tax by looney, two recent huge tax increases and an incredible huge increase in electric costs have make this state unliveable. my family has already started looking to leave and as soon as we secure employment elsewhere we will leave (two high income earners who pay a lot in taxes). keep pushing out your taxpayers and you will be left with nothing but taxtakers. bye Connecticut!

Charles Rothenberger

March 26, 2021 @ 9:39 am

your link to the Ceasar Rodney Institute’s Center for Energy and Environment “analysis” simply directs people to a spreadsheet. That’s not an analysis, that’s a conclusion. Show your work!