State officials have warned that upwards of 44,000 businesses in Connecticut have yet to register for Connecticut’s paid family and medical leave program and could potentially face fines.

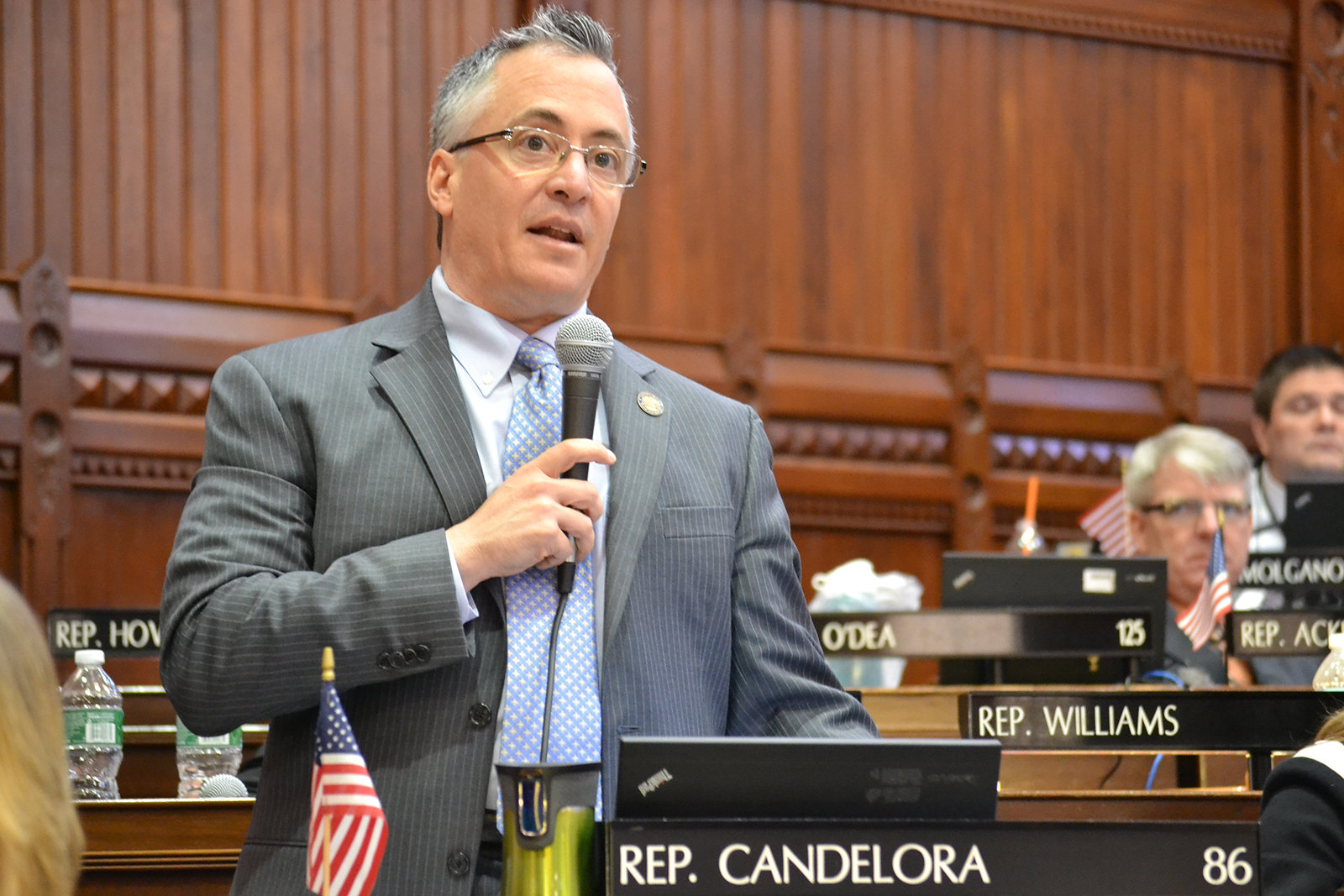

However, according to House Republican Leader Vincent Candelora, R-North Branford, the state of Connecticut itself is one of those businesses.

In a letter to Connecticut Comptroller Kevin Lembo, Candelora wrote that members of his staff have not had the mandatory .5 percent PFML paycheck deduction taken from their paychecks.

“Since this law applies to all non-unionized state employees, I’m concerned that this failure to make the required deductions is not limited to my staff alone,” Candelora wrote. “I am concerned that we are now two months into implementation of a program that our own government failed to comply with its provisions.”

Tyler Van Buren, director of communications for the Comptroller’s Office, says the state’s software system for administering payroll “proved incapable of accurately applying the deductions and a decision was made to delay the process until a custom-built solution could be implemented to ensure no ineligible employees would be charged.”

“The status of this process, and the decision to delay deductions, have been communicated to all statewide payroll officers several times since January,” Van Buren wrote in an email statement. “Non-union payroll deductions are now scheduled to begin in the second pay cycle of April and will follow Department of Labor guidance in applying a one percent catchup per pay cycle to meet the retroactive total back to January 1.”

The Paid Family and Medical Leave law was passed in 2019 with full support of Democrats in the legislature and Gov. Ned Lamont but opposed by Republicans and business associations.

The program is funded by a .5 percent employee payroll deduction and allows up to 12 weeks of paid time off for medical issues or to attend to a family member’s medical needs starting in 2022.

The law exempts state employees who are part of a union from paying the tax or taking advantage of the program. Roughly 94 percent of the state employee workforce belongs to a union, leaving 6 percent who should see a payroll deduction for PFML program, including legislative staff members.

Although the payroll deduction began on January first of 2021, employers have apparently been slow to register their businesses for the program and begin making the payroll deductions.

According to officials with the CT Paid Leave Authority, only 66,000 businesses have registered, leaving 44,000 unaccounted for.

“It’s outrageous that state government has yet to deduct a dime from the paychecks of its own employees while the paid family leave authority is urging private sector employers to comply,” Candelora said in a press release.

Funding of the program is critical to its survival as the amount of the benefit is determined by the amount of funding received through the payroll deduction. Too little funding means the program will pay a lower benefit.

Van Buren said the alternative to delaying the payroll deduction would have required each agency to manage its own deductions and it was decided that building a custom-solution was the better fix to ensure accuracy.

House Republicans have asked Gov. Lamont to delay implementation of the program to give businesses more time to comply and said the state’s failure to collect the payroll tax from its own employees is evidence the program should have been delayed.

“We’re troubled that we had to inquire about the deductions for non-unionized state employees—that it wasn’t a fact reported to the legislature,” Rep. Harry Arora, R-Greenwich, Ranking Member of the Labor Committee, said in the press release.

“Above all, transparency is critical to ensuring that residents can feel confident in this or any other state program,” Aurora said. “Given everything we know today, temporarily suspending the program to assess the current state of implementation and determine what’s needed to get this program firing correctly would be an appropriate move.”

K wolf

March 15, 2021 @ 7:14 pm

Legislators please repeal this unfair tax! Or apply it to all union employees in the state workforce. OR make it optional for all employees in the state. PRivate sector employees and non-union employees should not be mandated to pay a tax that state union employees do not have to pay. this tax is beyond unfair. it’s criminal.

Jesse

April 24, 2021 @ 6:42 am

Yankee Institute the paid lapdog of the right. Please find some real news.