The PCA Workforce Council contract passed by the legislature in 2018 requires the personal and bank account information of personal care attendants to be transferred to SEIU 1199 if the federal government ends automatic union dues deductions from Medicaid payments.

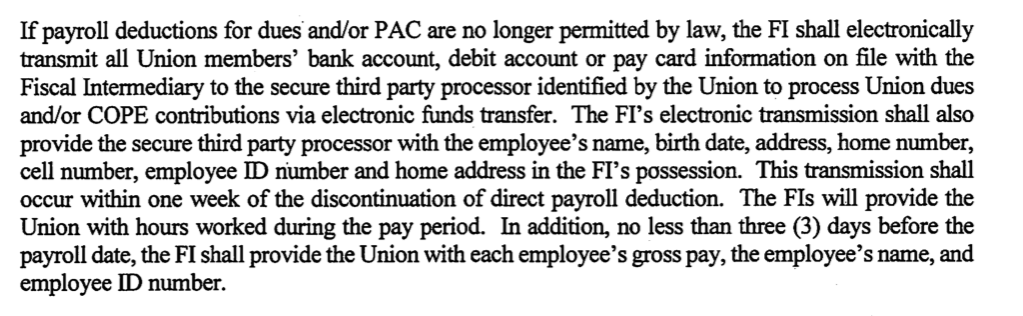

According to the contract, “If payroll deductions for dues and/or PAC (Political Action Committee) are no longer permitted by law, the FI (Fiscal Intermediary) shall electronically transmit all Union members’ bank account, debit account or pay card information on file with the Fiscal Intermediary to the secure third party processor identified by the Union to process the Union dues and/or COPE contributions via electronic transfer funds.”

The fiscal intermediary would transfer the electronic information — along with personal contact information — to the union within one week of any federal changes that would end automatic union dues deductions.

The previous contract contained no similar provision.

The possible transfer of bank account information appears to have been added into the 2018 contract as the Center for Medicare & Medicaid Services began a push to roll back the practice of third-party payroll deductions for Medicaid providers – known as “Medicaid dues skim.”

Authorization to deduct union dues and political donations from members’ bank accounts is now part of SEIU 1199’s membership form, according to the union’s website.

“In the event the PCA Workforce Council ceases payroll deductions, I authorize the Union to make withdrawals from my checking or savings account, in accordance with the authorization provided below,” the new membership sign-up reads.

The new contract provision acts as a third layer of protection for SEIU after CMS followed through with it’s rule change in 2019, which supposedly ended the deduction of union dues from Medicaid provider payments.

In response to the regulatory change, Connecticut Attorney General William Tong joined other states in a lawsuit against CMS and the Trump administration challenging the legality of the reform.

But, according the Department of Social Services, Connecticut has continued to deduct PCA union dues from Medicaid payment because the state uses fiscal intermediaries – Sunset Shores and Allied Community Resources – to process payroll deductions for PCAs employed through the PCA Workforce Council.

If all else fails, however, union members will have their dues and political donations deducted directly from their bank accounts and all their personal information will be transmitted to the union.

The added layer of protection for the union through direct withdrawals is important because, according to the Office of the Attorney General, Connecticut’s work-around has “yet to be formally established in litigation.”

The Attorney General’s Office has said it will continue to move forward with the lawsuit.

Although there are approximately 8,500 PCAs working through the PCA Workforce Council, union membership is optional and the Attorney General’s Office estimates there are roughly 4,300 dues-paying members.

The new PCA Workforce Council contract was passed as an emergency certification by the House of Representatives and the Senate in 2018.

The contract awarded raises to an estimated 8,500 PCAs, totaling $9.6 million in fiscal year 2020 and an annualized cost to the state of $11.6 million.

Although much attention was paid to the cost of raises, the contract also contained provisions that supersede state statute.

The contract provision that requires the fiscal intermediary to transfer PCAs personal and bank account information to the union was included in Article 17 of the contract, which is listed as superseding a state statute regarding requiring an employer to obtain authorization for employee payroll deductions.

Although PCAs employed through the PCA Workforce Council are technically employed by the person receiving services, the fiscal intermediary handles hour tracking and payroll deductions.

It is unclear how the union – if it were to track the hours and pay of PCAs to make deductions from their accounts – would fit into the process as it would also not be considered an employer.

New PCAs are required to attend a PCA orientation funded by $2 million from the state over four years, according to the contract. Although employers can opt-out of having a newly hired PCA attend the training and orientation, the PCA must still attend the thirty-minute union-pitch session of the orientation.

PCAs membership in the union is optional. PCAs can resign membership and cease having their dues deducted after the union informs the fiscal intermediary that membership has been cancelled.