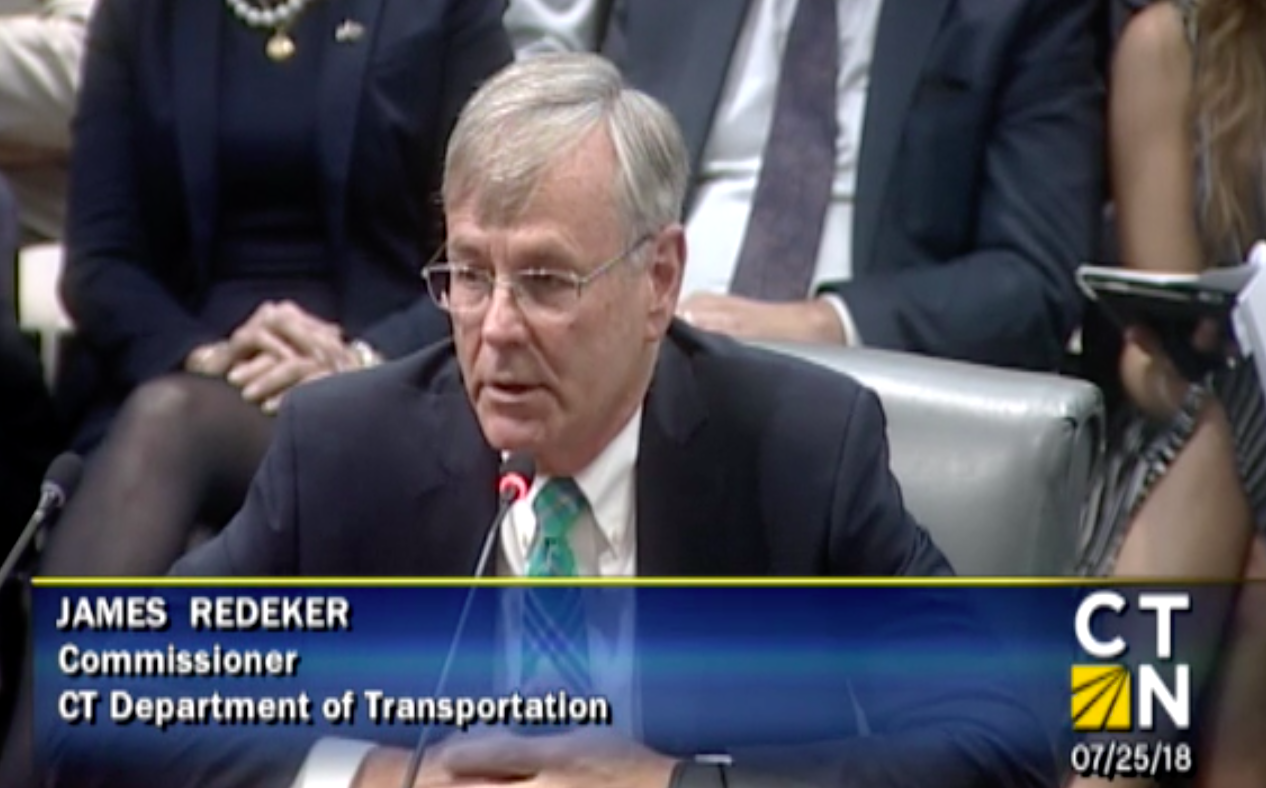

Department of Transportation Commissioner James Redeker said Connecticut could generate $1 billion in toll revenue by charging drivers 3.5 cents per mile during a July 25th Bond Commission meeting, which authorized Gov. Dannel Malloy’s $10 million tolling study, but his statements have been called into question by Sen. Len Suzio, R-Meriden, vice-chairman of Connecticut’s Transportation Committee.

In an email to the commissioner dated July 26 — one day after the Bond Commission meeting — Suzio wrote “I’ve reviewed the toll studies prepared by CDM Smith and could not find anything to support that claim. In fact, the rates assumed in those studies vary from $.09/mile to $.20/mile. Is there another report that I am not aware of that contains the information you cited yesterday?”

Despite several follow up emails, Suzio has yet to receive a reply from the commissioner, and the DOT did not respond to Yankee Institute’s requests for comment.

During the Bond Commission meeting Redeker said, “using one of the lowest rates in the country for a Connecticut E-Z pass tag, which is discounted heavily — with a frequent user discount as well for in-state residents and frequent users, as well — we think that a toll at about three and a half cents a mile… could generate about a billion dollars net revenue.”

“The numbers were shocking and not consistent with any of the studies,” Suzio said in an interview. “I think it’s very far-fetched to think Connecticut can raise $1 billion per year at 3.5 cents per mile.”

The most recent tolling study by CDM Smith estimated tolls between 10 and 20 cents per mile. At the low end, toll revenue would be $1.2 billion with 78 gantries on Connecticut’s interstates.

That figure increases to $1.6 billion if Connecticut installs 121 tolls all its highways, including Route 8 and Route 2.

The commissioner’s figure of 3.5 cents per mile appears related to a one-page DOT worksheet leaked to Hearst Media during the final weeks of the 2018 legislative session.

The worksheet posited toll rates ranging from 6.3 cents per mile to 7.9 cents, with discounts for drivers using a Connecticut E-Z Pass, which could potentially lower the rate to 4.4 cents per mile.

“He might very well be talking about effective rates which offer discounts,” Suzio said. “But it’s inconsistent with the 1,500 pages of consultant reports we’ve had so far.”

Redeker’s statements helped Gov. Malloy argue his case for bonding $10 million to complete tolling studies necessary for the Federal Highway Administration to approve tolls on Connecticut’s highways.

Malloy issued an executive order for DOT to conduct the studies after the legislature failed to vote on any tolling bills.

Sen. Joe Markley, R-Southington, filed an injunction to block the study, arguing it violates the Connecticut Constitution because the General Assembly did not agree to fund the study.

Depending on the November election, the tolling studies may be put to use or be much ado about nothing.

Although the Bond Commission approved the $10 million, the DOT will likely not find a company to conduct the studies before the election, which will usher in a new governor and legislature.

Andrew Roberts

August 17, 2018 @ 10:41 am

No one is looking at the cost of implementing the new toll tax compared to changing an existing tax. Let’s do a comparison study. Salaries, benefits, retirement for toll tax commissioner, new employees plus Infrastructure and maintenance costs or 50 years will be 100’s of millions. Compare to zero cost to change an existing tax.

joseph smith

August 17, 2018 @ 11:59 am

this is just another tax hidden by the tolls!enough already! people in conn are broke now! its a tax for working a job!

Paul Saffioti

August 17, 2018 @ 8:38 pm

Why do we need to waste 10 million on a toll study. Why doesnt the moron pick up a phone and ask one of the neighboring states how its working out. The state will be much better off when he is gone.

G.Simmons

August 18, 2018 @ 8:09 am

I hope to leave this draining state Soon. I am being bilked of every earned cent and taxed to death in Ct. Meanwhile the leadership is padding theirs and friends pockets living FREE and comfortable on my tax dollars. Most of the leadership is completely CLUELESS of how the piss poor Working class people struggle. A smart move would have been for revenue to be thought about BEFORE you, Mr.big shot chased BIG money, business ,and people out of Ct. You people are so stupid its scary.

Dan Zaborowski

August 18, 2018 @ 10:04 am

To much of what the Democrats shove down our throats is the Republicans that get on board with additional tax such as the passports to parks. I won 3 vehicles and charged $30.00 for all 3. I do not us e these parks during the peak season and how would I benefit taking all 3 at once. All the show cars are charged the same that so not enter the parks. Our Seniors that probably drive to the grocery store or Senior Citizen Centers. I just bought a newer use vehicle and that was added on no rebate from the other which I paid? Another useless tax and we pay for all the tractor trailers with tandems to use our roads. There has to be some compromise as our gas tax is out of sight. I will glad to pay for one passport to parks but shove this down my throat for 3 vehicles NOT. Let the voters decide not the Kangaroo Courts our elected officials

Joe Roque

August 24, 2018 @ 11:40 am

I agree with all the comments above this stupidity must be stopped . What a waste of our money, and one of these idiots said $10 million was a drop in the bucket!