The forthcoming Hallmark movie, “Christmas in Harlem,” may have wrapped up filming on Capitol Avenue in Hartford, but some of the biggest beneficiaries of Connecticut’s film tax credits may be a few blocks north.

Connecticut offers three kinds of tax incentives for movie making: the film production tax credit, the digital animation tax credit and the film infrastructure tax credit.

The credits began in 2006 as a way to lure movie and television film production to Connecticut, but film companies can sell their tax credits to corporations looking to reduce their state tax burden and no industry utilizes the credits more than Connecticut’s flagship insurance industry.

According to the Department of Economic and Community Development’s annual reports, over a ten-year period Connecticut issued $959.5 million in film production and digital media tax credits, film production infrastructure tax credits and digital animation tax credits.

During that same ten-year period Connecticut’s insurance companies claimed $581.8 million in film tax credits, amounting to 60 percent of the issued credits, according to a review of the Department of Revenue Services’ annual reports.

The credits were applied against the insurance premium tax – the tax Connecticut levies on insurance plans sold in the state. Insurance companies can use the film tax credit to offset up to 55 percent of their insurance premium tax.

Corporations can also use the film tax credits to offset up to 70 percent of their corporation business tax.

During the same ten-year time period, corporations claimed $308.8 million in film tax credits against Connecticut’s corporate business tax, although some of those corporations could also be film companies.

The film tax credits are sold by film companies to Connecticut corporations through brokerage firms that specialize in selling tax credits in states that offer them. For instance, Film Incentives Group, LLC, claims on its website that it sold over $21 million in Connecticut film tax credits in 2015.

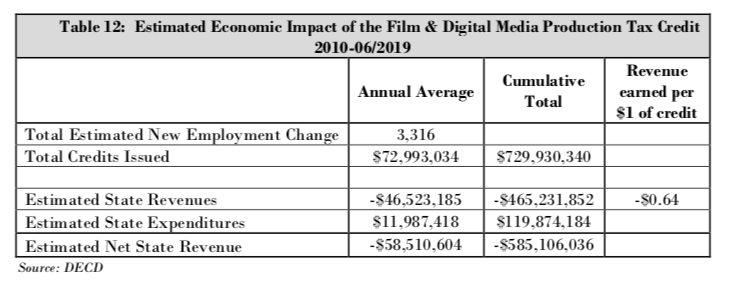

With the state awarding nearly $1 billion over ten years through its three television and film tax credits, the economic results are mixed, at best, and the DECD’s own reports find the credits have been a $772.8 million net loss for the state.

The report estimates that 4,632 new jobs were created on an average annual basis but notes that estimating the employment impact of the film credits on in-state employment is difficult and that many of those employed by film companies reside in other states.

The DECD report finds that “while there are gains in jobs, the additional revenues gained by the state do not compensate for the loss in state tax revenue due to the credits.”

Connecticut also lost Blue Sky Studios in 2021, when the Disney-owned company in Stamford closed down and laid off nearly 500 employees. The company had received $242.5 million in tax credits, but state auditors found that $66.8 million were improperly awarded to the studio. DECD disagreed with that finding.

A study conducted by the University of Southern California Sol Price School of Public Policy found film tax credits don’t result in increased economic activity or significant job growth.

According to DECD’s 2020 annual report, the agency has contracted with a consulting firm to study the economic impact of Connecticut’s film tax credits and said that it expected to receive the report by mid-2021 in order to make further recommendations.

James Hagan

October 4, 2021 @ 11:52 am

Thank you for the reporting, and no SURPRISE of course that The state of Ct

Loses or wastes tax REVENUE.

But with and endless “barrel” of money from apathetic taXpayers, there is no incentive for the state to make any changes.

And, to add “insult to injury”, the decd will spend more taxpayer dollars on a CONSULTANT, to tell The decd what they should already know, or should have known.

More money from the ned.ess barrel of taxpayer dollars.

Thanks Ned! Good work as usual.