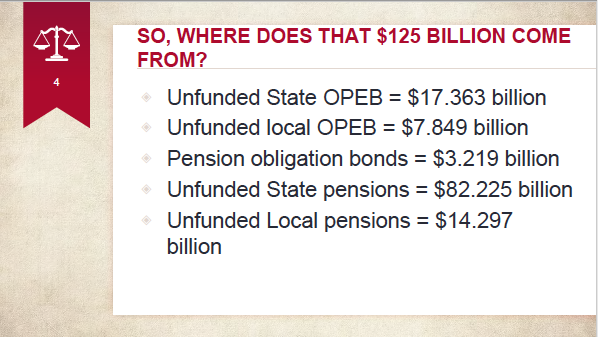

Connecticut’s total state and local unfunded pension and other post-employment benefits (OPEB) liability is a whopping $124.9 billion, according to an independent report delivered to the Connecticut Council of Municipalities.

Pro Bono Public Pensions, a nonprofit that advises state and local governments on pension sustainability, reported that the State of Connecticut faces $99.5 billion in unfunded pension and OPEB liabilities, while municipalities were on the hook for $22 billion.

The state’s portion of unfunded liabilities consumes nearly $2.5 billion per year in pension payments and another $1.2 billion in OPEB payments, according to the state’s latest valuation.

Those payments largely go pay off unfunded liabilities to support 99,594 active and retired state employees and 87,952 active and retired teachers, according to the Office of Fiscal Analysis.

The state also maintains pension funds for approximately 17,000 municipal employees and 493 judges, family support magistrates and compensation commissioners.

Pension obligation bonds accounted for another $3.2 billion, money governments borrowed to help boost pension funds.

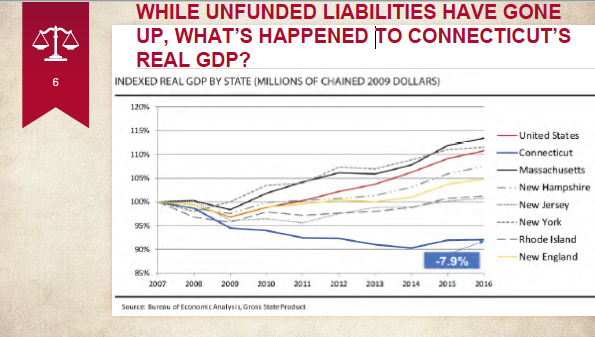

Another slide from the presentation show Connecticut’s real Gross Domestic Product has declined 7.9 percent since 2007.

Municipalities that were not part of the state Municipal Employee Retirement System on average paid between 96 and 97.2 percent of the annually required contribution toward their pension systems, but only 57.8 percent of the OPEB payments.

However, the author of the study warned that making full annual payments doesn’t necessarily increase the funded ratio for pension plans and that neither bonds nor the stock market is likely to help turn things around for Connecticut.

The report comes as CCM announced the creation of a new task force to tackle Connecticut’s property tax problems with a special focus on the state’s pension problems which continue to exert pressure on both state and local budgets by crowding out other spending, particularly education funding to municipalities and payment in lieu of taxes (PILOT) payments.

“The pension crisis is a significant issue for the task force because it’s a financial issue at the state level and will impact towns going forward,” said Kevin Maloney, director of communications for CCM.

A 2018 report analyzing municipal data supplied by the Office of Policy and Management showed per capita property tax revenue to towns and cities grew by 250 percent between 1981 and 2016, while Connecticut’s median income remained relatively flat.

Maloney said the property tax task force will be meeting over the next six to nine months to address Connecticut’s high property taxes and municipalities’ continued reliance on the property tax as their sole means of raising revenue absent state grants, which have been slashed in recent years to fill state budget gaps.

State funding for municipalities in the form of grants has become a hot topic in recent years as state budget problems have resulted in less grant funding for cities and towns, which face their own problems of rising costs.

PILOT grant payments have decreased by 35 percent since 2015, dropping from $83.6 million to $54.9 million, according to OFA, and sales tax revenue meant to be shared with municipalities has dwindled from $185 million in 2017 — less than was originally promised — to $39 million this year.

Meanwhile, a change in the education cost sharing grant formula has resulted in a reshuffling of money, reducing payments to some towns and increasing them to others, although OFA notes that fully funding the ECS grants in 2020 would require an additional $324 million.

Gov. Ned Lamont has yet to call a special session to approve a bonding package that would grant $60 million to municipalities for road repair which left municipalities digging into their snow-plowing reserves to pay for road repairs over the summer.

The state’s unfunded pension and OPEB liabilities are part of the fixed costs of Connecticut state government, which have been increasing rapidly and contributing to budget shortfalls.

According to the latest budget analysis by OFA, fixed costs are growing by over $500 million per year.

CCM and the Connecticut Council of Small Towns managed to fend off a push by Gov. Dannel Malloy and Lamont to foist part of the teacher pension payments onto municipalities in 2018 and 2019.

But the threat of future efforts by the state to either share the state retirement burden with municipalities or decrease grants — and the lack of major reforms for issues like binding arbitration — has sent municipal organizations scrambling to find revenue alternatives.

A 2018 study by Yankee Institute found that many Connecticut municipalities faced similar financial difficulties as the state: long term pension and debt problems, decreasing revenue and increasing costs.

ROY

November 21, 2019 @ 6:44 pm

Cut back cut back cut back …STOP GROSS SPENDING NO TO TOLLS NO TO TOLLS NO TO TOLLS. . STOP HOWDY DOODY FROM PUTTING US DEEP IN DEDT

Jim Bialy

November 22, 2019 @ 9:11 am

How can these outrageous contract pension benefits for state employees be binding when when they were paid for by union contributions (payments) to politicians reelection campaigns ? We need to void any contract agreement that involved “Contributions for contract deals”.

If the unions won’t work with the people of Ct to reduce benefits down to a reasonable level then we need to pass legislation today that States “All future state employee contracts must be voted on by the people of Ct and not some politician”.

JIM

Dan Hunt

November 23, 2019 @ 9:20 am

This fiscal mess is due to a bloated government which has expanded beyond the limited, enumerated powers expressly delegated to the State in the Connecticut Constitution with numerous unconstitutional departments and agencies. They must be eliminated and those powers restored to the people through their local governments. Any agreement entered into with union members in those unconstitutional departments and agencies is void since a contract cannot be established in violation of the law. Consequently the pension liability will be dramatically reduced and the money siphoned from the people and local governments by the State will restored to the the former two groups.

We will have not only a Constitutional State Government once again but one that will no longer be cost prohibitive to the people and therefore will be cost efficient. Until then, any other proposals are nothing more than smoke and mirrors.

Thad Stewart

November 24, 2019 @ 7:12 am

It is mind numbing to think that our elected officials know what the PROBLEM is, yet they REFUSE to fix the problem. Show me one middle class working family that would not love to tell their employer, “I can’t possibly do my job without getting more money from you”. Not very realistic, so then why do we allow this funny business to go on without any criminal consequences? Legislation needs to be passed to hold these politicians accountable. And while we are at it, NO more electing yourselves raises without the consent of the Connecticut voter.

Michael

November 25, 2019 @ 7:21 am

Connecticut needs tolls. Without them all of the expenses are paid for by Connecticut residents.

Very simple solution.

Patrick Henry

November 26, 2019 @ 11:48 am

95% will be incurred by CT residents that are already taxed to the point where those who can are LEAVING. This lunacy must stop.

Captain-Obvious

November 26, 2019 @ 12:49 pm

Ummm….. No. Connecticut needs to get rid of public unions and stop taxing people to death. No public employee deserves insanely generous and expensive to the rest of us pensions. Not economically feasible. Never was.

dan

November 26, 2019 @ 6:59 pm

we paid for all this with the largest tax increases in history who are u and what more can u give away without economic results.

art

November 25, 2019 @ 2:21 pm

people are not aware it seems that a teacher with 35 years gets 70% and 37.5 years 75%. Most end of career teachers are 95-110k so they will get 70k a year pensions for being phys ed, or k-8 or physics..makes no difference what they teach. No one will live in Conn to pay these taxes (for 45000 teachers) but even if they move to Florida Conn taxpayers will still owe them but not anyone who moves to a more responsible state (which is just about any except Ill, NY, NJ, Calif). Municipal underrated but just reading Conn Post many police close to 6 figure pensions in Bridgeport as well as Fairfield etc, even Firemen

Daniel Coleman

December 4, 2019 @ 5:52 pm

why does our governor and general assembly keep calling them pension obligations?…….that’s false…..why not use simple honest direct language……they are ‘pension freebies’ paid for by Ct taxpayers

Matthew Lawrence

February 7, 2020 @ 10:29 pm

Bring on the tolls….

Honestly, I commend all the cops/fireman/teachers for hustling the system. Please spare the narrative “you don’t deserve this bloated 70K annual pension at the expense of the tax payers.”

Yes they do. Just shut up and pay money up the rear so they can live a life of plenty.

Want to change it, vote conservatively.

Sadly, CT is a blue state.

John Doe

May 11, 2020 @ 7:19 pm

Retired Cops collection pensions. Collect free health care. Go and work full time for companies that offer health benefits but pass on the benefits because they get them free for life. Why isn’t the state going back to these double dippers and putting their health benefits on hold or why are they not forfeiting them when they get coverage with their new employer. Too many people in the wagon in CT and not enough pulling it. State Employee health benefits are free for those that got in with that wonderful benefit. Tired of listening to people brag about them.

rydhrdsgfsd fgbhnjmgkk

February 28, 2021 @ 12:49 pm

Funny how the same folks who don’t think a state worker (like a policeman or first responder) deserves all this money…but says nothing about the friends and family who got a nice retirement set up from Electric boat, pratt & Whitney, sikorsky, and every other defense contractor. How were these golden handshakes funded for our loved ones?

Oh, thru those $500 toilet seats and $200 hammers the Pentagon buys with your tax dollars. Please be sure to ask your grandparents to return your money 🙂

And who was it that let these unfunded pension plans thru? Rowland and REll….funny too that no one was complaining about this until democrats were in office. All the cheerleading was for a patriot football stadium…that turned out well.