Senate Republican Leader Kevin Kelly, R-Stratford, called on Sen. Richard Blumenthal to urge Democrats in the Connecticut General Assembly to reject the Transportation and Climate Initiative, which would increase the price of gasoline by forcing fuel wholesalers to compete for emission credits at auction.

In an interview with the Hartford Courant about the rapidly rising price of gasoline, which may hit $5 per gallon, Blumenthal said he was urging President Joe Biden to release some of the country’s oil reserves, saying the high prices affect lower and moderate-income families the hardest.

“Everybody pays it,” Blumenthal told the Courant. “It affects everyone regardless of their income. It has a very regressive effect. It impacts moderate and lower-income people more than higher-income because it’s a bigger portion of their daily expense and daily income.”

“Americans are concerned about the impact of inflation on their kitchen table economics, and a vast majority are already being hurt by rising prices on gas and food,” Kelly said in a press statement. “It’s completely out of touch for CT Democrats to continue pushing for a new gas tax which only worsens that situation.”

“I absolutely agree with Sen. Blumenthal’s comment that increases in gas prices hurt moderate and lower-income families the most. But Sen. Blumenthal has not backed up those words with action,” Kelly said. “He refuses to speak out against CT Democrats’ proposed gas tax. He ignores our calls to reject the new Connecticut tax and work on better solutions to reduce emissions on the federal level.”

Gov. Ned Lamont signed onto the TCI program’s final memorandum of understanding in December of 2020. Under the program, emissions from fuel sold in Connecticut would be capped and fuel wholesalers and distributors would compete at auction to purchase emission credits.

Half the money generated from the auctions would go the state, while the other half would to toward cities and be overseen by a climate justice advisory board.

However, the cost of the auctions would also likely be passed onto consumers through higher prices at the pump. The emissions cap declines year over year, but TCI and the governor’s office says that the price increase in the first year of the program would range from 5 to 9 cents per gallon.

Advocates for the program say that people are accustomed to wild fluctuations in the price of gasoline and so another 5 to 9 cents would likely go unnoticed, but as the price of nearly everything from food to fuel has seen sharp increases over the last year, the public may be more sensitive to the idea of Connecticut’s state government increasing the burden.

Earlier in the year, Connecticut Senate President Pro-Tem Martin Looney, D-New Haven, said the TCI program would also be regressive, hurting lower income people more than high-income earners.

Furthermore, the revenue from the TCI program would largely go toward building out Connecticut’s electric vehicle infrastructure and incentivizing electric vehicle purchases, which largely benefits residents in wealthy towns like Westport, who have benefited the most from Connecticut’s electric vehicle rebate program, according to data from the state’s CHEAPR program.

Gov. Lamont, the Department of Energy and Environmental Protection, environmental groups and a number of Democrat legislators pushed for the TCI program to passed during the 2021 legislative session.

Republicans fought against the measure, labeling it another gasoline tax and holding rallies at gas stations throughout the state.

The bill was never brought up for a vote during the 2021 session but will most likely be revisited during the 2022 session, and advocates have continually called for a special session to pass the measure before the end of the year.

“If Sen. Blumenthal stands by his words that increases in gas prices hurt to low- and middle-income families, then he needs to stand with us against a new gas tax. He needs to stand up to Connecticut Democrats,” Kelly said. “He needs to work with us on better clean air solutions that don’t take more out of our families’ budgets when they can least afford it.”

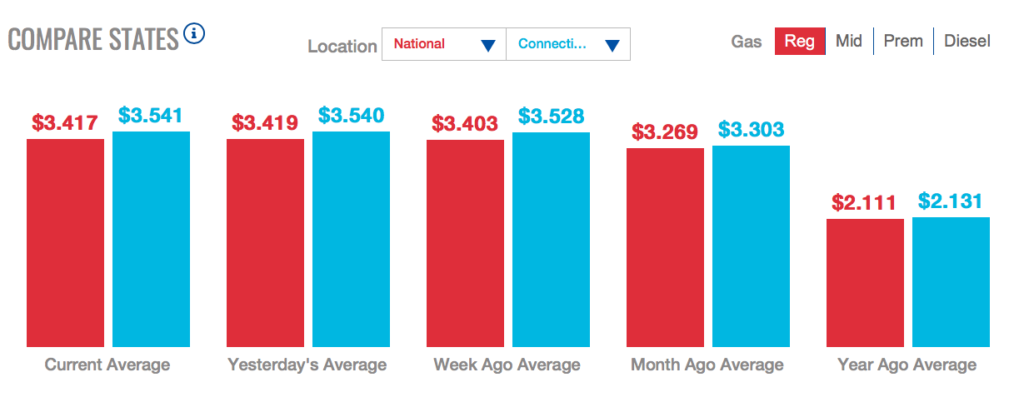

Average gasoline prices in Connecticut are at $3.54 per gallon, according to AAA, an increase of $1.41 per gallon over this time last year.

Dennis Michaud

November 18, 2021 @ 11:56 pm

CoConnecticut is expensive enough we do not need more taxes thank you