The University of Connecticut and UConn Health are pushing for legislation that would require the state of Connecticut to cover roughly $100 million in unfunded pension and retiree healthcare costs the institutions normally have to pay out of pocket.

The state of Connecticut made a $211 million block grant to UConn with an additional $187 million contribution toward those legacy costs in 2020, while UConn Health received $128 million block grant with an additional $166.7 million toward fringe benefits, according to their budget presentations.

However, the contribution is not enough to keep up with the ever-rising costs of the state’s $64 billion in unfunded pension and retiree healthcare liabilities, and the payments are driving budget deficits, tuition increases and a loss of grant funding at UConn and UConn Health, according to officials.

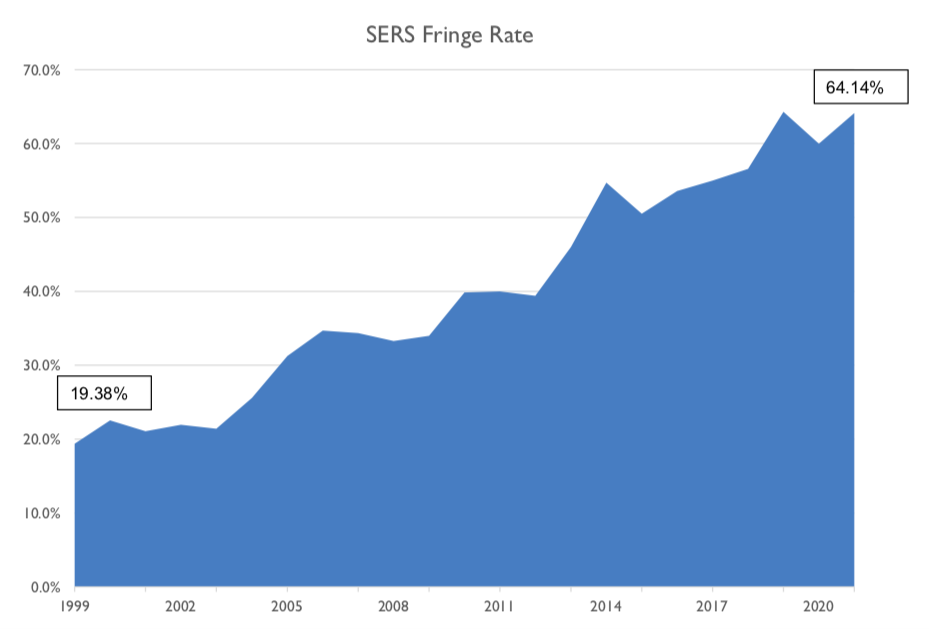

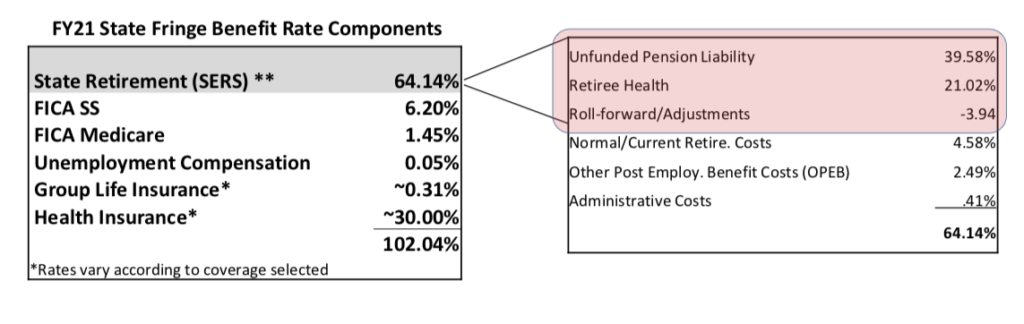

Connecticut’s employee fringe benefit rates are driven excessively high as the state tries to make up for those unfunded liabilities. According to the Comptroller’s Office, the typical, non-hazardous duty state employee fringe benefit rate is now 64.14 percent of payroll.

Combined with federal costs like Medicare, Social Security and unemployment compensation, the fringe benefit rate rises to 102.04 percent of payroll, essentially doubling the cost of each employee, according to written testimony submitted by UConn Chief Financial Officer Scott Jordan and UConn Health Chief Executive Officer Dr. Andrew Agwunobi.

These costs make research expenses 20 percent higher than UConn’s peers, 46 percent higher than other hospitals, and adds $850 in increased tuition onto students and their families.

“These are not costs we’ve created or have any control over,” Jordan said during a public hearing before the Higher Education and Employment Advancement Committee on March 9. “It’s a problem because it makes us uncompetitive, it affects our budget, it affects our students and their families.”

Jordan added that $27 million in UConn’s tuition and fees go toward unfunded pension and retiree health benefits. “That’s a cost we’re putting on students and their families that is not going toward their education, it’s going to the pensions of retired state and UConn employees,” Jordan said.

“The unfunded legacy costs the state expects UConn Health to fund from operations, they’re significant and they’re rising,” Agwunobi said. “Without these legacy costs, we would end each fiscal year either break-even or slightly positive.”

Instead, both institutions are facing deficits that have only been worsened by the COVID-19 pandemic.

“A sustainable solution is essential,” Agwunobi said.

The legislation would essentially require the state to cover the full cost of the state’s unfunded pension liabilities. UConn officials also asked that the legislation include retiree healthcare liabilities as well.

“This is a real critical issue and I also think it’s also a moral issue,” said Rep. Gregory Haddad, D-Mansfield, who shared the story of UConn researcher he knew personally that left the university because the unfunded pension costs hindered her research.

“I am appalled that students who are paying for a higher education, for a post-secondary education, at a public institution in Connecticut, are essentially being viewed as a mechanism to pay off unfunded pension liabilities,” Haddad said.

UConn’s testimony showed nine different researchers with $17.7 million in research grants who have left the university “due in part” to high fringe benefit costs undermining their work. The researchers left UConn for universities like the Georgia Institute of Technology, University of Florida and Yale.

Those research portfolios have since grown to $33.3 million, according to UConn’s testimony.

Connecticut’s unfunded liabilities for both pensions and retiree healthcare – also known as OPEB – are estimated at $64.7 billion, according to the most recent actuarial reports.

Both Gov. Ned Lamont and Gov. Dannel Malloy refinanced pension debt for state employees and teachers, stretching the payments out until 2045 to reduce the annual cost increases.

Nevertheless, the annual costs of the payment are expected to grow to roughly $2 billion per year for the State Employee Retirement System and $2 billion per year for the Teachers’ Retirement System. Most of those payments are due to the unfunded liabilities.

The state’s unfunded legacy costs have affected nearly every aspect of state government, from consuming the tax increases of 2011 and 2015, to increasing costs and tuition at state universities and community colleges, and even affecting the competitiveness of Bradley International Airport.

The Higher Education Committee voted unanimously to pass the bill.

**Meghan Portfolio contributed to this article**