CT Voices for Children, a public policy organization based in New Haven, released the first in a series of recommendations for mitigating the economic recession caused by the COVID-19 pandemic. Their recommendations included increasing the income tax rate on Connecticut’s highest tax bracket and increasing the size of Connecticut’s government.

“After years of restricting the size of the state workforce, the Connecticut government should increase its capacity as well as its accountability and oversight to ensure that all new emergency relief programs are administered in a timely and appropriate manner,” the report said. “Although tax revenues are declining, the state should not reduce its spending.”

The authors of the report called for increasing taxes on the top 1 percent of the income earners and on estates in the top 5 percent, while adding tax credits for lower income families.

“In managing the recession and recovery, the Connecticut government should increase taxes on the wealthy in order, first, to maintain spending and, second, to lower the disproportionate tax burden borne by working and middle-class families,” the report said, noting these increases could be either permanent or temporary.

During an online press conference, Emily Byrne, executive director of CT Voices, and research and policy fellow Patrick O’Brien, Ph.D, said that government spending stimulates the economy and that for every dollar of government spending there is a $1.50 in increased economic activity.

“The economic boost of each dollar in government spending is greater than the economic drag of each dollar in taxes,” O’Brien said. “The economic boost of each dollar in tax benefits for the lower and middle economic groups is greater than the economic drag of each dollar of taxes on the wealthy.”

The report also called on the state to use the Rainy Day Fund to keep government spending at current levels, which the state is likely to do in the near future, considering the budgetary and economic implications of the downturn and forced closure of businesses.

The call for increasing taxes on Connecticut’s wealthy residents is one that has been pushed for years not only by CT Voices for Children but by the House Progressive Caucus and Connecticut’s government union leaders.

Since the 2008 Recession, the income tax rate for Connecticut’s top income tax bracket has increased from 5 percent to 6.99 percent over a series of three tax increases by Gov. M. Jodi Rell in 2009 and Gov. Dannel Malloy in 2011 and 2015.

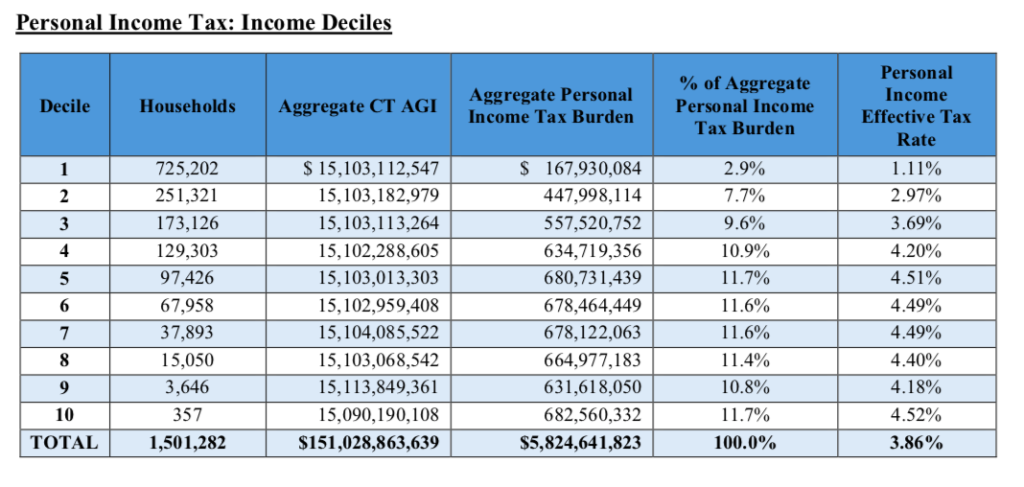

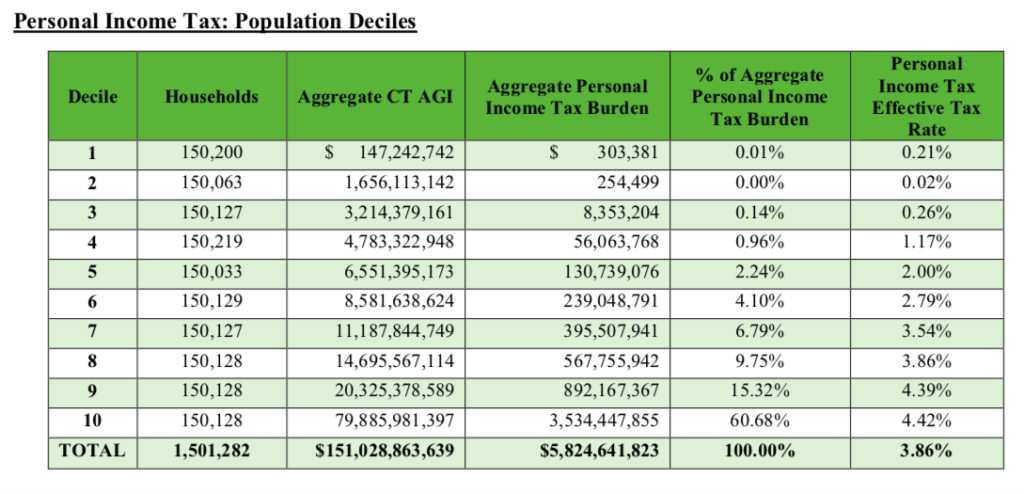

According to the 2014 tax incidence study, the wealthiest 357 families in Connecticut paid 11.7 percent of the total personal income tax burden for the state. By another measure in the report, the wealthiest ten percent of income earners — those earning $165,394 and up — paid 60.68 percent of the income tax burden.

The tax incidence report was last published in 2014 and did not include the 2015 tax increase from 6.7 percent to 6.99 percent on the top income tax bracket. Although the tax incidence report is supposed to be compiled every two years, the government has continually cut it from the budget.

In previous presentations, CT Voices for Children has focused on the effective tax rates of those top earners when accounting for all of Connecticut’s taxes, including sales and property taxes, noting that they effectively pay a lower tax rate as a percentage of income than the working or middle-class residents.

Connecticut has experienced a net loss of high-income residents, according to figures from the Internal Revenue Service which tracks state migration based on income, with the highest income bracket listed as earning over $200,000.

In 2015, Connecticut saw a net loss of 2,050 tax filers earning over $200,000 per year, which resulted in a total net loss of $2.6 billion in adjusted gross income.

The most recent data from the IRS showed a net loss of 1,519 income tax filers earning over $200,000, resulting in a loss of $574,9 million, half of the $1.1 billion net loss of adjusted gross income.

Wealthy investors such as Paul Tudor Jones, Barry Sternlicht and Edward Lampert have also departed Connecticut, largely for Florida which draws the largest share of Connecticut residents who move out of state.

CT Voices’ report, however, disputes that people move because of tax rates, particularly the wealthy, citing a policy study by the Economic Policy Institute.

“In regard to flight of high-income households, most migration decisions seem to be made for reasons other than taxation (housing prices are a large factor), and while some small increase in out-migration following tax increases is possible, the evidence is clear that… raising taxes is a better strategy for closing state budget shortfalls than cutting spending,” the report says.

Gov. Ned Lamont has thus far resisted calls for increasing the tax rate on top earners, including increasing the capital gains tax or adding a surcharge to financial services, as did Gov. Dannel Malloy at the end of his term.

Yankee Institute President Carol Platt Liebau responded to the calls for higher taxes and expanding the government workforce.

“We have seen three major tax increases – including raising taxes on the wealthy and businesses — since the 2008 recession, and since that time our state has experienced more major budget deficits, some of lowest job and economic growth in country and the outmigration of residents to other states,” Liebau said. “It is not government workers who are out of jobs and not getting paychecks, it is those in the private sector, the very people whose taxes pay for this government and whose lives depend on the ability to earn a living.”

Connecticut had only just recovered all the private sector jobs lost during the 2008 recession, whereas neighbors like Massachusetts had recovered 350 percent of lost jobs. Connecticut’s annualized personal income growth trailed the rest of the country between 2007 and 2017, according to Pew Charitable Trusts.

The Voices for Children report also included recommendations for the federal government, such as maintaining interest rates at zero, providing more fiscal support and not attempting to reduce the deficit until the country returns to full employment and that deficit reduction should be accomplished through “an increase in progressive taxes, not a reduction in spending.”

Byrne said she hopes these measures will prevent a recession from becoming a depression.

Wylmina Hettinga

April 5, 2020 @ 3:51 am

The Voice for CHILDREN recommends increasing the size of the state government FOR CHILDREN??? During a shelter in place where the only ones left to protect the CHILDREN are their families???! The state governments have separated more citizen’s children from their parents than all of our past Presidents combined and you want PARENTS to pay more to the STATE for CHILDREN??? We don’t trust you with our CHILDREN! You need to go and re-think this and this time ask PARENTS what is best for THEIR children before you post again. I guarantee that it won’t be to give the state more money.

Thad Stewart

April 5, 2020 @ 8:33 am

Why are people so afraid of personal accountability? Why is it someone else’s responsibility to take care of you and your family? It is time for some people to put their big boy pants on and do what needs to be done, and STOP complaining.