During his hour-long interview with WTIC 1080, Gov. Ned Lamont fielded questions from callers, one of whom questioned why the state diverted $170 million in vehicle sales tax from the Special Transportation Fund.

The governor denied that funds had been diverted, labeling it a “myth.”

“That’s a myth that gets perpetuated day in and day out and there’s just no truth to it,” the governor said. “What people are referring to in the car tax and starting in 2017, that car tax used to go into the general fund, we started putting it in the transportation fund… that is still happening, there’s no diversion taking place, so you can put that to rest.”

Similarly, in a press conference at the Capitol, House Speaker Joe Aresimowicz, D-Berlin, said he was tired of hearing that the state had diverted funds away from the STF and that he wanted to address “honesty” in the public.

“It has to stop, all these accusations of past acts by the legislature and what we’re going to do moving forward,” Aresimowicz said. “They talked about us misappropriating the STF, even this year, we all know that didn’t happen. It didn’t happen. We changed the structure, but we never went in and took the money out.”

Although Aresimowicz is correct that the legislature did not take funds out of the STF this year – the STF is protected with a constitutional lock box – the legislature and governor did divert $171.6 million in vehicle sales tax revenue away from transportation fund and into the General Fund.

It’s quite literally in the budget.

The bi-partisan budget passed in 2017 sought to bolster the transportation fund at a time when Gov. Dannel Malloy was calling for numerous tolls on Connecticut highways to pay for his extended infrastructure plan called “Let’s Go CT.”

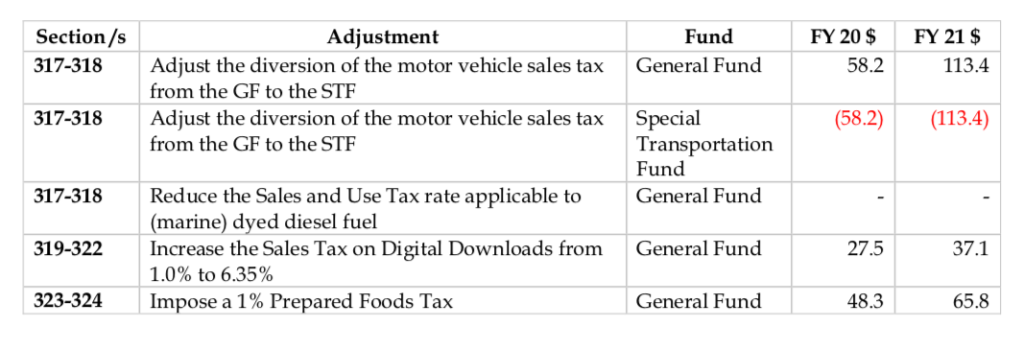

According to that budget signed into law, sales tax revenue from vehicle purchases would be transferred from the General Fund into the STF, ramping up from 8 percent of vehicle sales tax revenue in 2017 to 100 percent by 2024.

Beginning in 2020, the vehicle sales tax transfer was supposed to be 33 percent of revenue, growing to 56 percent by 2021.

When Lamont released his first budget proposal in February of 2019, however, he sought to freeze the transfer amount at 8 percent, which would have short-changed the STF by $1.19 billion.

Because the sales tax revenue would not already be in the STF, it was not protected by the lock box. The proposal was also not considered a “raid” or a “sweep” of the STF, which was no longer possible under the lock box, but rather a “diversion.”

The legislature, in their drafting of a budget, adjusted the governor’s withholding of vehicle sales tax revenue from the STF. Instead of freezing it at 8 percent indefinitely, the legislature decreased the amount of the transfer in 2020 from 33 percent to 17 percent and in 2021 from 56 percent to 25 percent.

That resulted in $171 million less into the transportation fund over 2020 and 2021.

Since Connecticut has a biannual budget, years 2022 through 2024 of vehicle sales tax transfers were left untouched. Democrats likely recognized the optics of the diverting money away from the STF when leadership was claiming tolls were needed to fund transportation.

But that doesn’t mean the same thing can’t be done in the next budget-writing session.

Because vehicle sales tax revenue is deposited first into the General Fund and then transferred to the Special Transportation Fund, leadership and the governor can claim they are still putting money into transportation – just not as much as the 2017 budget had allocated – and they can say that all the vehicle sales tax revenue will eventually be put into the STF, provided there are no future budget changes.

But they can’t deny that $171 million of vehicle sales tax revenue that was supposed to go into the STF in 2020 and 2021 under previous law was diverted to the General Fund in the latest budget.

And at least one Democratic senator said he wasn’t pleased with the revenue diversion.

Speaking at the Wilton Library on June 17, Sen. Will Haskell, D-Wilton, answered the exact same question addressed to Lamont during his radio interview — why the legislature diverted part of the vehicle sales revenue — but gave a much different answer.

“It was certainly not something I was pleased about in the budget as an advocate for tolls and an advocate for greater transportation funding,” Haskell said. “In the future, I do not think we should be diverting money that’s supposed to go into the transportation fund.”

Meghan Portfolio contributed to this article

Pete Ross

January 16, 2020 @ 2:13 pm

I thank the Yankee Institute for making this issue clear. This is a perfect example of how Democrat politicians word smith the truth to fit their agenda. This is typical of how the citizens of Connecticut have been lied to over the years which resulted in the dismal financial situation the state is currently in. I can only hope these manipulative politicians are voted out of office and replaced with citizens that represent the will of the people – which is “no more taxes” and “reduce the size of government”.

Donald Lavallee

January 17, 2020 @ 6:26 pm

Diverting monies and reducing % of monies going into the STF is still moving monies from one coffer to another. I don’t care how you explain it.

Ben Frank

January 19, 2020 @ 8:19 pm

It’s amazing how “simple” the governor and his minions believe the people of Ct are. He continuously lies and covers it up by a simple denial. Then his minions back him up believing that nobody will look into it and it’ll go away. Time for the people of this once great state to stand up and vote him out, despite the votes he’s buying via promises to the lower class voters of Hartford, Bridgeport and New Haven.

Bob Sachse

January 20, 2020 @ 1:27 pm

Time to Impeach him POS

Thad Stewart

January 22, 2020 @ 8:10 pm

The politicians of this state have borrowed continuously against the union pension fund for decades. Not paying back a dime. It is they who need to fund the pension liability, with pay cuts, cutting gubment waste across the board, and sitting down with the unions and negotiating a deal that every taxpaying citizen can live with. You can not TAX your way to prosperity.

Mike Henderson

January 23, 2020 @ 6:39 pm

Pants on fire Gov! Maybe try the truth for one…at least one time!

Mary Bagnaschi

January 24, 2020 @ 4:38 pm

Since most, if not all, of the Auditors at CT Auditors of Public Accounts are not even certified public accountants and therefore have no license to file complaints against that agencies complicit rubber stamp approving every state and quasi state agency they ‘audit’ without having the licensure credentials to do so, is it really a continued surprise that CT continues to rank amongst last in every economic forecast that Yankee Institute and other news organizations have reported but for what? Ask John Geragosian about this, he heads up the State Auditors of public accounts but neither he or his counter part Robert Kane about the accounting budget discrepancies and how many, including them, are certified public accountants. Geragosian was a state rep for years, ensuring legislation did not warrant such licensure requirements for auditors of public accounts. This is social engineering at its finest for the socialist communists running this state right into their long planned shit hole state all in the best interest of the state employees, not for the citizens they get elected and paid to serve.

Liss

February 2, 2020 @ 1:53 pm

Why don’t we just release inmates and fill governmental seats with them?

I mean let’s face it pretty much everyone in our state government is a criminal anyway and if he or she isn’t a criminal when they get into office, they will be before their term is up.

According to the Vera Institute for Justice, data from the year 2015, Connecticut has the highest yearly inmate incarceration cost of the nation. It costs an average of $62,000 a year (in 2015) to house and maintain just one inmate.

So let’s let inmates work in the government for free instead of doing prison time and save all that money.

Well it won’t be saved it’ll just be more money that can be inappropriately diverted.

With 16,347 people incarcerated in our state costing $1,016,118,399 annually,

*Over one trillion dollars per year*

let’s use that money to clean up our oceans, forests and all the other destruction we’ve done to our climate and use the existing criminals instead of paying new ones.

They can’t possibly do things any worse than what is already going on.