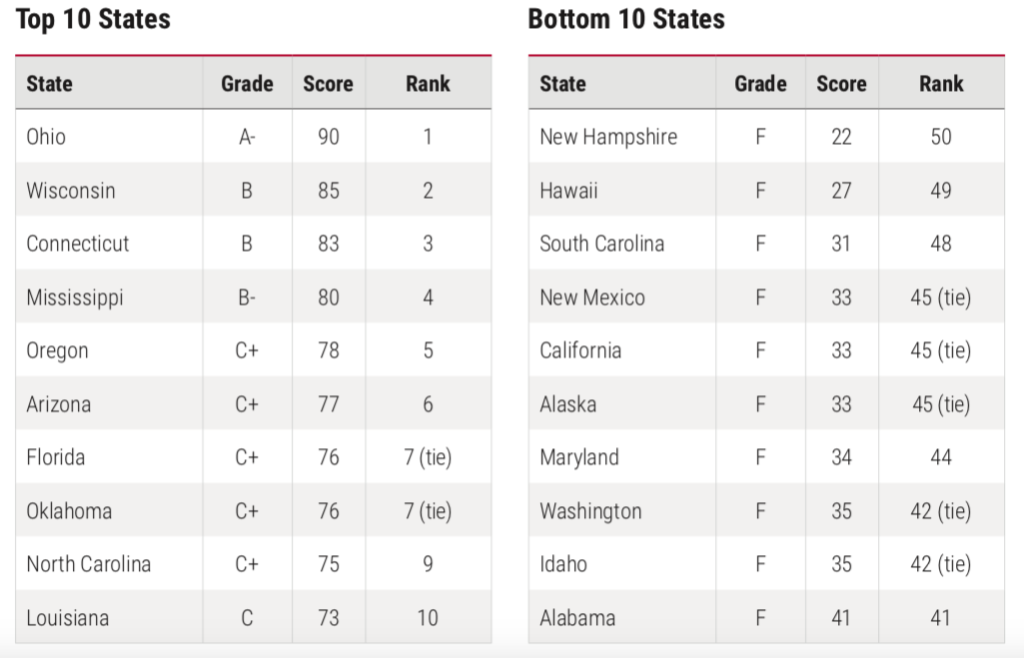

Connecticut received a “B” rating in a new report that ranks states based on the transparency of economic development incentives given to businesses to either move into, or remain, in the state. It was the third highest grade in the United States.

The report issued by Frontier Group and U.S. PIRG notes that Connecticut was one of only three states to include “itemized grant payments to companies in their online spending portals,” and one of six states to “publish a comprehensive, statewide report detailing economic development spending of all active programs.”

The report was touted by State Comptroller Kevin Lembo who, in 2017, pushed for legislation requiring an audit of the Department of Economic and Community Development’s annual report on economic incentives — a push that was backed by a diverse group of organizations.

The initial audit of DECD’s annual report showed the department had reported misleading figures, either inflating or deflating the economic and job impact of the incentives.

“Our state invests hundreds of millions of dollars every year in economic development, and so taxpayers and policy makers deserve to know the return on investment,” Lembo said in a press release. “This report, the first of its kind to emphasize economic development investments, acknowledges the strides Connecticut has made over the last several years to ensure that the state’s economic development investments are openly reported to the public and receive the oversight and analysis they deserve.”

According to the DECD’s 2018 annual report, the agency has awarded $1.3 billion in economic assistance to companies from 2009 to 2018 through the Manufacturing Assistance Act and the Small Business Express program.

The First Five Plus Program, which began under Gov. Dannel Malloy, has awarded $502 million to large corporations in the form of low interest loans, grants and tax credits since the program’s inception in 2011.

Part of the First Five funds are paid through the Manufacturing Assistance Act.

The DECD says the economic incentive packages spur job growth and private investment, but, despite their efforts, Connecticut’s job and economic growth has remained stubbornly slow since the 2008 recession.

Connecticut experienced 4 percent job growth over the last decade, compared to 15 percent for the country, according to Hearst columnist Dan Haar. Connecticut’s gross domestic product actually shrank by .5 percent, while the rest of the country grew 19 percent during that same time period.

A 2019 study by Yankee Institute found that Connecticut gave away more money in economic incentives per year than it took in through its corporate tax. Nearly all the loan and grant money given to businesses by the state is bonded, putting taxpayers on the hook for interest payments.

Connecticut also saw the loss of some companies who received state assistance, including Alexion Pharmaceuticals, which decamped for Massachusetts.

David Lehman took over as DECD commissioner under Gov. Ned Lamont and says the department is reforming the way in which it offers economic incentives; companies will have to produce job growth first before receiving the development package, an “earn-as-you-go” approach.

Whether the new approach creates better results for the state’s economic incentive packages remains to be seen, but oversight will continue.

Lembo remarked that Connecticut is “a leader on open government,” and the comptroller has worked to produce Connecticut’s Open Checkbook website, which enables the public to look at state spending and revenue online.

Economic incentive packages for companies, and their results, can be viewed on Connecticut Open Data website.

“I look forward to continuing our work with open government advocates, state auditors, economic development officials and legislators with the goal of making Connecticut the most open and accountable state in the country,” Lembo said.

Bill Fotsch

January 16, 2020 @ 9:27 am

Was the report transparent about how companies are leaving Connecticut due to the anti-business government policies and high taxes? If not, I think the reporting agency should reconsider its report on transparency… The good news is, regardless of the report, these problems are widely known.