A new report released by Chicago-based Truth in Accounting ranked Connecticut dead last in the country for fiscal transparency, but that score isn’t sitting well with the Office of the Comptroller.

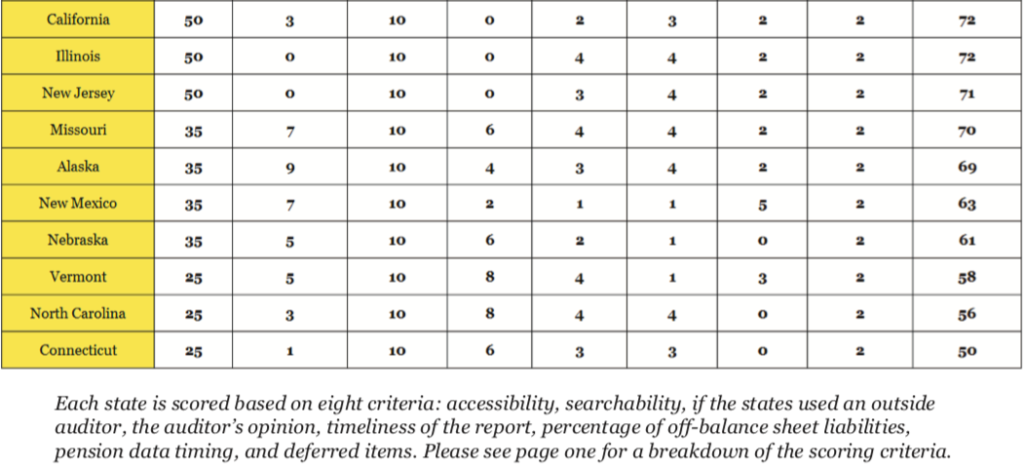

According to TIA, Connecticut’s score improved six points over last year, scoring a 50, thanks to a “timely release of the state’s Comprehensive Annual Financial Report,” but was still behind North Carolina, which scored a 56.

“The state does not prepare a CAFR for its largest pension plan and uses a state official, the state auditor, to audit the state’s CAFR,” the study says. “Connecticut’s net position is also inflated by $8.2 billion, largely because the state defers recognizing losses incurred when the net pension liabilities increase.”

The study scored states on eight different metrics, including having an independent auditor review state financial reports, reporting all retirement liabilities without deferring them, timeliness of the reports and ease of access to those reports.

The Office of the State Comptroller, which is charge of compiling and publishing Connecticut’s financial reports, disagreed strongly with the assessment.

Tara Downes, spokeswoman for the comptroller’s office, said Connecticut produces a statewide CAFR and actuarial reports on its pension system, which are found online.

“Truth in Accounting has failed to demonstrate what information is provided in other states’ pension CAFRs that cannot be easily accessed through our existing reporting and transparency system,” Downes said in an email. “The reasoning and basis for their scoring methodology lacks transparency, so it is unclear whether their scoring is actually related to state transparency or if it’s driven by other motivators.”

The comptroller’s office has made strides in bringing government transparency online in recent years, particularly with its Open Connecticut website, which allows taxpayers to search through state agency spending and revenue, as well as search state employee pay and pension information.

But this is not the first time Truth in Accounting has faulted Connecticut’s fiscal reporting in the past, pointing out that unfunded retirement debt has previously been underreported.

Truth in Accounting’s 2018 report said Connecticut had underreported its OPEB liabilities by $10 billion but – like every other state – would have to conform with accounting standards put forward by the Government Accounting Standards Board, which will increase the amount of reported debt.

According to Connecticut’s latest pension and OPEB valuations, the state has a total $35 billion in unfunded pension debt and another $20.7 billion in unfunded OPEB debt, but numbers can differ depending how they are calculated.

A recent report from the Connecticut Conference of Municipalities placed the total pension and OPEB debt for both the state and local governments at nearly $125 billion.

Either way, the state has made little headway in reducing the unfunded obligations in the past ten years despite making full annually required contributions toward the pension debt. Unfunded debt ratios have increased and the escalating costs are putting pressure on Connecticut’s budget.

“State governments have historically struggled to provide the public with meaningful information about their financial health,” said TIA founder and CEO Sheila Weinberg in a press release. “We have seen reporting efforts hampered in the past by conflicts of interest, out of date information, and slow publication.”

Weinberg said this year’s report attempted to highlight states that were doing a good job on fiscal transparency. The top scoring state was Idaho, which scored 88 points.

Massachusetts and New York scored 84 points and 83 points, respectively.

Christine

December 2, 2019 @ 10:56 pm

What a surprise. Not.