Who benefits from pensions?

Imagine 100 teachers are hired by a Hartford, Connecticut school district, all of them are age 25, they are all women, and all hold a master’s degree. What percentage of them will benefit from the pension system and, of that percent, who benefits the most?

According to a recent research paper published by the Yankee Institute for Public Policy, only 48 percent of the hypothetical teachers would receive any benefit from the Connect Teacher Retirement System. Most teachers will experience some life event, such as a career change, having a child, moving to another state, that will end their employment before becoming invested in the Teacher Retirement System. For these teachers, a defined contribution plan, like a 401(k), with an employer match would be more beneficial than the Teacher Retirement System.

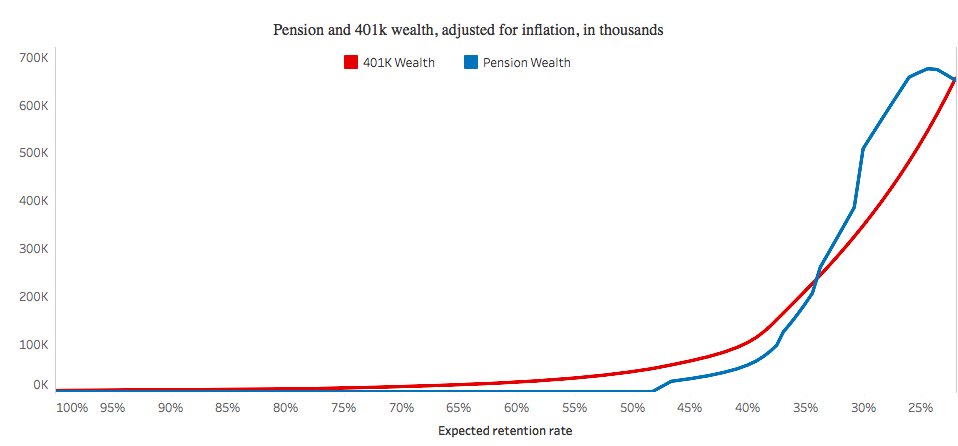

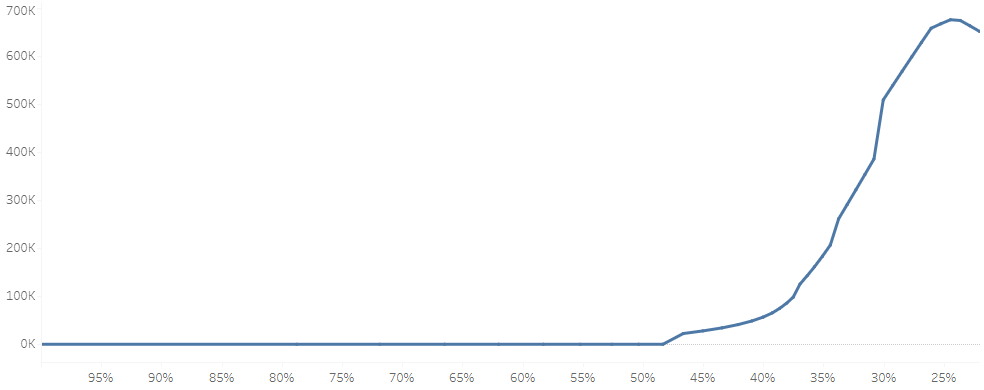

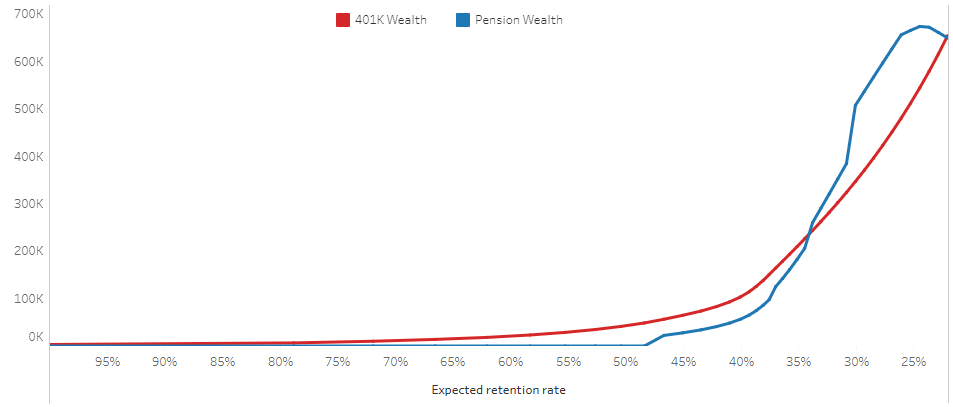

The pension system is also heavily skewed toward benefiting teachers who have worked a specific range of years. For example, between their 23rd and 33rd year working, teachers experience their largest spike in pension wealth. Before this period, pension wealth accrues slowly and, after this period, pension wealth declines.

Pension benefits relative to DC benefits

Proponents of pension reform often point to defined contribution plans as an alternative, as they have successfully replaced pensions in the private sector. One of the benefits of a defined contribution plan is its portability, with the accrued funds from employer contributions able to be passed on to your next employers defined contribution plan. Another benefit is that the eligibility requirements for defined contribution plans are far more relaxed than pension vesting requirements, sometimes providing benefits immediately upon being hired.

In the graph below, a defined contribution plan is laid over the pension plan. This defined contribution plan uses the same rate of return and inflation assumptions as the pension wealth estimate and assumes a 6.5 percent employer match that is met every year. Relative to the pension system, the defined contribution plan produces a more linear accumulation of wealth, benefiting younger teachers and not penalizing older teachers in their final years of employment. About two thirds of the hypothetical teachers would be better off under the defined contribution plan.

The benefit of owning your benefit

State governments accrue unfunded pension liabilities three primary ways; they contribute less than the actuarially required contribution, they raid funds to patch over budget deficits, and they overestimate future investment returns and thus underestimate their actuarially required contributions. Switching young teachers to a defined contribution plan protects state employees by removing the state’s ability to underfund the teacher’s retirement benefit. Instead, the teacher owns their benefit and can invest it how they see fit. From this perspective, a defined contribution plan benefits more than two thirds of teachers, it benefits them all.