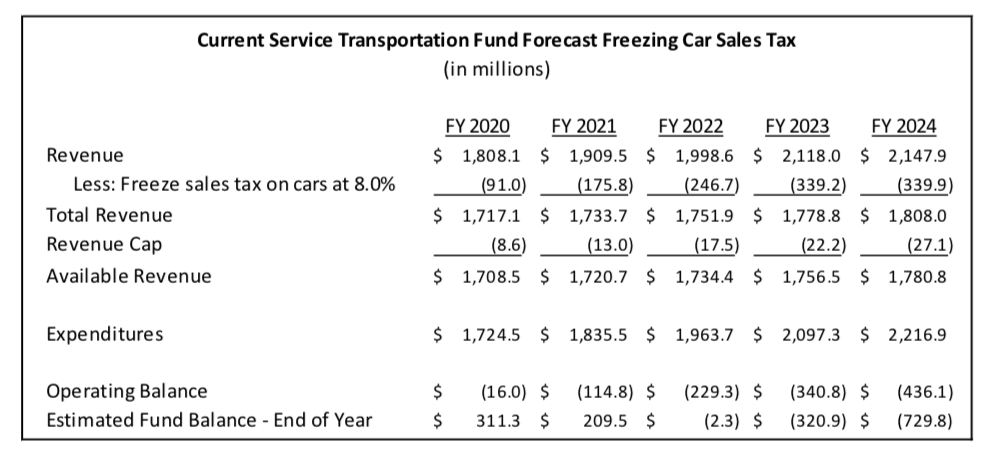

Gov. Ned Lamont’s budget will freeze the transfer of vehicle sales tax revenue from the General Fund to the Special Transportation Fund, essentially bankrupting the state’s transportation fund by 2022.

Whereas the STF was projected to have a surplus and increase revenue by $300 million over the next three years, according to budget projections by the Office of Fiscal Analysis and the Office of Policy and Management, the governor’s budget short-changes the STF by $1.19 billion over the next five years.

The sales tax transfer from the General Fund to the STF was scheduled to be phased in from 8 percent of car sales tax revenue to 100 percent by 2024. General Fund transfers are not protected by the new Transportation Lock Box. Freezing the sales tax transfer at 8 percent will leave the STF underfunded by $729.8 million by 2024, according to the governor’s budget.

Were the sales tax transfer left in place, the STF would have a significant surplus during the same time period, according to the governor’s budget proposal. “This proposal acknowledges this was never a comprehensive, sustainable solution for both the General Fund and Special Transportation Funds,” the budget reads. In order to fully fund the STF, the governor instead proposes installing electronic tolling gantries on Connecticut highways, although his

proposal is more limited than the figures compiled by the Connecticut Department of transportation.

Lamont is proposing 53 tolling gantries along I-84, I-95, I-91 and the Merritt Parkway, which will raise an estimated $800 million per year. This is less than the 82 tolling gantries on all major highways proposed in a Connecticut Department of Transportation study, which would bring in an estimated $1 billion per year.

The study estimates 60 percent of that revenue would come from in-state residents, who would be afforded discounts through a CT E-Z Pass system. If tolling authorization is passed, the tolls could conceivably be built by 2024, although the STF would, by that point, have been in the red for several years.

The $1.1 billion in sales tax revenue which would have gone to support transportation spending will instead remain in the General Fund as the governor attempts to bridge this year’s budget deficit and potentially future deficits.

It would not be the first time the state has withheld money meant for the transportation fund in order to bridge budget gaps.

Between 2011 and 2018, the legislature short-changed the STF by $650 million in scheduled revenue transfers and “raids” of the fund. This was particularly true in years where revenue to the STF was higher than projected, meaning lawmakers could withhold transportation revenue without the STF being underfunded.

However, in the case of Lamont’s budget proposal, freezing the sales tax transfer will leave the STF in the red, essentially bankrupting the fund.

The Transportation Lock Box passed by voters in 2018 protects revenue which is already in the STF but does not protect scheduled transfers from the General Fund, such as the sales tax transfer.

Lamont told members of the General Assembly that he could not support bonding money for transportation projects under his “Debt Diet” plan and would have to increase revenue for state transportation spending. “After 40 years of underinvesting in transportation, we can’t borrow our way out of this mess,” Lamont said in his speech Wednesday.

Walter

February 20, 2019 @ 7:56 pm

Where are the spending CUTS???? Lamont is equally as bad as Malloy … Congratulations CT Dems… 2 most hated governor’s in the country.

Edward J Max

February 21, 2019 @ 5:56 am

What is it going to cost just to drive to work everyday? Emergency trip to the ED will include tolls? How is Lamont able to raid a “Special Fund” and hand the money over to his friends in the legislature?

[email protected]

February 21, 2019 @ 9:56 am

I will be taking a one-way drive right out of this state soon enough.

Jeff Z

February 21, 2019 @ 9:57 am

It’s pointless to even complain anymore. The citizens will take the abuse with a minimum of push back, just like always. It’d be lovely if people would just stop paying their property taxes en masse. I mean, what could they actually do if even 10% of the people did that? It certainly would get their attention. But people are ultimately spineless and cowed (means intimidated).

So what’s next? Move, if you can. Better do it soon because as it stands now, the supply outstrips the demand. Check Zillow! Take notice of all the properties for sale in Ct, not to mention the uptick in foreclosures. Who’s gonna buy?!?! There go the values on your house.

It’s more than demoralizing. Everything they institute takes away from any wage increases you might get. And don’t kid yourself…Republicans have no miracle plan either. As it is they ran the worst possible candidate. And JR Romano??? Head of the Republican party is a dope! He has a history of nothing but failure. He’s from Derby as am I, so I know. He helped Derby run Anthony Staffieri in 2005. We would have been better if the Democrat ran unopposed. Or if the Republicans had run a corpse for mayor. Thanks JR for 8 lost years.

Anyway, Ct is done. Yes, quite dead. As a doornail.

TD Baer

February 22, 2019 @ 8:21 am

25 years ago my wife and I considered leaving CT but we stayed as we were connected to several old relatives – and now we are the old ones who are stuck here!!!!

Kathy Bryant

March 7, 2019 @ 4:57 pm

Lamont is just as bad as Malloy, if not worse. How much is it going to cost to go to through each toll? I cannot afford to pay for these Tolls, as I’m disabled.

What about the people that have a very, very low income? People like me who have a very, very low income and cannot afford to pay for these Tolls

PLEASE SAY NO TO TOLLS!!!

ray rys

March 11, 2019 @ 1:21 am

if you cant afford tolls take public transportation and dont complain

Joel

March 13, 2019 @ 8:14 am

If only there were public transportation to take.

Tom Holzel

March 10, 2019 @ 11:15 am

“General Fund transfers are not protected by the new Transportation Lock Box. ” That comment says it all. Liberal promised (“locked-box”) mean ABSOLUTELY NOTHING.

Mike

March 10, 2019 @ 2:38 pm

My wife works down in South Windsor and sometimes Westbrook

if she has to pay tolls to get to work maybe MA should start charging Ct drivers

who cut up rte 91 to go to Vermont and points north for skiiing . Will have to send the

Governor a email and ask him..Good way to get our toads fixed by out of state CT drivers.

Lynnette Kaschke

March 10, 2019 @ 6:24 pm

We need to ask our CT leaders “where is our money going?!” The extra funds teachers are paying in the name of pension funding is actually not going to pensions, and the highest gas, income, and property taxes are not enough to sustain our state…time to stop spending, stop entitlements, stop the unnecessary projects and buying out the unions for votes, stop sucking from the working and start saying no to those who can but are not pulling their weight. Unemployment benefits should not go on forever. Time to make a real change that will make a difference for the betterment of future of CT, not the tax and spend that is unsustainable and will bankrupt us in the long run. We all need to budget, to work and to save. Time for our government to do the same. Why not look at other states that are successful and take some tips from them. Tolls won’t work here because we are already taxed to the max and the construction of the gantries will cost more than they are worth. We need to get and keep good jobs in CT, lure people in for tourism, not chase them away with tolls and soda/food taxes, and invest in those things that will make CT money, not spend foolishly. Otherwise people and businesses will move away, no one will come visit and CT will become Venezuela. A sad day for our state, our country that politicians don’t care about the well being of our state. Only care about their votes, keeping destructive Democrats in office. Republicans are silent and not taking a stronger stand. Really sad about CT, as it used to be great.

Ann J. Dupree

March 11, 2019 @ 6:50 am

It is just CRAZY! Tolls every six miles? So, instead of bankrupting the state they plan on bankrupting the average citizen who uses the roads for every day commerce. The folks of Connecticut pay one of the highest gas taxes in the nation, which I assumed was for better roads and bridges add to that fact road construction takes far longer than it should once a project begins. Plus it appears that only certain sections of the state will have to bear the burden of tolls. And how much will it cost per toll? So, there is a gas taxes, property tax, income tax and now a proposed gas tax. Again, are they CRAZY??????

Larry

March 11, 2019 @ 7:44 am

When they had the tolls they didn’t use the money for the roads instead they used it for something else . No guarantees that they won’t do it again

Mike

March 12, 2019 @ 11:04 am

Instead of all the smoke and mirrors all he is doing is confusing the public. We don’t need a lock box or anything else. If the tolls are to come about the structure of the bill should state that all income from the tolls should only be used for repairs of roads and bridges. Not for what ever the governors next pet project is.

Alex Langer

March 12, 2019 @ 1:46 pm

Before we talk about tolls we need to talk about an audit, billions are being wasted.

Before we talk about tolls, lets talk about an audit.

https://www.courant.com/opinion/op-ed/hc-op-herbst-tolls-0227-20190227-cbsqtb56mjdudafrpmgx6frb24-story.html

Jack Liversidge

March 12, 2019 @ 4:34 pm

This is ridiculous, I’m sick and tired of paying taxes and the money goes somewhere else. Taxes paid for fuel and vehicle taxes go to our roads and bridges. Not Trains, Planes, Busses or anything else!

Lance Crossman Sr

March 15, 2019 @ 11:41 pm

4 points I’d like to make:

1. If tolling would be in existence, you can forget about all that Federal money that Trump’s campaign promises by supplying Federal money to the states for infrastructure.

2. Toiling will cause commercial transportation to increase dramatically and will raise the cost of goods and services to the people of Connecticut and and and surrounding states. This will probably be a 25% increase of all of your goods and services so as to say $1,000 spent is now $1,250 spent. The state of Connecticut knows that this is an increased tax revenue without changing the tax percentile, keep that in mind.

3. With Connecticut being in the top 10 most expensive States spending money per mile on its highways, learn a thing or two on how states in the top 10 spend their money wisely. One example is don’t use cheap materials in construction that only last 10 years for a million dollars per mile for example but use better and stronger materials that last three times longer that cost only 1.5 million dollars per mile

Make sure you use the gummy Tire to fill in any cracks that naturally happen instead of using scabs over the potholes and when a area needs to be fixed fix it then and there so it doesn’t cost 10 20 or 50 times more than what it would have if you took care of it the proper time.

4. I’m not seeing anybody talk about how much Administration fees are lost in the tolling process. If you give me $1,000 in $100 bills and I only give you $850 in return in $50 bills, is that right for me to do to you and say they’re take that?

It’s obvious that the spending has been reckless in the last two decades at least and many are believing that this was done on purpose to cause tolls to happen and get Kickbacks of all kinds to the people writing up these bills.

There are other unforeseen realistic probability factors such as Imports shipping to Maine instead of New Jersey and New York. All of those commercial vehicles are taxed per gallon with the diesel Karma tax per mile through each state on its own State rate, and the tolls that these trucking companies already have to pay, Wilmore attract overseas shippers to want to ship to places such as Maine for a shorter distance and to avoid the mentioned in this paragraph above. There are many different routes to take to avoid these future probable tolls and that will mean all of those people who want to buy a bag of chips and soda and food and restaurants and get their haircut and get a hotel and spend money in your state will no longer spend it there because they’re rerouting around Connecticut tolls.

As a truck driver, I spend over $500 coming West of Chicago going to New Jersey. We are bombarded by these tools all throughout New England and trying to get over to New England now look at what happened with Rhode Island with the unconstitutional trucker tools only in how much that cost the end-user which is the public with the increases of sales of goods and services?

On the topic about freeing up the congestion, set up 3 times more rest areas and parking areas and you will find us Truckers closer to where we need to ship the goods to instead of traveling 125 miles to these places along side of cars in rush hour traffic that cause 80% of all trucks involved accidents.

Howie H.

March 17, 2019 @ 5:55 pm

Not only does automated vehicle ID avail automatic tolling, it also avails automatic speeding citations by clocking average speed between gantries. You can be sure that the state will pick up on that revenue stream.