Moody’s Investment Services warned that Connecticut’s debt service, pension liabilities and retiree healthcare liabilities – known as the state’s fixed costs – “will continue to weigh” on the state, even with healthy revenue growth, in a report on surging pension liabilities.

Moody’s lists Connecticut with an A1 (stable) rating, after the agency downgraded Connecticut’s General Obligation bonds and revenue bonds in 2017, citing the state’s hefty debt burden.

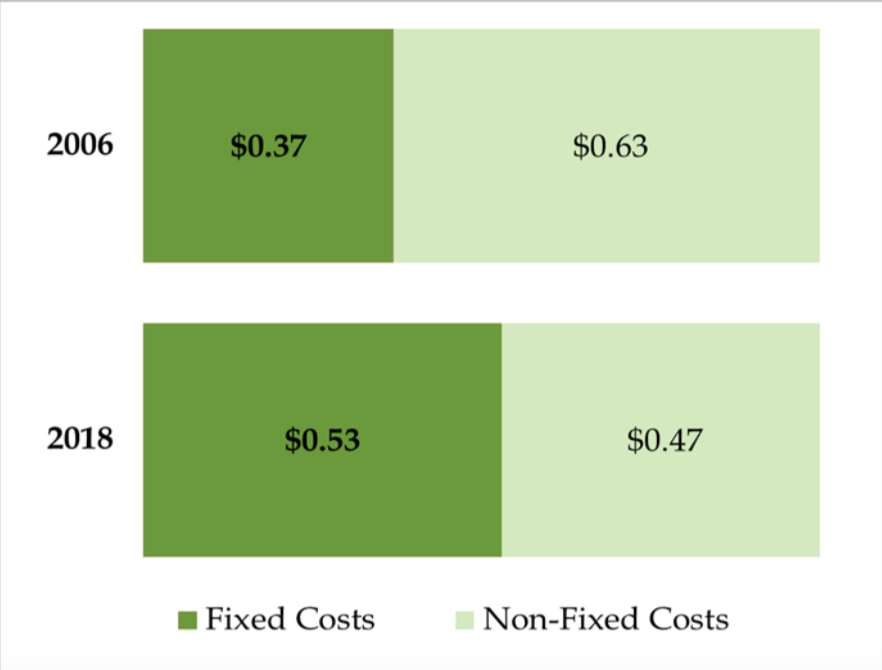

In Moody’s analysis of pension debt across the country, the agency wrote that Connecticut’s “fixed costs for debt service, retiree health, and pensions on a tread-water basis exceeded 30 percent of own-source revenue.”

State pension plans across the country experienced low investment returns in 2015 and 2016, according to the ratings agency. Recent market gains have begun to reverse previous years’ losses, and the agency predicts higher investment gains for 2017 and 2018 will lead to lower pension debt.

Pension plans assume a rate of return from investments. The rate of return — or “discount rate” — allows a state to lower the amount of money it contributes to the pension fund, but when investment earnings miss the mark it can increase unfunded liabilities and drive up costs, putting more pressure on state budgets.

Gov. Dannel Malloy and the State Employee Retirement Board lowered the discount rate for state employee pensions from 8 percent to 6.9 percent in 2017. The discount rate for Connecticut’s Teachers Retirement System was lowered from 8.5 to 8 percent in 2016, although that rate is still considered by some as too high.

Investment returns for SERS is a history of riches and ruin, depending on Wall Street. In 2017, the state employee pension fund returned 14.32 percent, but in only 2.84 percent and .26 percent in 2015 and 2016 respectively.

The 2008 recession hit Connecticut’s pension investments especially hard with a 4.83 percent loss in 2008 and a massive 18.25 percent loss in 2009. The Teachers Retirement System had similar gains and losses.

A 2015 report by the Center for Retirement Studies at Boston College warned that failing to meet the discount rate for the Teachers Retirement System could drive teacher pension costs up to $6 billion per year, although State Treasurer Denise Nappier says such an increase is unlikely.

Even if Connecticut meets its discount rates, the cost for pensions and retiree healthcare is projected to grow significantly.

A number of groups recommend using a safe discount rate equal to the interest on a bond – typically around 2 percent.

But lowering the discount rate means the state must contribute more to the fund to meet its annually required contribution, something Connecticut probably can’t afford as the state faces massive budget deficits for the foreseeable future, due in large part to the growth of fixed costs, like unfunded pension liabilities.

Connecticut’s fortunes are tied tightly to Wall Street, with investment gains and losses not only affecting tax revenue, but also affecting the state’s pension funds.

Connecticut suffered bond rating downgrades from the major ratings agencies in 2017 due to its high debt and fixed costs, which raises the cost of borrowing for the state.