Connecticut owes more on the state credit card per resident than nearly every other state in the country, according to a new study.

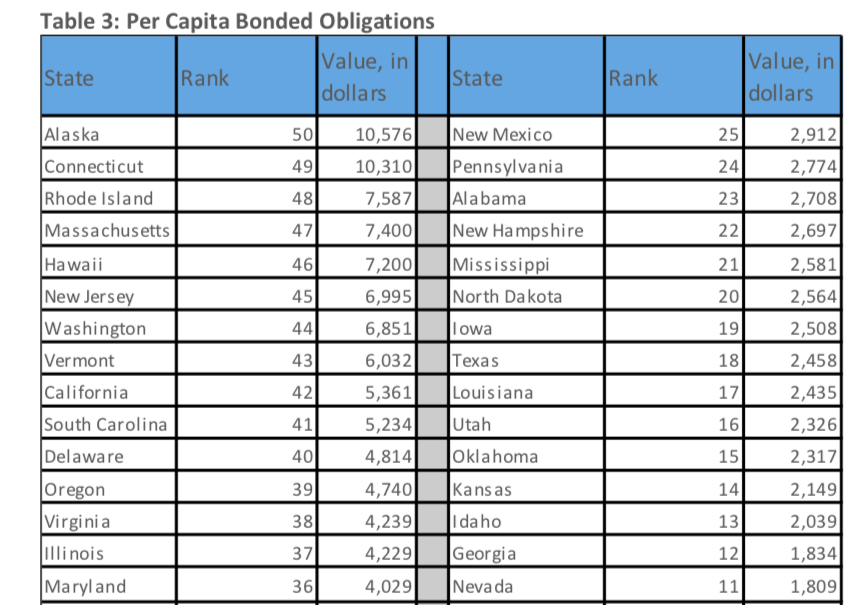

The American Legislative Exchange Council released a study examining the level of bonded debt across the country and found that Connecticut has the second-highest level of bonded debt per person than every other state except Alaska.

According to the study based on Connecticut’s comprehensive financial report, the state has a total $36.9 billion in bonded debt, which equals $10,310 for every Connecticut resident.

Despite being one of the smallest states, Connecticut total bonded debt was the 8th highest in the country.

Thurston Powers, one of the authors of the report, says that although Alaska had the highest debt per capita, Connecticut’s situation is worse.

“Alaska has a massive rainy day fund and the state Permanent Fund,” Powers said. “Taking into consideration about 70 billion dollars of assets Alaska holds, Connecticut is the worst off, all else being equal.”

Some of Connecticut’s neighbors didn’t fare so well either. New York, New Jersey and Massachusetts all had higher levels of total bonded debt, but their larger populations lowered per capita obligations for those states.

Rep. Christopher Davis, R-Ellington, who serves on both the State Bonding Commission and the Finance, Revenue and Bonding Committee, says the results of ALEC’s study are “not surprising.”

“Under the last seven and half years of the Malloy administration, bonding has more than doubled per year,” Davis said. “It’s not a surprise to me that we are now at a very high level, if not the highest level, per capita in the country.”

Davis says Connecticut is slightly different from other states in that it bonds for school construction at the state level, whereas other states handle school construction at the local or county level.

Connecticut borrows money for nearly every aspect of government, from transportation to school building and economic incentives for businesses.

Payments for Connecticut’s debt is one of the growing “fixed costs” of state government, which – along with pensions, Medicaid, and retiree health benefits – now make up nearly half of Connecticut’s budget.

Debt service costs now account for 13 percent of Connecticut’s annual budget, or $2.9 billion in 2019, according to the Office of Fiscal Analysis.

Connecticut’s debt service payments from Connecticut’s General Fund are expected to grow by $155.7 million next year, according to the OFA’s Fiscal Accountability Report. Debt payments from Connecticut’s Special Transportation Fund are expected to increase by $61.2 million, according to the Office of Policy and Management.

“Every dollar more we spend on debt service is a dollar less that you can spend toward education or healthcare or any other public safety service as well,” Davis said. “Coupled with the SEBAC agreement — which fully restricts our ability to cut costs across the state of Connecticut — it makes it that much harder to provide the services our constituents expect us to provide.”

The 2017 SEBAC agreement locked in state employee raises and guaranteed layoff protections through 2022. It also extended the retirement benefits package for state employees to 2027.

Connecticut’s level of debt was cited in April of 2018 when S&P Global Ratings downgraded Connecticut’s bond rating from A+ to A. Downgrades by ratings agencies can increase the cost of state borrowing.

A report by Dan Haar of Hearst Media found that Connecticut’s cost of borrowing is more akin to states rated BBB.

The growth of Connecticut’s fixed costs shows little sign of slowing down due to rising pension costs, but lawmakers did pass a bonding cap as part of the 2017 budget.

Under the cap, Connecticut will limit its borrowing to $1.9 billion per year, a significant decrease from Connecticut’s high of $3.8 billion in 2016, but Davis says he believes the cap is still “pretty high” and that it adjusts for inflation every year.

“It’s still a historically very high number,” Davis said. “Ultimately that should be seen as a ceiling, not necessarily a goal as to how much should be spent every year.”

The ALEC report said Connecticut’s bonding cap “only protects against the over-issuance of general obligation bonds, meaning that the state could simply issue more revenue bonds or revenue bonds out of component units.”

“Component units” are quasi-public agencies such as the Connecticut Airport Authority, which can issue bonds, although they can default without encumbering the taxpayer, depending on the agency’s relationship to the state.

The study also noted that Connecticut had the second smallest “Rainy Day Fund” in 2017, enough to fund government operations for a few days.

Connecticut’s low emergency reserves contribute to its lower bond rating. Although Alaska has more debt per capita than Connecticut, it has a AAA credit rating due to its large reserve fund, totaling nearly $65 billion.

“Maintenance of a healthy rainy-day fund signals fiscal responsibility to investors and credit rating agencies,” the authors wrote. “Although rainy day funds can prevent fiscal mismanagement, channeling resources into these reserves and protecting these reserves from premature drawdown often proves politically difficult.”

Connecticut was able to boost its Rainy Day Fund in 2018 thanks to a tax revenue windfall largely related to Wall Street gains and a new volatility cap, which was also established under the 2017 budget.

The volatility cap requires Connecticut to save tax revenue when quarterly filings exceed $3.15 billion. Connecticut has historically drawn heavily from its reserves to fill budget gaps, leaving the state in a precarious position were an emergency to arise.

The combined total of bonded debt for every U.S. state is $1.1 trillion, according to ALEC’s analysis.

Tom McCormick

January 11, 2019 @ 11:41 am

CT is joining the ranks of the debt peons. Look for more in the way of bond locks as Wall Street diminishes CT sovereignty just as the IMF does to debt-ridden countries.

John O'Malley

January 20, 2019 @ 2:32 pm

With Connecticut’s Bonded per capita debt being 2nd highest in the country

along with the country’s 2nd highest real-estate property tax rate….

The highest utility rates (electric) in the continental US…….

Ranked the 8th worst state to start a business…….all while causing a

population loss …….and ironically the Millennials/students many of whom helped elect our tax and spend politicians will be leaving Connecticut for other states that engage in “responsible” spending and tax rates and an economic environment that provides employment opportunities.