This year we’ve tried to shine a light on Connecticut’s bonded debt, as well as our pension and retiree healthcare liabilities. When all of this debt is combined, Connecticut is one of the most indebted states in the nation.

A new report by J.P. Morgan’s Michael Cembalest provides additional clarity.

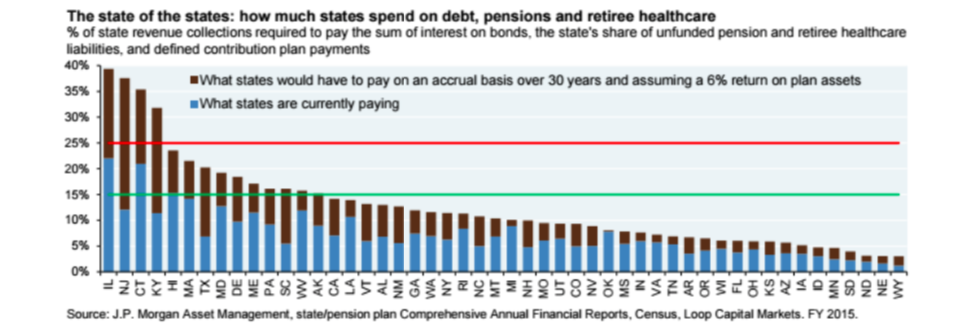

Connecticut ranks third in debt service costs, behind Illinois and New Jersey. While this may be “old news,” what is new is the deep dive the report takes into the states’ budgets to show what it would cost if they want to start climbing out of debt.

The report shows that even if Connecticut spread out its pension and retiree healthcare debt over 30 years instead of the current 20, the state would still have to spend 35 percent of its budget to meet these obligations. This puts us over the “red line” in the report.

“When a state is at the red line, however, they’ve got some serious challenges since the math becomes very difficult,” Cembalest says in the report.

How difficult? Right now the state is spending 21 percent of its budget on its debt – already the second highest in the nation.

What would it take to get us to 35 percent? A 14 percent tax increase, a 14 percent cut in state spending, or a 700 percent increase in state employee contributions to the pension system.

You do the math. None of these outcomes is politically feasible. Which is why reform isn’t just a good idea, it’s a necessity.