Your taxes keep rising—so why is Connecticut broke?

Connecticut residents pay the highest taxes in the entire country, second only to New York.

Next year, lawmakers must close a multi-billion-dollar budget gap—and in the coming months, that deficit is only expected to grow.

This problem shouldn’t exist. After all, in 2011, Governor Malloy signed a $1.8 billion tax increase package, and another $800 million tax hike in 2015. Just last year, the General Assembly again passed $180 million in new taxes.

But even as they increase taxes, lawmakers also cut funding for essential services like education, mental health, and aid for the disabled. And at the same time, some lawmakers call for yet another round of tax increases. It’s a vicious cycle, with the people of Connecticut paying the price at both ends.

Why are taxes going up even as services decrease?

Gov. Dannel Malloy and his budget chief, Ben Barnes, admitted that every penny of Connecticut’s significant 2011 and 2015 tax increases went to pay for pensions and other retirement benefits.

The status quo isn’t working for Connecticut residents.

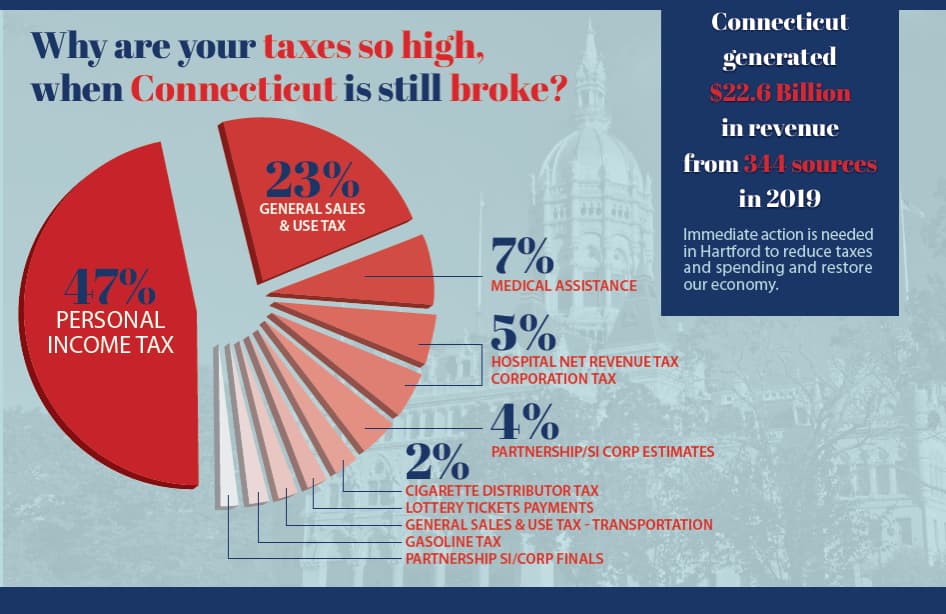

This flyer includes the closest approximation we can compile to all the taxes and fees Connecticut collects, some fees taking in as little as $10. The state needs to analyze its revenue streams and eliminate those doing more harm than good.

Here’s what we mean. The bottom 200 sources of revenue amount to only 0.22% of Connecticut’s total revenue.

Did you know that some of these taxes and fees can hurt small businesses? Here are a few of the 2019 taxes and fees totals from the bottom 200 revenue sources.

- In the General Fund, there’s a fee for state lease of oyster grounds – $75,860

- In the General Fund, there’s a tax on the registration fee for Charitable Games – $44,375

- In the Transportation Fund, there’s an annual fee for applying to have an informational sign – $ 18,000

- In the Revenue General Fund, there’s a tax on the sale of advertising space – $3,266

- In the Revenue Transportation Fund, there a tax on the sale of photocopies of government printing matters – $622.36

Download the full list of the 344 state revenue sources to track your taxes and fees.