In an election year, Connecticut’s state employee unions appear positioned for another significant round of compensation growth.

While lawmakers debate fiscal guardrails and warn of federal funding uncertainty, the governor’s own budget documents show tens — and in some cases hundreds — of millions of dollars being set aside for future wage adjustments, healthcare growth, and pension-related obligations tied to SEBAC contracts.

At the same time, at least one lawmaker is proposing a very different path: a two-year wage freeze for state employees.

The Quiet Cushion: $169 Million on Hand

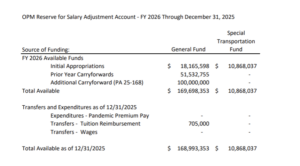

Start with the Reserve for Salary Adjustment (RSA) account — a fund administered by the Office of Policy and Management that exists specifically to cover collective bargaining costs, wage settlements, accrual payouts, and other negotiated compensation items.

As of December 31, 2025, that account held:

- $169.7 million in the General Fund

- $10.9 million in the Special Transportation Fund

The RSA exists for one purpose: to absorb the cost of negotiated wage and benefit increases. OPM’s own reportingnotes that additional transfers tied to finalized bargaining agreements are likely before the fiscal year concludes.

Put plainly, the money for future union obligations is already sitting in reserve.

Retirees cashing out accrued time? Covered.

New wage agreements? Covered.

Contractual payouts baked into SEBAC deals? Covered.

And the fund is not shrinking — it’s being replenished.

$186 Million for “Salary Adjustments”

The scale becomes clear in the Office of Fiscal Analysis (OFA) breakdown of the second year of the biennial budget.

For FY27, the upcoming fiscal year, the budget includes:

- $186,551,369 in the General Fund

- $19,864,541 in the Special Transportation Fund

This is not a last-minute addition. The money was built into the FY26–FY27 budget adopted in 2025.

That is nearly $206 million positioned for raises, payouts, and contract costs for the 35 bargaining units that make up SEBAC.

In other words, the funding for the next round of agreements is already embedded in the budget.

All of this comes as lawmakers caution about fiscal uncertainty and warn against weakening the state’s guardrails. The rhetoric is restraint. The numbers suggest business as usual.

Health Care Costs Continue Their Climb

Healthcare spending is rising just as steadily.

According to OFA, the governor’s FY27 budget increases spending on state employee health benefits by:

- $71.26 million for active employees

- $38.84 million for retired employees

That’s more than $110 million in additional General Fund costs in a single year, on top of:

- $779 million for active employee health benefits

- $957 million for retiree health benefits

These are not new programs. They are the ongoing costs of maintaining benefits negotiated under SEBAC contracts.

When lawmakers describe “fixed costs” squeezing the budget, this is what they mean.

The Pension Pay-Down That Wasn’t

Now consider pensions.

The State Employees Retirement System (SERS) requires an Actuarially Determined Employer Contribution (ADEC) each year —the amount actuaries calculate is necessary to maintain solvency.

The governor’s revised budget includes:

- $5.37 million in additional General Fund contributions

- $448,760 in the Special Transportation Fund

Why the increase?

Because the previous budget proposal assumed savings from an additional $500 million pension pay-down, a deposit that was ultimately bypassed and redirected into a Federal Cuts Response Fund.

Had that $500 million been applied to pension liabilities, the state would have reduced future required contributions by roughly $41 million annually.

Instead, because that deposit was not made, actuarial requirements increase.

Spend the money elsewhere today, and taxpayers pay more every year going forward.

That is the tradeoff.

A Different Proposal

Against this backdrop, Rep. Tina Courpas (R-Greenwich) has requested legislation to freeze wage and salary increases for state employees for at least two years.

The case for restraint is straightforward. State employee compensation exceeds $10.5 billion annually, with wages alone totaling more than $6 billion. Under Gov. Lamont, state employees have received cumulative wage and step increases of approximately 33%.

Whether such a freeze is politically viable in an election year is another matter.

The governor has previously told AFSCME members:

“Every year that I’ve been here you’ve gotten a raise, and every year I’m here, you’re going to get a raise.”

That statement was delivered not in a budget hearing, but at a closed-door union conference.

The Election-Year Question

Consider the full picture:

- $169+ million currently in the RSA account

- $186 million budgeted for salary adjustments

- $110+ million in additional health service costs

- Higher pension contributions due to a skipped $500 million pay-down

This is not belt-tightening. It is a portrait of steady expansion — in an election year.

Fiscal guardrails were designed to prevent overspending and protect long-term stability. But collectively bargained benefits are long-term commitments that compound — especially when pension deposits are deferred and healthcare costs continue to rise.

When budgets tighten, most programs face scrutiny. Proposals are scaled back. Every dollar is debated.

Yet when it comes to SEBAC obligations, the money appears to be waiting in advance,

Taxpayers may reasonably ask whether this budget reflects fiscal discipline — or election-year priorities.