In Part 1 earlier this week, we saw how Connecticut’s paid leave law generally exceeds the regional regulatory standard for paid sick leave. This post will highlight how exactly that regulatory burden impacts small businesses.

After HB 5005’s passage, Connecticut’s new paid family leave legislation will place a greater burden on small businesses than most of its eastern neighbors. Come 2027, employers will be forced to provide one hour of paid leave for every 30 hours worked, and employees can accrue up to 40 hours per year.

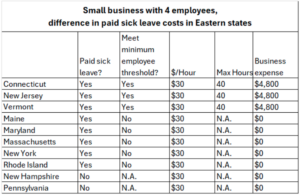

To demonstrate the difference in paid sick leave costs to small businesses, imagine that 10 businesses, each with four employees who make $30/hour, open a shop in different states. In Connecticut, New Jersey and Vermont, if all employees accrue the maximum 40 hours in paid sick leave, this will cost each of those businesses $4,800. A customer-facing business will need to schedule an additional employee to cover the shift of the employee(s) who is taking their paid sick leave. Conversely, in Maine, Maryland, Massachusetts, New York and Rhode Island, those same small businesses are not forced to provide paid sick leave because they do not meet the minimum employee threshold.

$4,800 might seem to be a pitiable amount to legislators regularly making decisions accounting for hundreds of millions of taxpayer dollars. But if legislators were to ask anyone who has started a small business, they might be surprised to find that $4,800 could very well be the difference between a business owner staying open or shuttering their doors. If businesses close, this will make the employer, employee and state coffers poorer.

Shortly after Connecticut’s first round of paid sick leave legislation passed in 2012, the Center for Economic and Policy Research (CEPR)’s surveyed 251 Connecticut businesses in “Good for Business? Connecticut’s Paid Sick Leave Law.” In the report, 53.2% of Connecticut establishments indicated some form of a cost increase, including 22.2% reporting an increase of at least 2%. In response, 15.5% of Connecticut businesses increased prices; 10.6% reduced employee hours; and 5.6% either reduced operating hours, wages or quality of service. Meanwhile, 39.9% of Connecticut businesses found it difficult or somewhat difficult to do extra record-keeping involved in tracking paid sick leave. If this was the impact 10 years ago on mature, large businesses, we have every reason to believe that imposing paid sick leave on small businesses would be even more detrimental to employees, customers and the business itself.

To achieve economic dynamism, Connecticut needs to foster an economy that allows small businesses to mount challenges to big businesses, without regulatory weights (like paid sick leave, among a dozen others) around their necks before they can even get started. Such regulatory burdens weigh more heavily on new small businesses than larger, mature businesses that grew before greater regulatory burdens were introduced. Given enough time to build up a customer base, start-ups will want to do right by their employees and offer them paid sick time. But without a “grace period,” such start-ups face a greater risk of shutting down early.

It is little wonder that Connecticut’s large businesses had few objections to HB 5005. After all, more challenges for the upstarts will let big businesses rest a little easier at night, content that the General Assembly is protecting them from their competitors, even if legislators only intended to help employees with paid sick leave.

For a state with the second-highest business tax burden in the country, Connecticut can ill-afford to introduce new regulations on its businesses. We can only hope that Connecticut’s well-educated workforce will prove enough of a bulwark to soften the blow from yet another mandate from Hartford.