A coalition of communists, socialists, labor unions and other progressive groups will be uniting to demand a “tax the rich, fund public education, cap the rent and more” budget at the state Capitol, May 17.

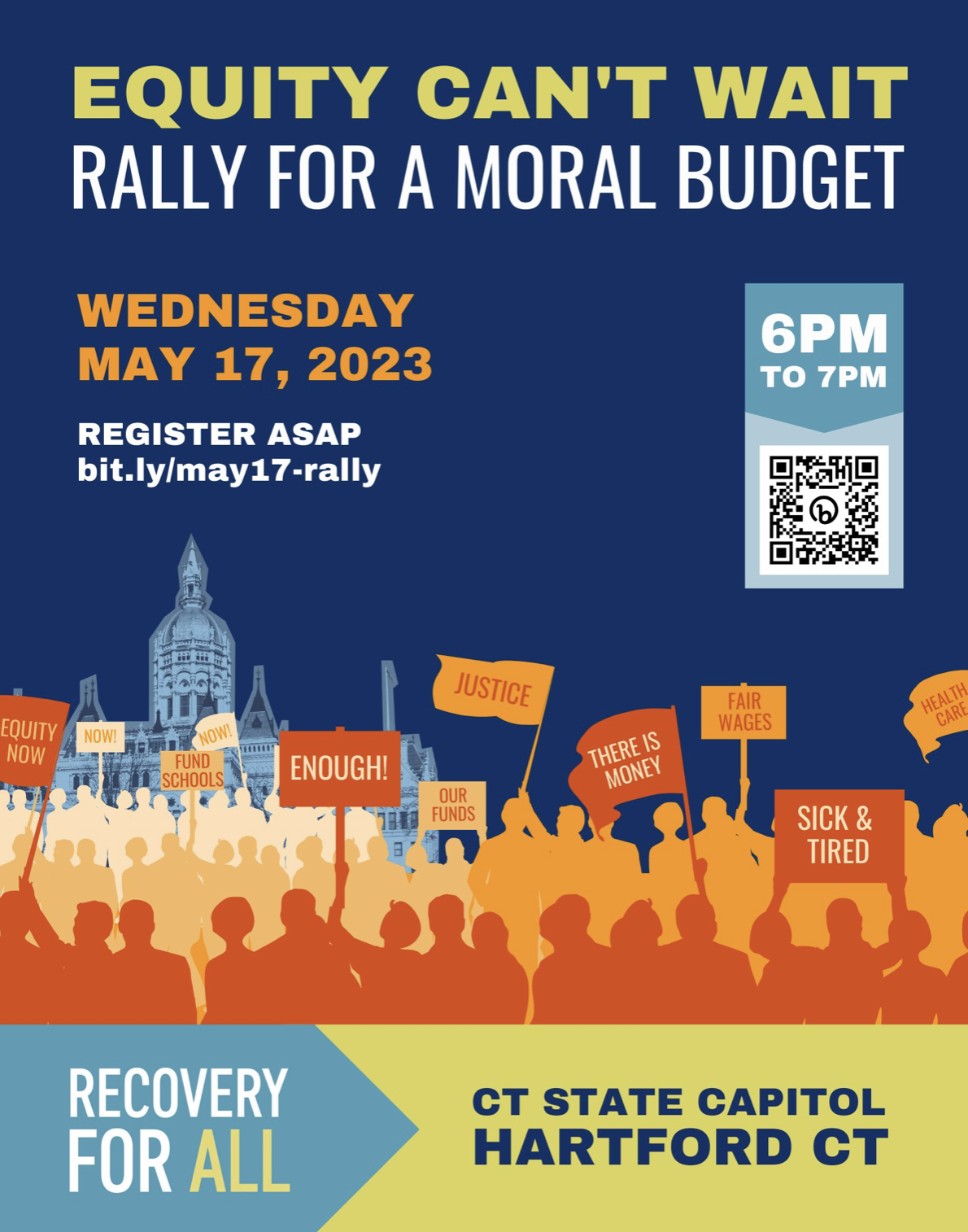

“Equity Can’t Wait: Rally for a Moral Budget” is hosted by Recovery For All (RFA), which represents a coalition of labor, community and faith organizations aimed at eliminating “systemic inequalities and rebuild[ing] a better Connecticut.” Organizations part of the coalition, like the CT AFL-CIO, are also pushing the event.

Thousands are anticipated to participate in the all-day event that will lobby for funding equitable, social justice causes and predictive scheduling — which would require certain employers to provide advanced notice to certain employees of such employees’ work schedule.

The RFA has criticized Gov. Ned Lamont’s current proposal for not tapping into the state’s $3.3 billion rainy-day fund, falling short of “meeting the extreme post-pandemic needs” in an email invitation to supporters.

“We demand dramatic investment in the programs and services our communities desperately need to survive and flourish,” RFA states on its website. “Our legislation would provide immediate relief to struggling working families and generate billions of dollars in shared resources by requiring the wealthiest among us to contribute more to the common good of all.”

As part of the ‘moral budget,’ RFA’s equity agenda includes fully and equitably funding pre K-12 public schools, teachers, paraeducators; public colleges and universities; investing in long-term care and childcare; expanding Husky to all residents regardless of immigration status; restoring and expanding the public sector safety net and worker protections like paid sick leave, the minimum wage, and predictive scheduling.

How much will this budget cost and impact Connecticut families and businesses? Those numbers are harder to come by — or at least RFA offers no figures on its website. But in a March 2022 policy report (that predominantly criticizes Yankee Institute’s free market principles), RFA’s ‘alternative’ route to a viable Connecticut returns to the same old, tired progressive playbook: tax the rich.

Yet between 2012 and 2018, Connecticut suffered an exodus of high earners at a rate that trailed only Washington, D.C., according to a 2021 Pioneer Institute study. Likewise, corporations have migrated their headquarters out of state, most recently the LEGO Group shipping its U.S. base to Boston. Meanwhile, Connecticut consistently ranks poorly in every tax category — individual, corporate, sales, property and unemployment insurance — in the Tax Foundation’s ‘2023 State Business Tax Climate Index.’ Overall, the state finished 47th in the study.

The evidence suggests that taxing the wealthy and businesses will likely inspire more people to flee for greener pastures — and further drain resources from those who cannot leave (i.e. the very people RFA claims it wants to help).

One cost associated with the RFA’s advocacy is the predictive scheduling bill. According to the bill’s fiscal note, the Department of Labor would be required to hire a wage enforcement agent that will cost $74,883 in FY24 and $99,407 in FY25; the bill will also impact the State Comptroller-Fringe Benefits account by $28,639 in FY24 and $39,140 in FY25.

Opponents of the legislation argue predictive scheduling is “impractical” governmental interventionism, subjecting small businesses — already struggling to survive post-pandemic — to penalties and even civil action.

“It is important for lawmakers to keep in mind that for small and mid-sized businesses,” testified Andy Markowski, state director of the National Federation of Independent Business (NFIB), “where staffing needs sometimes depends on varying customer demand or other factors outside of the businesses’ control, this proposal could have the effect of taking away autonomy and flexibility to staff and schedule as appropriate to meet fluctuating (or even certain emergency/unanticipated) staffing needs.”

In short, RFA’s ‘moral’ budget is expansive in terms of aspirations, but, when the bill comes due, it has no other recourse than shouting the uninspired ‘tax the rich’ mantra. A truly moral budget would be to let Connecticut’s citizens keep more of what they earn — instead of paying exorbitant taxes — and encourage more businesses to grow and stay here so people can obtain a job to help their families and loved ones.