The amount of money Connecticut expends on overtime payments and workers’ compensation costs is outpacing its nearest neighbors, according to a report by the Boston Consulting Group.

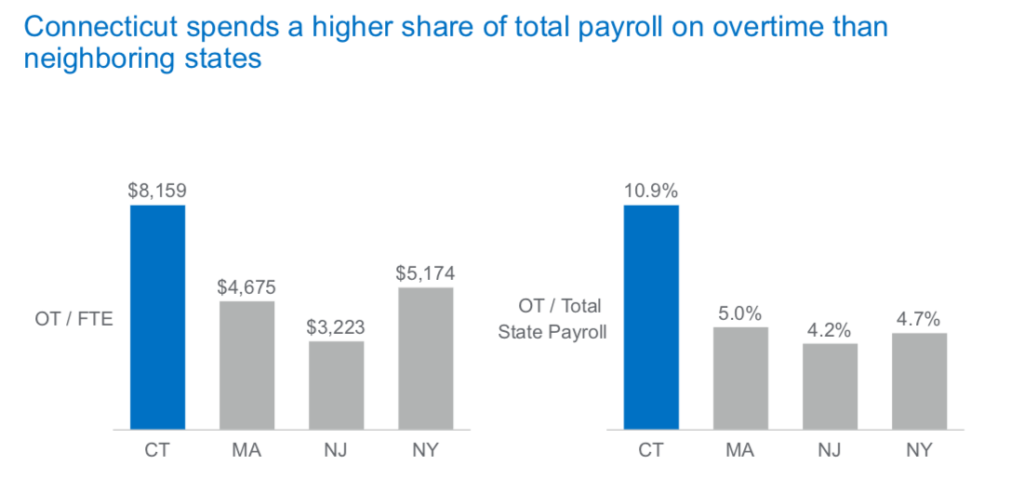

The report, which looked for ways to make Connecticut state government more efficient, found the state is spending more on overtime payments as a percentage of payroll and has more generous workers’ compensation rates than New York, New Jersey and Massachusetts.

Four state agencies – the Department of Correction, the Department of Mental Health and Addiction Services, the Department of Developmental Services and the Department of Emergency Services and Public Protection – account for most of Connecticut’s $256 million in overtime costs.

The DOC, DMHAS, DDS and the Department of Children and Families drove most of Connecticut’s $100 million in worker compensation costs, as well, the report found.

Overtime costs were found to be primarily driven by absenteeism, job vacancies, “sub-optimal scheduling,” and statutes and labor regulations and, with the state expecting a surge of state employee retirements before June of 2022, the report warns overtime costs could grow.

“High spending on overtime is a major driver of the State’s high fringe benefit costs,” the authors wrote. “Addressing these costs must be a key objective for the state.”

The report found Connecticut spends significantly more per payroll on overtime than New York, New Jersey or Massachusetts.

“Though the State’s goal should not be to fully eliminate OT… the State must bring these costs more in line with neighboring states, such as Massachusetts and New York, where the levels of overtime for the same types of services are lower,” the report says.

The consultants found Connecticut state employees’ absenteeism rates “are high relative to the private sector and to other states’ governments” and that family leave and sick leave “are significant drivers of OT.”

The report noted a “vicious circle” of workers using approved paid family leave time to remain on the job but reduce their caseload “effectively shifting their work to colleagues who subsequently may suffer from burn-out.”

“Many managers also observe a tendency of some workers to take sick leave around weekends or single days off, unnecessarily driving additional overtime needs without good cause,” the report says.

But some of the problems with overtime are related to how shifts are scheduled, part of the labor rules outlined in Connecticut’s collective bargaining contracts with state employee labor unions.

“Some 24/7 agencies are staffed by employees on 35-hour work weeks,” the report said. “Given that those employees work 7-hour days, 3 hours of OT or overlapping hours are required every day.”

Other examples of scheduling issues leading to overtime included requiring State Police to provide security for sporting events and overseeing fireworks displays; DCF employees taking time off early in their pay period and then making it up on the back end, which counts as overtime, and overtime scheduling and distribution being managed by employees in the same union as the employees receiving the overtime.

“There is also the opportunity for schedulers in the same bargaining unit to manipulate the process if favor of their friends,” the report notes.

“Making changes to many of these rules requires bargaining with labor unions,” the consultants wrote.

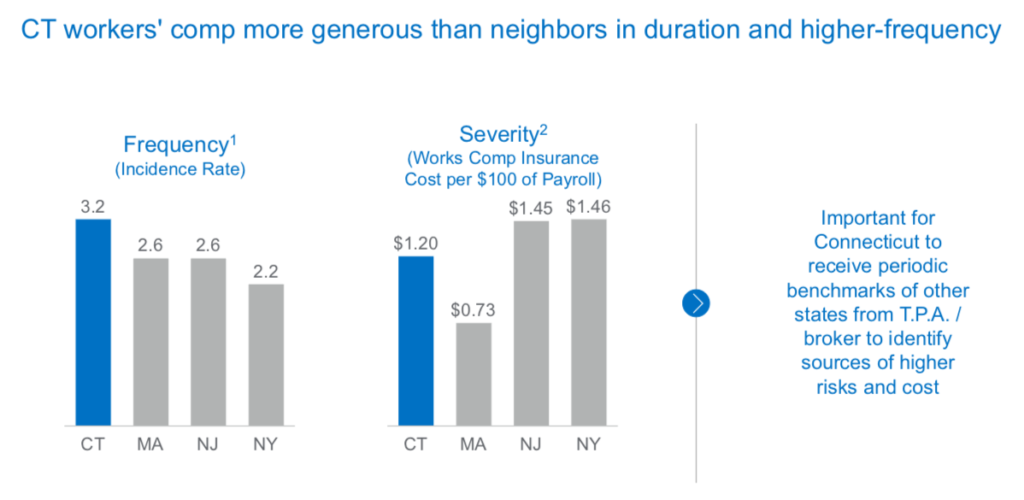

The report also found Connecticut’s workers compensation is “far more generous” than other states and Connecticut state employees use workers compensation at a higher rate than neighboring states.

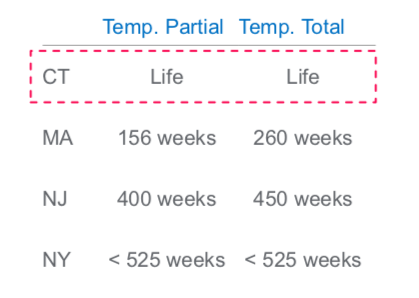

Seventy-six percent of worker compensation claims are for temporary disability, however under Connecticut statute, temporary disability benefits have no time limit, unlike Massachusetts, New York and New Jersey.

“One major factor in Connecticut’s costs being higher than peer states is that Connecticut allows workers to receive lifetime benefits for temporary (partial and total) disability,” the report notes. “Given the definition of ‘temporary’ disability, the State should match its peers and implement common-sense reform by time limiting these benefits, which constitute 76% of the total workers’ compensation expenses.”

Among their recommendations, the Boston Consulting Group wrote that Connecticut should pass legislation bringing Connecticut’s worker’s compensation benefits and limits in line with Massachusetts, streamline the hiring process to fill employee vacancies quickly and use a third-party administrator to monitor overtime usage, absenteeism and family leave.

“Establishing a Workers’ Compensation/absenteeism/overtime ‘Czar’ would ensure there is a single office in the State monitoring these costs, which are larger than most agency budgets,” the consultants wrote. “By assigning an individual to lead organizational and cultural transformation who can be held accountable to drive change, Connecticut can begin to address the issues.”

Overtime payments and temporary workers’ compensation payments are used in calculating state employee pensions.

The most recent retirement tier — Tier IV — reduced the amount of overtime that can be used toward calculating a pension payout by averaging the amount of overtime an employee earned over the course of their career, rather than relying on the three highest earning years.

Connecticut spent $234.9 million on overtime in 2020, according to the Office of Fiscal Analysis.