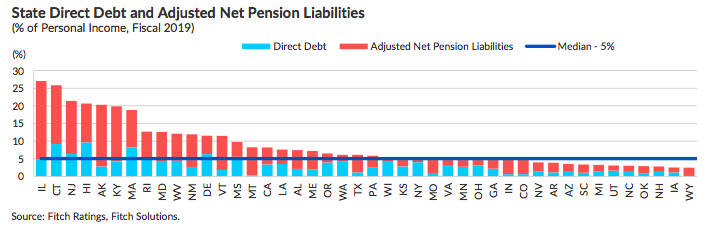

A new report from Fitch Ratings placed Connecticut second only to Illinois in the amount of state debt compared to personal income.

The 2020 State Liability Report looked at direct debt and net pension liabilities as a percentage of personal income and found Connecticut’s debt accounted for roughly 26 percent of personal income compared to the national median of 5 percent.

Connecticut was ranked 49th in the country for its debt to personal income ratio, worse off than New Jersey, Hawaii and Arkansas, but little has changed for Connecticut over the last few years.

“The ten states with the highest burdens in fiscal 2019 have occupied the top 10 slots in each of the last four years,” the report says. “Illinois maintained its 50th-ranked position and Connecticut its 49th-ranked position through this period.”

According to the data in the report, Connecticut had $25 billion in direct debt and an additional $46 billion in unfunded pension liabilities.

One of the key factors in Connecticut’s net pension debt – besides decades of underfunding — was Connecticut’s unfunded teacher pension liabilities, pegged at roughly $13 billion.

“As with higher debt burden states, one key commonality among high pension burden states is that the state directly carries some of all of the unfunded pension liability associated with certain public workers outside of state government,” the report states. “For most of these states, the net pension liability of local school teachers is carried by the state. This factor is far less of a driver of pension liabilities for lower-burden states.”

The report also noted that pension liabilities tend to grow faster over time than direct debt, with pension liabilities rising .7 percent on a compound annual basis as opposed to .1 percent for direct debt.

This was attributed to a number of factors, including failure to meet investment returns and actuarial changes.

However, the experience of pension liability growth among states like Connecticut may be higher than Fitch Ratings’ analysis because the ratings agency used a fixed rate of return for pension liabilities.

Connecticut and other states have lowered their assumed rate of return since the 2008 recession. Lowering the rate of return increases the amount of unfunded liabilities.

Connecticut decreased the assumed rate of return for its major pension funds from 8 percent to 6.9 percent, which subsequently increased the net pension liability.

However, even that lower rate may prove difficult in 2020 which saw wild swings in the stock market due to the pandemic.

Investment losses will be recognized gradually over five years, putting upward pressure on employer contribution rates beginning in 2022 and reversing several years of flat to declining contribution rates.

Fitch Ratings 2020 State Liability Report

The report by Fitch Ratings said the coronavirus recession will have a “delayed impact” on state pension liabilities.

“Those pensions with a June 30 measurement date – the vast majority of state plans – will suffer a setback in asset performance, albeit to a lesser degree than initially expected,” the report states.

“Investment losses will be recognized gradually over five years, putting upward pressure on employer contribution rates beginning in 2022 and reversing several years of flat to declining contribution rates.”

That could be problematic for Connecticut, which has only seen contribution rates increase every year even as the state has re-amortized its pension liabilities to keep contribution rates from spiking to unsupportable levels.

Connecticut faces a $900 million deficit in fiscal year 2022 and pension contributions by the state were projected to rise by $259.7 million before the economic downturn, according to the Office of Fiscal Analysis. If Connecticut fails to meet its rate of return over the next few years it could drive those costs higher.

Milliman Consultings’s 100 Public Pension Funding Index found annual returns were just 3.84 percent, according to Fitch Ratings.

Although Connecticut’s investment returns for the 2020 fiscal year have not yet been posted, 2019 saw investment returns of 5.88 percent, according to the Office of the State Treasurer.

The report notes that some states have managed to improve their overall standings through benefit reforms.

Oklahoma joined the top ten states by contributing more than its annually required contribution, and Colorado and Minnesota lowered their debt to income ratios by reforming cost of living adjustments for retirees.

Robert S Zapp

December 23, 2020 @ 8:13 pm

Gee, and here I believed rino weiker and the dems would solve all of connecticut’s deficit and debt problems when an income tax was surreptitiously imposed in 1991. I remember. Weiker said imposing an income tax would be like throwing gasoline on a fire. Then the lying nabob gets an award from the Kennedy school of government.

Tom G

February 16, 2021 @ 12:47 am

OTher states look better on paper bc their teacher pensions aren’t on THEIr state budgets. We have the best teachers and they will get their pensions. Otherwise our towns and school districts would be the ones paying/defaulting, out of property taxes, and the result would be uneven, unfair and discriminatory.

J l riedel

March 25, 2021 @ 1:19 am

Yes kick the ederly in the state

To take care of mismanaged funds in this state for at least 10 – 12 years. Let alone all of the corporations have left and they did nothing to save them.