Connecticut’s teachers’ unions are angered over changes to how the state calculates teacher pension death benefit payments for spouses and are working behind the scenes to reverse the reforms, according to emails obtained by Yankee Institute.

When a retired teacher passes away, the Connecticut Teachers Retirement Board cuts a lump-sum check to the late teacher’s spouse based on the teacher’s overall contribution to the pension fund, minus a percentage of benefits already received – known as Plan N.

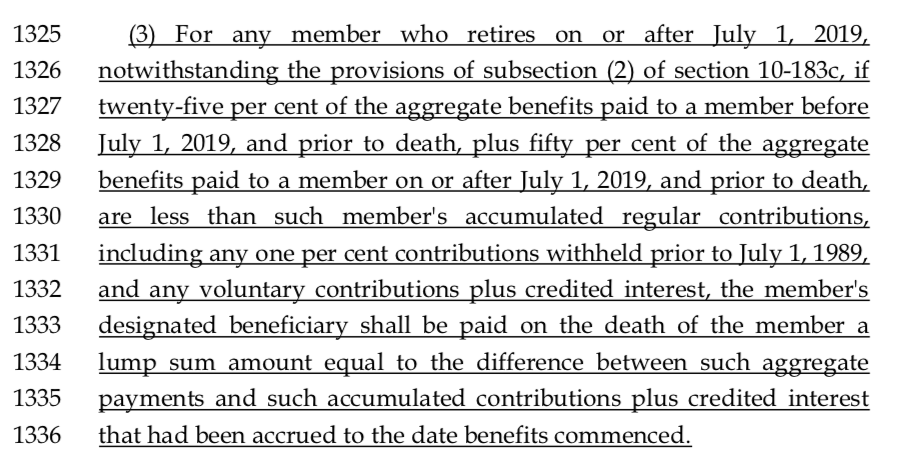

However, according to concerned teachers’ union officials, the formula to determine the survivor benefit was changed when Gov. Ned Lamont restructured the state’s teacher pension debt payments as part of the 2019 budget.

The change results in a teacher’s total account balance being drawn down at a faster rate, rising from 25 percent of their annual pension payment to 50 percent. This leaves less money in the teacher’s retirement account to calculate the death benefit package but keeps more money in the massively underfunded Teachers Retirement System.

The change affects teachers who retire after July 1, 2019 and have elected Plan N for their retirement plan. There are two other retirement plans available.

But the change is not sitting well with union officials in the American Federation of Teachers CT, a union that supported Lamont’s gubernatorial campaign.

These changes we believe are in violation of existing case law and we are exploring different legal options in the event that political options fail us.

Teri Merisotis, Legislative Advocate for AFT CT in February 21 email

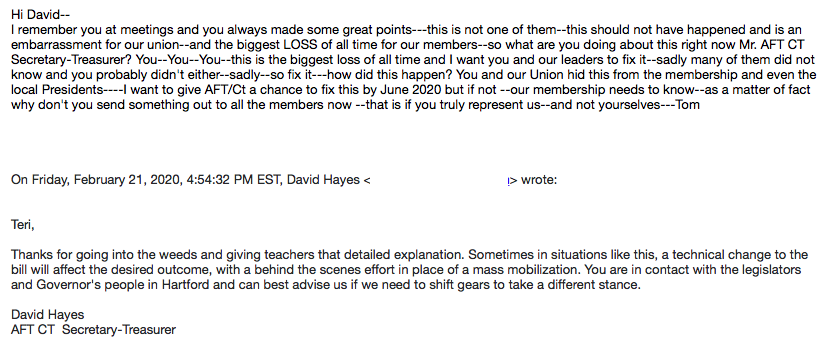

In a February 21 email, former Vice President of AFT CT and New Haven school counselor, Thomas Burns, said the pension changes could cost him $150,000.

“I am sure that everyone on this email does not know that we have lost a bunch in our retirement money’s,” Burns wrote in an email to a number of union officials. “This hurts — a huge failure which was hidden from membership and if I knew personally I would have retired last year.”

“Please ask the powers that be how this happened in secrecy,” Burns added.

The email was primarily addressed to Teri Merisotis, legislative advocate for AFT CT.

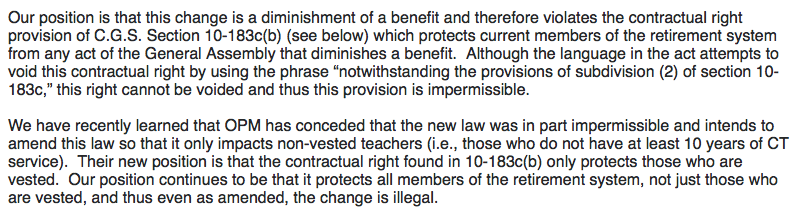

Merisotis responded that AFT considers the change “illegal” and is “in conversation with the Governor’s office and the Treasurer’s office.”

“AFT Connecticut is on top of the issue and working with [Connecticut Education Association],” Merisotis wrote. “These changes we believe are in violation of existing case law and we are exploring different legal options in the event that political options fail us.”

Merisotis said OPM conceded the change “in part, impermissible” and intends to limit the change to teachers with less than 10 years on the job and not yet fully vested in the pension system.

“Our position continues to be that it protects all members of the retirement system, not just those who are vested, and thus even as amended, the change is illegal,” Merisotis wrote.

“Sometimes in situations like this, a technical change to the bill will affect the desired outcome, with a behind the scenes effort in place of mass mobilization,” wrote David Hayes, AFT CT secretary-treasurer. “You are in contact with the legislators and Governor’s people in Hartford and can best advise us if we need to shift gears to take a different stance.”

Burns labeled the change as “the biggest loss of all time for our members,” and “an embarrassment for our union.” He said teachers should be made aware of the changes.

As part of the 2019 budget, Gov. Ned Lamont and the State Treasurer’s Office did some financial wrangling to re-amortize teacher pension debt payments and avoid an unsupportable spike in payments, which could have ranged from $3 billion per year to $6 billion.

The restructuring of the debt was included in the budget, setting aside $300 million to back teacher pension bonds taken out in 2008, along with the provision changing the death benefit payment under Plan N.

The change in language apparently went unnoticed by teachers union officials, until now.

Unlike state employee retirement benefits which are set in contract, teacher pensions are set in statute and can be changed legislatively, as they were in the 2019 budget. Reversing those changes would likely require a vote by the General Assembly.

Connecticut’s Teachers Retirement System currently faces $16.7 billion in unfunded liabilities and requires an annual payment of $1.2 billion, according to the latest actuarial valuation. The annual payment is expected to increase to $1.6 billion by 2024, according to the Office of Fiscal Analysis.

Despite making the full annual payment for more than a decade, teacher pension debt has actually increased.

Two years ago, the legislature increased teachers’ retirement contributions from 6 percent of pay to 7 percent, resulting in $38 million in additional pension payments.

Although Connecticut teachers’ pension contribution remained lower than similar states, like Massachusetts, the $38 million never went toward the underfunded teacher pension system because the state reduced its pension payment by the same amount.

According to the OFA, the average Connecticut teacher retires earning $93,909 per year and receives a pension of $60,777.

OPM and the State Treasurer’s Office did not return request for comment by time of publication.

Justin Murphy

March 4, 2020 @ 9:04 am

Can someone please clarify this sentence? ‘The change results in a teacher’s total account balance being drawn down at a faster rate, rising from 25 percent of their annual pension payment to 50 percent.’ Does this mean the teacher is receiving more of their account while alive as retirement income, and less as a life insurance payout after they die? Thank you!

March 5, 2020 @ 9:35 am

The death benefit is based on the teacher’s total contribution to the plan, minus a percentage of what they have received each year in pension income. If a teacher, over the course of their career, contributed $300,000 toward his/her pension and every year they received a $60,000 annual pension payment, $30,000 (50%) would be deducted from the $300,000. If the retiree dies after 5 years, that would leave $150,000 in death benefit payout to the spouse. Before the change, only 25% of the annual pension payment was deducted from the teacher’s total contribution toward the plan.