Connecticut could potentially lease part of its tolling infrastructure to telecommunication companies looking to develop 5G wireless technology, according to emails obtained through a Freedom of Information request and forwarded to Yankee Institute.

In an April 29, 2019 email from Rep. Stephen Meskers, D-Greenwich, to members of Lamont’s team, including Deputy Chief of Staff Jonathan Dach and Director of Legislative Affairs Chris Soto, Meskers suggested the administration reach out to friends in the telecom industry to see “what a backbone in our interstate tolling network would be worth to lease out.”

“We might have to overbuild the fiber optic capacity on the toll roads but it could be worth some serious money,” Meskers wrote.

Soto responded to a second email from Meskers on May 2, saying the administration was considering the idea.

The FOI request focused on the Lamont administration’s work with telecommunication companies like AT&T and T-Mobile on legislation streamlining access to state and municipal properties for 5G development.

The legislation was passed by the General Assembly during the 2019 session and signed into law by Lamont this past July.

Toll gantries would be connected with fiber optic cables to rapidly transmit E-ZPass information and license plate photographs to an administrator for billing.

The fiber optic cables could also be used to support wireless 5G technology, which relies on a network “backbone” to support small cell sites through either a wired or wireless connection, according to PC Magazine.

According to Wired, “Huge numbers of new transmitters will be needed to relay all that data to your phone, and many of those transmitters still connect to the internet through fiber-optic cable – glass as thin as strands of hair carrying pulses of light.”

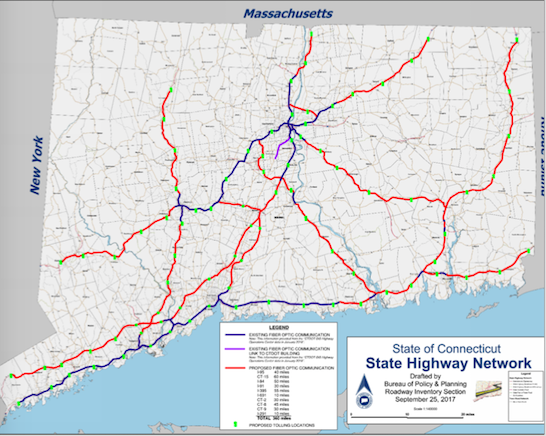

The idea of leasing fiber optic lines in Connecticut’s tolling infrastructure is not necessarily new.

According to the Connecticut Department of Transportation’s 2018 tolling study, other states have leased their fiber-optic cables to private companies.

“Other tolling agencies have also leased the unused fiber optic strands in the roadside fiber ducts to third parties,” tolling consultant CDM Smith wrote in their 2018 report. “This practice could leverage the newly-constructed statewide fiber optic system for additional revenue for the CTDOT.”

The report also notes that Connecticut currently has “about 175 miles or so” of fiber optic cable already installed along some of its highways and would require installation of another 360 miles of cable.

But those proposals were geared toward a much more extensive tolling system involving 82 congestion toll gantries on nearly every highway in the state to bring in an estimated $800 million in revenue per year, a plan that has since been discarded by Lamont and Democrat leaders.

The latest proposal settled upon by Lamont and Democrat leaders is to toll only trucks at 12 locations throughout the state, which is estimated to take in $187 million per year – much less than Lamont hoped for in his CT2030 transportation plan.

Whether or not Lamont’s administration will continue to entertain the idea of leasing fiber optic cable for tolls – or if new cable will be required given the limited number of gantries under the latest plan – remains in question.

Lamont’s private-sector career was in telecommunications, eventually becoming chairman of Lamont Digital Systems, based in Greenwich. Lamont sold the company in 2015.

**Meghan Portfolio contributed to this article**