Republicans in Naugatuck have called for the resignation of Naugatuck Tax Collector Jim Goggin and other public officials after an audit of the Naugatuck Tax Collectors Office by the State of Connecticut found multiple issues related to employee training, the waiving of interest for individual tax payments and late refund payments.

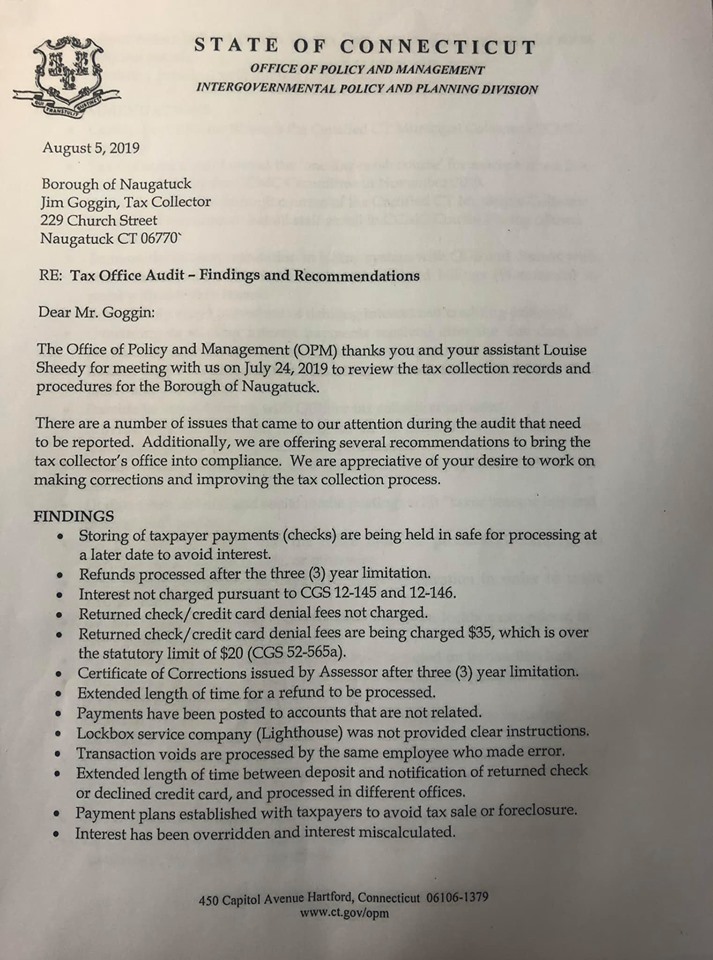

The audit conducted by the Connecticut Office of Policy & Management found Naugatuck stored tax checks in a safe to avoid interest penalties, over-charged for declined checks and the waived interest charges for tax payments that were received late.

The Connecticut Office of Policy & Management outlined its findings in a letter dated August 5, 2019 that was sent to Naugatuck Tax Collector Jim Goggin and was made public when the Naugatuck Republican Town Committee posted the letter on its Facebook page.

A letter sent by the Naugatuck Republican Town Committee to Naugatuck Mayor N. Warren Hess III faulted the mayor’s office for not sharing the audit findings with the public and other town officials.

“It is our position that these violations by the Tax Collector require immediate attention and that per your request the resignation of Mr. Jim Goggin as Borough Tax Collector immediately,” the letter states. “Furthermore, anyone in the Tax Collector’s office who knowingly participated and covered up these actions needs to be immediately removed.

An anonymous email apparently spurred the release by the Naugatuck RTC.

“I am shocked that the State of Connecticut audited a CT Tax Collector, found that they waived interest/fees ILLEGALLY, (in a letter dated Aug. 5, 2019), that the State has required the town to re-bill all taxes, fees, interested that was waived,” the email read. “Yet no one in the press has picked this up or done a story on it?”

The email went on to claim that the tax collector “has failed to issue refunds owed to residents to the tune of over $100,000.”

The audit did find that refunds were processed after the three-year limitation, but it did not list an amount. It also noted that many of the tax refunds were due to Naugatuck splitting vehicle tax payments into two payments per year, rather than one payment.

Goggin, however, said in an interview that the issues highlighted in the audit are minor instances of the town trying to assist a small number of individuals who have a history of paying their taxes on time.

According to Goggin, one of the biggest issues involved tax payments mailed by six different individuals that were never received by his office.

When those individuals called to find out why their tax payments had not been processed, Goggin asked them to wait for a period of time to see if they arrived by mail.

When the tax payments failed to arrive, Goggin informed them they could send in new checks and that he would waive the interest penalty. The state of Connecticut, however, faulted this waiver of interest.

Goggin said the interest for all six payments amounted to “less than $2,400.”

In another instance, three individuals who traveled to Portugal and would not be in the United States when their tax payments were due submitted their tax payments early.

“We have a big Portuguese community and they go to Portugal for the month of July,” Goggin said. “So, they ask if they can give us the checks and we can process them when the bill is due.”

According to Goggin, the checks were held in a safe and then processed at payment time, but one of the checks was missed when they were removed from the safe, resulting in a late payment. Goggin waived the interest for the late payment because it was an internal error.

“They [OPM] said we have to tell these people going forward that we can’t do that anymore,” Goggin said.

The audit also found that Naugatuck violated state limitations on what a municipality can charge for a bounced check or credit card denial fee. Naugatuck charged $35 for a denied payment, but state statute says the maximum penalty is $20.

“We’ve had that charge on the books forever,” Goggin said. “It’s now $20 going forward.”

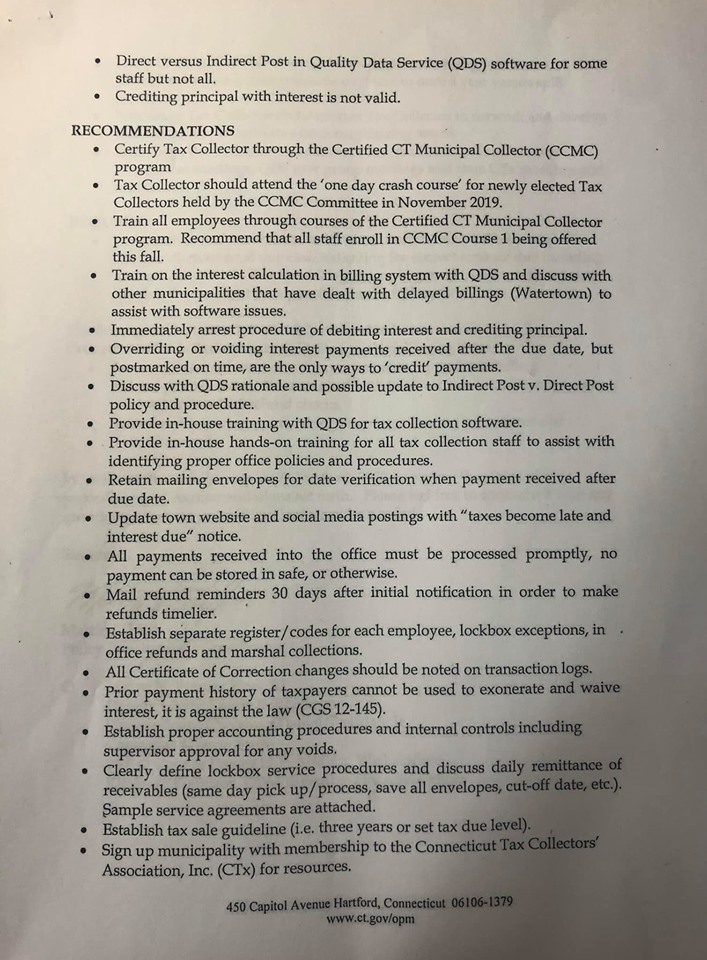

The audit made numerous procedural and training recommendations, which Goggin said his office has already begun to undergo, including himself.

“They said I need to get certified, so that’s what I’m doing. I’ve begun taking classes,” Goggin said.

Goggin, who has served as tax collector for 12 years, believes that release of this letter is largely political as he faces an election challenge from a Republican rival, Kasdyn Click.

“We went through an audit with OPM and we continue to go through this with OPM,” Goggin said. “The findings came up and the findings were answered.”

Chair of the Naugatuck RTC Catherine Ernsky said their decision to release these documents publicly was about transparency, not politics.

“Why we decided to bring this public is because they failed to do so after two months,” Ernsky said. “To me, I think that is alarming.”

Ernsky notes that their letter also calls for the removal of Dan Sheridan, chairman of the Finance Committee, who is a Republican. “There’s no party politics here.”

Goggin was disciplined in 2017 when it was found he altered tax payments by amounts of less than a dollar in order to “make things work,” according to media reports.

George paolini

October 27, 2019 @ 9:49 pm

These seem to be legitimate scenarios which are very correctable. I see no fraud. Procedure will change. As long as procedure is now followed I see no reason for further action. Let the voting process be judge & jury.

anonymouslistenerinct

October 28, 2019 @ 9:03 am

Had the Tax Collector been doing his job and collected all of the taxes and fees, the mill rate might have gone down after the last assessment. Not to mention, I have been doing some research and most CT towns are in the high 90% collection rates, why is Naugatuck’s prior year collection % only at 85%????? And, he has been elected for 12 years and is just taking his first class now?????

Not following state law indicates that the tax collector is a criminal… how can you consciously vote for him? He can be sentenced to jail…. and from what I found out, the audit findings from the state were for a one month time period – how can anyone be sure that he hasn’t been doing illegal things for the 12 years he has been here??? I am sure that is why the state is strongly advising the town to do a full forensic audit for as many years back as possible, but based on Pete’s comments, he wont be doing that…. doesn’t that seem a bit odd? Looks like a good old boy club to me….he will not have my vote…fool me once, shame on you… fool me twice …well that isn’t going to happen.

carl slicer

November 7, 2019 @ 4:26 pm

Is there a place where we can see the letter from the State of Conn?

Thanks Carl SLicer