Democrats in the state legislature have been on defense since a Republican press conference last Thursday that announced some grocery items will now be subject to a 7.35 percent sales tax.

The budget included a 1 percent sales tax increase for restaurants but included pre-prepared foods sold in grocery stores as being subject to the sales tax and potentially costing Connecticut shoppers up to $90 million per year.

According to guidance published by the Department of Revenue Services, the new tax will affect grocery items ranging from protein bars to rotisserie chickens.

“Under prior law, supermarkets and grocery stores were not required to collect sales tax on all meals and beverages in the same manner as eating establishments,” the DRS report says. “However, the new legislation requires that grocery stores collect sales tax on all meals and taxable beverages as of October 1, 2019.”

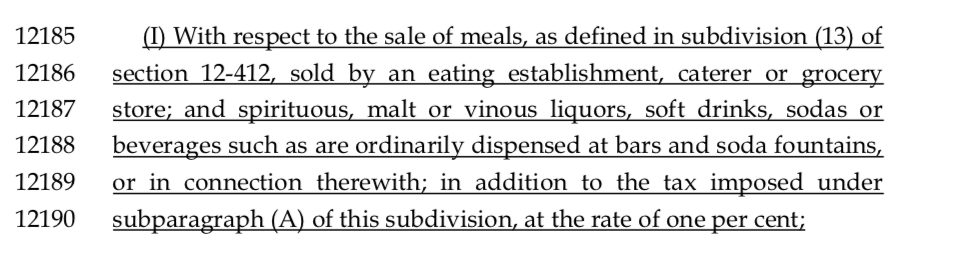

The language change was part of the budget released by Finance, Revenue and Bonding Committee, essentially adding the word “grocery store” to the type of “eating establishments” that must include sales tax for prepared meals.

Although the original estimated revenue from the increased restaurant sales tax was $114 million, the inclusion of grocery items under the guidance of DRS increased the estimated tax revenue by $90 million per year.

The announcement sent grocery stores scrambling to update barcodes, but Democrats say that was never the intention of the bill and faulted the DRS for including those items in its report.

Senate Democrats wrote in a letter to DRS Commissioner Scott Jackson that they were “shocked to see that DRS has somehow interpreted the language in the budget to significantly broaden the base on what meals and beverages would be covered by the sales tax.”

“This interpretation goes against the legislative intent of the new law and against the interpretation of the new law by all three of our nonpartisan offices,” the letter states.

Gov. Ned Lamont said he was going to take a second look at the sales tax expansion. “I want to ensure that the budget that was approved by lawmakers is enacted in the spirit in which it was passed,” Lamont wrote on Twitter Monday and said he was directing OPM Secretary Melissa McCaw and Commissioner Jackson to review the guidance and interpretation published by DRS.

Republicans have been vocal in calling out the Democrat-controlled legislature for passing the budget with what amounts to a tax on groceries.

Senate Minority Leader Len Fasano, R-North Haven, said “Democrats cannot own up to their mistakes.”

“For Democrats, and now the governor in yet another flip flop, to lay blame on the DRS Commissioner and ask him to ignore the very language they wrote is absurd,” Fasano said in a press statement. “What good is any law if it can simply be ignored by request of a legislator?”

Fasano suggested the legislature return in a special session to undo the inclusion of grocery stores as being subject to the sales tax, arguing the language cannot be changed by the Lamont administration alone.

Democrats and the governor’s office also pushed back against Republicans, saying the GOP had not offered their own budget during session.

The balance of power in the legislature shifted significantly during the 2018 election, with Democrats now in total control of the House of Representatives and Senate after two years of a slim majority in the House and a tied Senate.

The Lamont administration reportedly considered a plan early in the session to levy a 2 percent sales tax on groceries – an idea put forward by the Commission on Fiscal Stability and Economic Growth, made up of Connecticut business leaders and CEOs.

But the idea was so roundly decried by nearly everyone that it was quickly back-peddled and supposedly discarded.

Paul Yankowski

September 19, 2019 @ 11:38 am

Only in CT once the house is sold BYE BYE

Ramp

September 19, 2019 @ 11:46 am

What ever happened to Yankee ingenuity?

We seem to be stuck on a oneway street of ever increasing taxes.

Libertarian Advocate

September 19, 2019 @ 4:06 pm

Perhaps the Republicans should have kept their lips zipped and permit the Demoncrats to hoist themselves on their own petard?

Clifford Gay

September 19, 2019 @ 4:47 pm

That’s it I’m moving I’m tired of all the taxes audible I just can’t live in Connecticut anymore and I own a house in Plainfield

Claire M Young

September 20, 2019 @ 12:53 am

So is there or is there not a tax on a yogurt cup bought from the dairy case? Single serve frozen pot pies? A rotisserie chicken (serves 4)? An apple? A chocolate bar? A pint of milk?

This is ridiculous. State government needs to get its act together, and fast. Grocery food which is not meant to be eaten in the store should not be taxed. The

David

September 20, 2019 @ 7:29 am

So glad I fled The People’s Republic Of Connecticut back in 2014. Yes, it was about the taxes.

Fred Farckle

September 20, 2019 @ 9:50 am

I moved after living in Ct over 55 years so these additional taxes don’t bother me anymore. Instead of stessing over their new ways to steal my money from me I feel sorrowfull humor that the politicians don’t yet get it. Instead of cutting their bennies or salaries they take the easy way of just taxing everyone else more. I just finished reading Atlas Shrugged and wow is it relevant in regards to how Ct is operated. I expect to see it going bankrupt to get out of its obligations. Sad.

Carik

October 14, 2019 @ 8:09 am

Democrats are destroying Connecticut. They are trying to destroy the whole country.

Why is it they always make huge promises to those in need which they never fulfill and

still tax the working people to supposedly enact all of their invalid, impossible programs?

The taxes they have enacted in Connecticut October 1, 2019 will cripple small businesses

and drive up living costs of the people who can afford it least. Wake up Americans. We MUST

vote them out to save ourselves and our country.

Denis Eton-Hogg

October 27, 2019 @ 3:45 pm

Left the sinking ship called Connecticut in 2016 and brought my business with me. Best decision we ever made. The politicians buy votes by giving state employees and unions the taxpayers’ hard earned money. They cannot understand the concept of living within their means.