Early in the legislative session, word spread that the Gov. Ned Lamont administration was considering a possible sales tax for grocery items. The subsequent outcry from groups across the political divide buried the idea, seemingly forever.

But, according to House and Senate Republicans, certain groceries are going to be taxed at 7.35 percent – the increased sales tax rate for restaurants.

Both Senate and House Republicans presented their findings at a press conference at the Capitol, citing a report from the Department of Revenue Services.

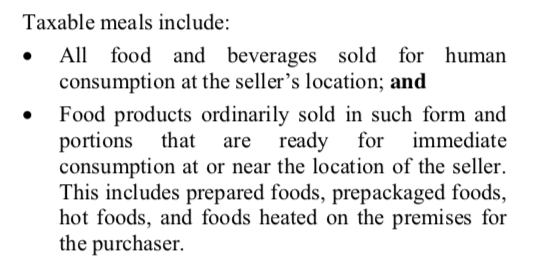

According to DRS, prepared foods “in such form and portions that are ready for immediate consumption at or near the location of the seller” will be subject to the tax. “This includes prepared foods, prepackaged foods, hot foods, and foods heated on premises for the purchaser.”

That definition includes sandwiches, frozen desserts sold in prepackaged multi-unit packs, meal replacement bars, soup sold in containers of 8 ounces or less, cooked chicken or ribs, small bags of chips, pre-prepared salads of 8 ounces or less and baked goods sold in quantities of five or less.

Republicans claim the budget expanded the definition of restaurant meals to include items purchased at grocery stores that could conceivably be called a “meal” and are ready for “immediate consumption.”

Senate Republican leader Len Fasano, R-North Haven, said the sales tax for “meals” at grocery stores was a hasty money grab “to expand the universe of taxation.”

“It’s unfair, it’s not right and it’s unjust,” Fasano said. “The bottom line is that it’s a grocery tax on consumers.”

Rep. Vincent Candelora, R-Branford, said the taxation change will force grocery stores to go through their inventories to try to determine which items are a “meal” ready for consumption and subject to the tax and which are not, potentially levying the tax on a large number of grocery items to avoid audits or penalties.

“The Democrats have exposed all consumers in Connecticut to taxation of any food item,” Candelora said. “This policy is going to have broad, wide sweeping impacts on our families who are already struggling from all the other taxes we have seen in the budget over the last ten years.”

Grocery stores were already taxed for single meals they sold in areas of the grocery store that allowed for selling hot foods or beverages that provided seating areas. However, the budget language expanded the definition to include items purchased from grocery store aisles.

I’m not sure any of us realized the breadth of items covered under the new law until DRS issued its guidance.

Wayne Pesce, President of the Connecticut Food Association

Wayne Pesce, president of the Connecticut Food Association which represents grocery stores in Connecticut, said “consumers are sure to be surprised about an additional 1 percent tax on staple items such as rotisserie chicken, bagels and single serve beverages.”

“Grocery retailers are working toward compliance on hundreds of upc’s [barcodes] that need to be changed in their point of sale systems,” Pesce said. “I’m not sure any of us realized the breadth of items covered under the new law until DRS issued guidance.”

The new tax will become effective on October 1, 2019.

Republicans said they have requested an analysis from the Office of Fiscal Analysis to determine the estimated revenue figures.

The OFA estimated the additional 1 percent sales tax on prepared foods would bring in $48.3 million in 2020 and $65.8 million in 2021.

The 2019 budget expanded the state sales tax to include items previously untaxed like parking lots, dry cleaning and interior design services and raised the tax on digital downloads from one percent to the state sales tax of 6.35 percent.

The governor’s office pushed back against Republicans saying they closed a budget gap without increasing tax rates and criticized the GOP for not submitting their own budget.

Belinda Salvestrini

September 12, 2019 @ 6:35 pm

I cant believe our govenor is getting away with this food tax and everything else he wants to tax. He is not considering all the people who live pay check to pay check . All he did for the middle class is make it harder to live in this state with no regard for anyone but himself. What’s it going to take everyone leave this state and not come back because he doesn’t care about our state

J.R.

September 12, 2019 @ 11:22 pm

Pigs feeding from the public trough….what Hartford is doing to the working class in Connecticut is nothing short of criminal. Disgraceful!

Kenneth Holifield

September 13, 2019 @ 9:53 am

we the people need the #Fairtax in place we need taxes to be fair! please don’t pick winners and losers!

Fairtax.org

Thad Stewart

September 14, 2019 @ 1:24 pm

The only way this is going to change is if We the People of the state of Connecticut vote out of office the crooks who are stealing from the taxpayers to pay off the unions.

John Feher

September 18, 2019 @ 6:27 am

We made a decision to leave Ct when Lamont won the election.Were comfortably living here in SC and enjoying all the extra money we no longer have to pay in taxes in CT.Sad to leave but glad we did.

Dave Westefeld

September 20, 2019 @ 3:49 am

why doesn’t Lamont start taxing those bloated state worker and teachers pensions?….teachers get half their pensions tax free already!…..oh that’s right….Lamont is already bought and paid for by the state and teachers unions…..nothing but a public union puppet

A.J

September 21, 2019 @ 11:42 am

Lamont is worth at least 90 million. He will NEVER be affected by this tax. When will we learn and stop voting in these RICH people whose main purpose is to protect their millions. He wii never care if we eat or not… This is definitely a poor man’s tax. When is the last time he entered a grocery store…to shop?