As Democrats in the legislature float proposals to raise the income tax rate on Connecticut’s highest earners and increase the capital gains tax, Chief Executive Officer for Greenwich-based AQR Capital Management Clifford Asness tweeted “Do people generally prefer living in Texas or Florida? Asking for a friend.”

Asness’ tweet linked to a February article by CT Mirror in which the powerful Progressive Caucus in the House of Representatives called for increasing the income tax for Connecticut’s top income bracket.

This past week saw another proposal to increase the capital gains tax by 2 percent, an idea which has received support from Democratic lawmakers including House Majority Leader Matthew Ritter, D-Hartford, and co-chair of the Finance, Revenue and Bonding Committee Jason Rojas, D-East Hartford.

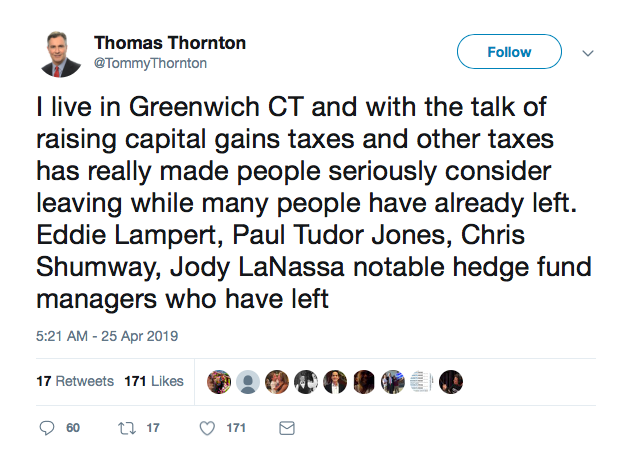

Thomas Thornton of Hedge Fund Telemetry, a data collection and analysis firm, also chimed in on the proposal to raise the capital gains tax, saying “the talk of raising capital gains taxes and other taxes has really made people seriously consider leaving while many people have already left.”

Although the tweet by Asness may have been tongue-in-cheek, it could also have been a shot across the bow for Connecticut, causing some lawmakers – including Gov. Ned Lamont – to pay attention.

Connecticut has a history of losing major hedge funds and billionaire CEOs to Florida over the past eight years, including Paul Tudor Jones of Tudor Investment Corp., Edward Lampert, Barry Sternlicht of Starwood Capital Group, C. Dean Metropoulos and Thomas Peterffy of Interactive Brokers.

Those five individuals had a combined net worth of $68 billion, according to a study by the Cato Institute.

According to the Internal Revenue Service, Connecticut saw a massive outmigration of wealth following the 2015 tax increase, with a net loss of $2.6 billion in adjusted gross income to other states – the bulk of that loss came from those earning more than $200,000 per year.

The loss of a major investment firm or billionaire can cause big swings in Connecticut’s tax revenue.

A 2014 tax incidence study found just 357 of Connecticut’s wealthiest families paid 11.72 percent of the personal income tax revenue and 5.4. percent of Connecticut total tax burden.

Connecticut’s fiscal situation closely tied with investment earnings, the state’s financial services sector being one of the biggest and most productive for tax revenue, and Fairfield County is known as a home for major investment firms.

That reputation has slightly diminished as major investors depart for Florida, which does not levy an income tax and has actively marketed itself to Connecticut financial firms.

AQR Capital is based in Greenwich and is listed as the second largest hedge fund in the world, according to a listing by Institutional Investors Alpha 2017 Hedge Fund 100 list, managing $70 billion in assets.

Although Lamont has said he was against another income tax increase on Connecticut’s wealthy citizens, Democratic party leaders are pushing back.

Lamont used his Greenwich business connections and resume to ride to victory in the 2018 gubernatorial election against Bob Stefanowski, another wealthy businessman, and has enlisted former business executive like Indra Nooyi, former CEO of PepsiCo, and David Lehman, former Wall Street executive as part of his team.

Lamont has also been reaching out to Greenwich business owners and executive to help sell his tolling proposal.

But since taking office Lamont is facing increased pressure to balance the budget with tax increases on Connecticut’s top earners.

Lamont’s budget called for expanding the sales tax, tolling Connecticut’s highways, taxes on hospitals and maintaining a corporate surcharge meant to expire this year to balance his budget.

Both the Finance, Revenue and Bonding Committee and the Appropriations Committee are expected to release their budget proposals next week.

H P Boyle

April 28, 2019 @ 12:59 am

Under any reasonable accounting standards, CT Is bankrupt. No bankrupt state (or country for that matter) has taxed itself back to solvency. The tax base continues to erode and jobs continue to flee the state. Nothing in the governors budget not the democrats budget addresses this. Tax tax tax is their solution. It won’t work. There is no economic hub to NY like a Boston or NYC. Restore the trains to the speeds of our grandparents age, cut the state payroll to levels of RI or MA and recognize the bankruptcy of the state pension programs and we might have a chance. Until then, we are on the path of Illinois…a race to the bottom.

David Chu

May 1, 2019 @ 12:29 pm

A venture capitalist I know who has a home in Fairfield County and in Palm Beach, FL also has an app on his phone that tells him how many days he can be in CT before he’s liable for state taxes. Since it uses GPS to verify his whereabouts, it’s bullet-proof for tax auditing purposes. I suspect this app is very popular among sometime Connecticut “residents.”

Eli Levine

July 7, 2019 @ 6:20 pm

I think we need to take a serious reframe of the way societies develop their economies and economic systems and capabilities. The fact of the matter is that two financial things must happen: first, the state government must pay off its debts and correct for the deficits that were started under the Roland and Rell administrations. The second thing the state government must do is restart its capacity to generate revenue effectively without needing to increase the tax rates (even if some new taxes are placed on certain individuals and companies to help pay for those new investments and the state deficits created under the Republican administrations and the continued presence of Neoliberals in the Democratic Party).

To get these revenue streams going for the state, you need initial investments into ensuring that people can consume more by increasing bargaining power during wage and salary negotiations, and covering some of the common costs of living and economic development (such as education for everyone, or healthcare) through taxation derived from the private sector’s productive output. This increases the potential for sales tax revenues and generally makes the State a more attractive place to live. I suggest focusing on getting workers to own the firms they work at directly as a means to get some companies who do business in our state to be more financially balanced internally between management and workers. If the evidence is accurate from the co-operative and ESOP model literature, these changes to business structure could actually unleash the creative and productive capacities of our firms by making it so the people who are most intimately involved with the tasks of production directly benefit from what they do to improve the productive and wealth generating capacity of the companies they own. The government only needs to change how they define firm ownership, and then derive revenue to pay for the services, projects, and programs that the market doesn’t fulfill in a quality or satisfactory fashion from the improved productive capacities of the market actors and the citizenry.

You also need to make the land more economically productive per square unit of land for both sales and property tax purposes. This requires careful coordination between the State government down and across the constituent municipal governments. Investments to improve the housing stock of the state where they’re already present, maintain or increase density with historically and locally appropriate green architecture architecture, improve the capacity and effectiveness of public transit across the state, and to reclaim waterfronts and downtowns from highways (starting with Hartford, New Haven, and Bridgeport specifically)d can all be steps that the State government can proactively begin legislating for and developing policy. Small investments can be made to improve the capacity of the COGs, and to harmonize state through local connections right down to the target constituency that is being served for social services, infrastructure provision, and regional/urban development. In this way, the State government may make investments that improve conditions for businesses and businesspeople to function that yield returns on investment for the State government. In this way, we can over time make the financing expenditure neutral, or net positive for the State’s revenue streams.

All of this requires investment. All of this depends on the debt being within manageable and sustainable levels. All of this requires revenue. The government either gets the revenue from those it does the least amount of financial and social harm to, or the State becomes a less attractive place to live, work, and do business in. You either start the virtuous cycle up again of development feeding future development; investments feeding future investments, or you get a vicious cycle of decline, divestment, and staggeringly cruel inequality that stifles economy-wide productive capacities and peoples’ well-being (which is precisely what the State of Connecticut suffers from symptomatically). We either fix this the same way it was created: with government policies, programs, and choices, or we continue to decline as a state, a region of states, and a nation from divestment and the capture of our economy. Let those who don’t want to invest in communities leave. If their wealth was taxed minimally, and they paid minimal amounts into the system (to the point where it’s either $0, near $0, or a credit in your favor), you don’t lose all that much in comparison with the single mother of 3 who is spending in the state more of her income than that wealthy person was in the first place. I’d rather make sure that single mother of 3 who’s struggling with payments for childcare, education, health, and the costs of getting from place to place, and living in harsh housing conditions gets what she needs, because she will stay, work on improving her and her kids’ lives, and presto, we have a total of 4 taxpaying citizens who love the state versus one very rich one that wasn’t paying in anyway who didn’t care much about the state or its people to begin with. You see what I’m getting at here?