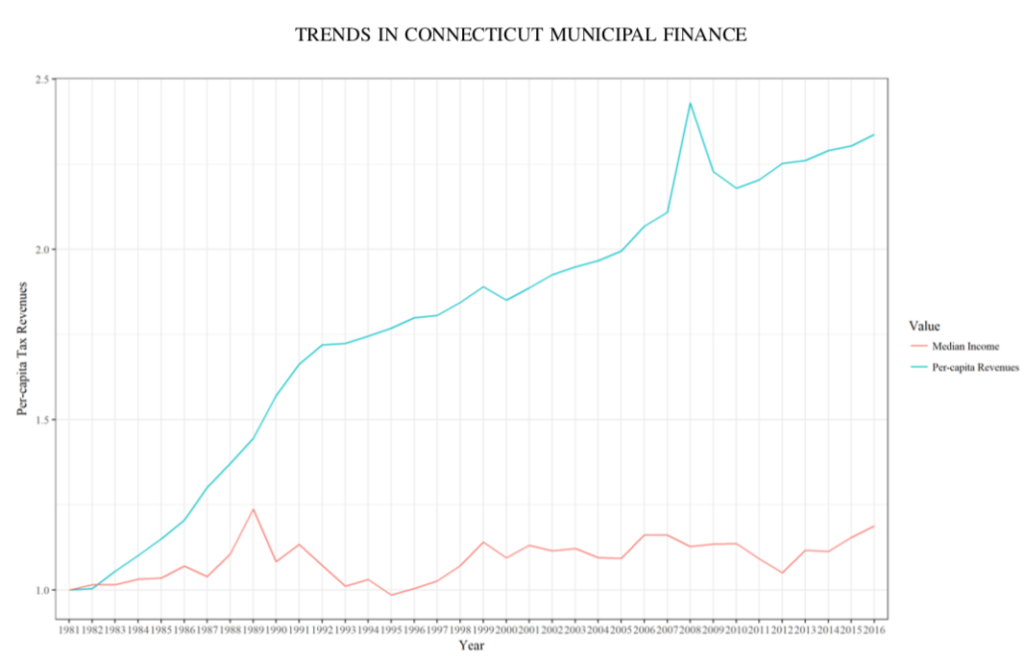

Property taxes and revenue to Connecticut municipalities has more than doubled since 1981, while Connecticut residents’ median income levels have grown very little, according to a new report.

Decades of data compiled by the Connecticut Office of Policy and Management and analyzed by the Western Connecticut Council of Governments shows the increasing pressure on Connecticut property tax payers over the years.

Per-capita revenue to Connecticut municipalities grew 2.5 times over previous levels between 1981 and 2016, according to the report. The figures include state grants to municipalities, which also grew significantly during that time. All figures were adjusted for inflation.

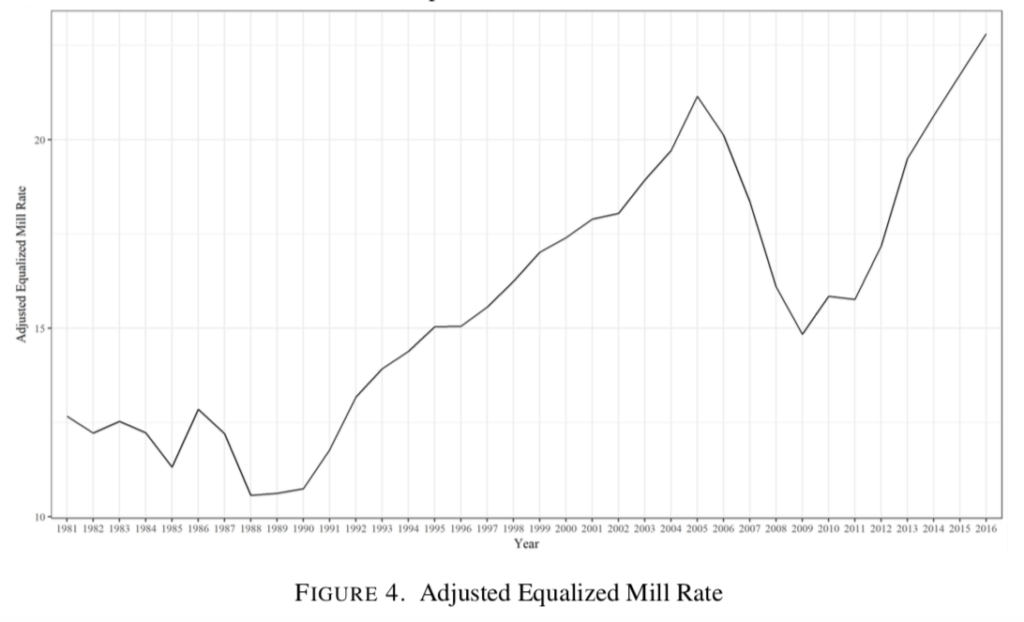

Mill rates showed significant increases based on OPM’s adjusted data. Mill rates sky-rocketed starting in 1991, the same year Connecticut instituted the state income tax.

Rates dropped quickly during the 2008 recession, but the data now shows mill rates have surpassed pre-recession levels.

Essentially, Connecticut’s taxpayer burden at both the state and municipal level increased dramatically following the passage of the income tax, but residents’ income levels have not.

The median household income in Connecticut is lower than it was in 1989, when adjusted for inflation.

According to the U.S. Census Bureau, Connecticut’s median income in 1989 was $41,721, the highest in the country at the time. In 2018 dollars, that amount equals $86,820, which is $13,000 more than Connecticut’s current median income of 73,433.

Connecticut’s personal income growth since the 2008 recession has been the lowest in the nation, even as taxes were raised three times between 2009 and 2015.

Despite revenue to municipalities more than doubling, towns and cities aren’t necessarily awash in money; some towns are facing fiscal distress due to rising costs and expenses due to debt.

A newly-released study by the Yankee Institute found nearly two-thirds of Connecticut municipalities faced elevated fiscal distress, with eight municipalities facing a potential crisis.

Municipalities face many of the same problems as the state, including high levels of pension debt, high levels of bonded debt and declining populations.

Education funding is the largest expenditure for Connecticut towns and cities, taking up 58.8 percent of municipal revenue on average, according to OPM data. While the number of students has declined in many towns, education spending continues to grow due to costs associated with labor, insurance and employee benefits.

On average, per pupil spending for Connecticut municipalities rose nearly $1,100 between the 2013-14 school year and the 2015-1016 school year.

Municipal aid from the state, however, remains in jeopardy as future state budget deficits threaten cuts. Even municipalities whose education funding is held flat face difficulty because education costs at the local level continue to rise.

Connecticut’s high cost of living and heavy tax burden is top on voters’ minds, according to a survey released by Sacred Heart University Institute of Public Policy.

The survey found that more than 90 percent of voters were concerned with Connecticut’s high cost of living and tax burden.

Sk8sonice

August 26, 2018 @ 12:15 am

You are erroneously conflating high cost of living with heavy tax burden. That is an ongoing mistake, and the consequence is rising inequality where the less affluent municipalities face crises, including bankruptcy and failing education systems while affluent communities complain about taxes but fund their schools and refuse to contribute toward shared resource improvement. Everybody gets squeezed but the affluent communities win the improvements.

Denis

August 26, 2018 @ 12:22 pm

Lack of growth caused by high taxes and migration of taxpayers including ex state employees and teachers. Our homes are worth 30% less since 2012 than the nation as a whole. The candidate that shows he is committed to growing our economy and our home values will win the election.

John

August 27, 2018 @ 10:59 am

Sk8s tax rates effect the cost of living no matter how you shake it. Raise the rate of taxes by 10% and you increase the over all cost by 1%. In this state taxes account for over 10% of the cost of living, unless you own absolutely nothing. Mill rates around 30 on average across the state means a 100,000 house is taxed at 3,000 a year. Try to find a 100,000 dollar home that is halfway decent. A person making 50,000 should be able to afford that but effectively pays 5% of pretax income on this property. Then they pay another 6% income tax and 6.5% sales tax on purchases not including state fees on electric, cable and vehicles (no public transportation). When all is said and done CT taxes at about 12-15%, then the fed gets you for another 25%+. The rich in this state pay 10% in income taxes and contribute even more with sales taxes on purchases(more expensive purchases on avg.). In your perfect pay your fair share world what percentage of income is a fair share?

ted hutchinson

September 29, 2018 @ 6:33 pm

The CT taxpayers will continue to vote for higher taxes and increases in government employee and school teach unions retirement programs. They will never change. It does not matter if some cities like Hartford go broke for others will have to save the day and bail them out. Ct government leaders are a greedy bunch. All the big cities are run by progressives, all the states congressional elected officials are progressives, the governor and his staff are progressives. They all work together to attempt to destroy the state. The only way this can change is to elect some new and different leaders. The governor is simply one of the worst in the entire USA.

Robert

October 1, 2018 @ 2:02 pm

We need to elect officials with guts to take on the unions. Let mis-managed city governments go bankrupt. End 20-25 year retirements with family medical. Stop financing stupid projects with bonding (That have such high risk banks won’t fund them.) and stop the insanity of infrastructure projects such as tunnels in Hartford and putting I-84 at ground level. The latter is to keep the contractors fat and the money flowing back to the re-election campaigns.