Connecticut’s income tax is on everyone’s mind. Some gubernatorial candidates are calling for its abolition in order to spur economic growth, while others say some taxes — although, not necessarily the income tax — must be raised to solve Connecticut’s continuing budget problems.

Whatever may happen with Connecticut’s income tax, it is clear that something went wrong.

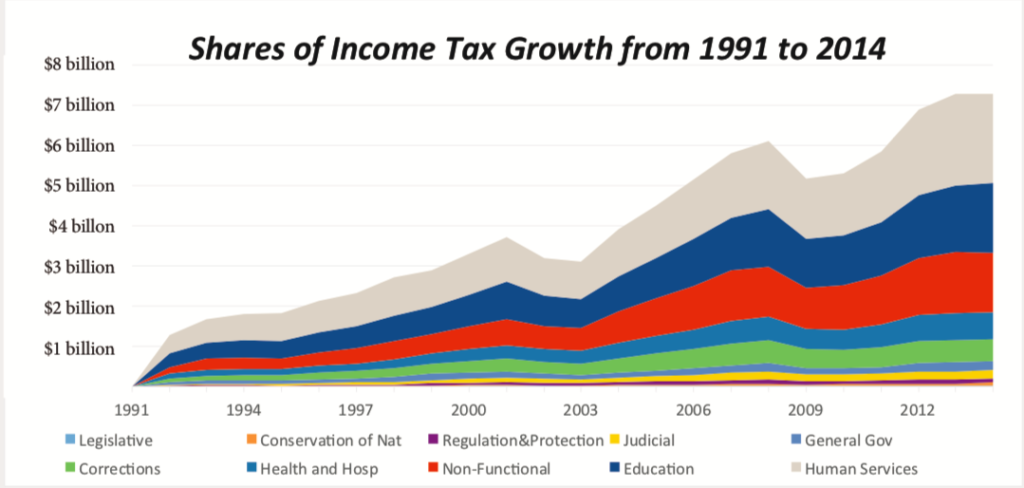

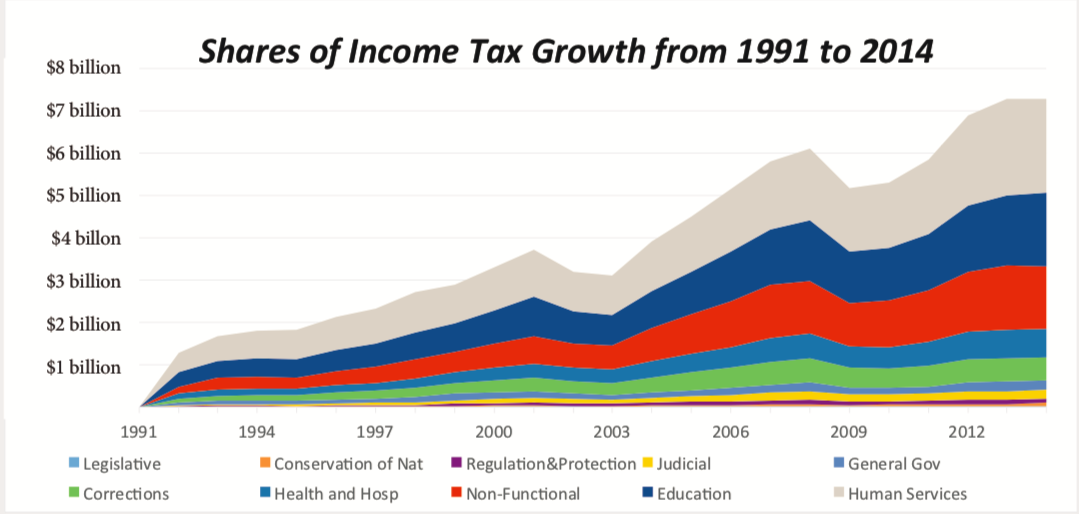

Although the income tax brought in $126 billion between 1991 and 2014, Connecticut’s government spending grew 71 percent faster than inflation, leading to budget deficits and, naturally, tax increases.

According to Pew Charitable Trusts, between 2002 and 2016 Connecticut consistently spent more money than it took in, averaging only 97 percent of revenue needed to meet expense demands.

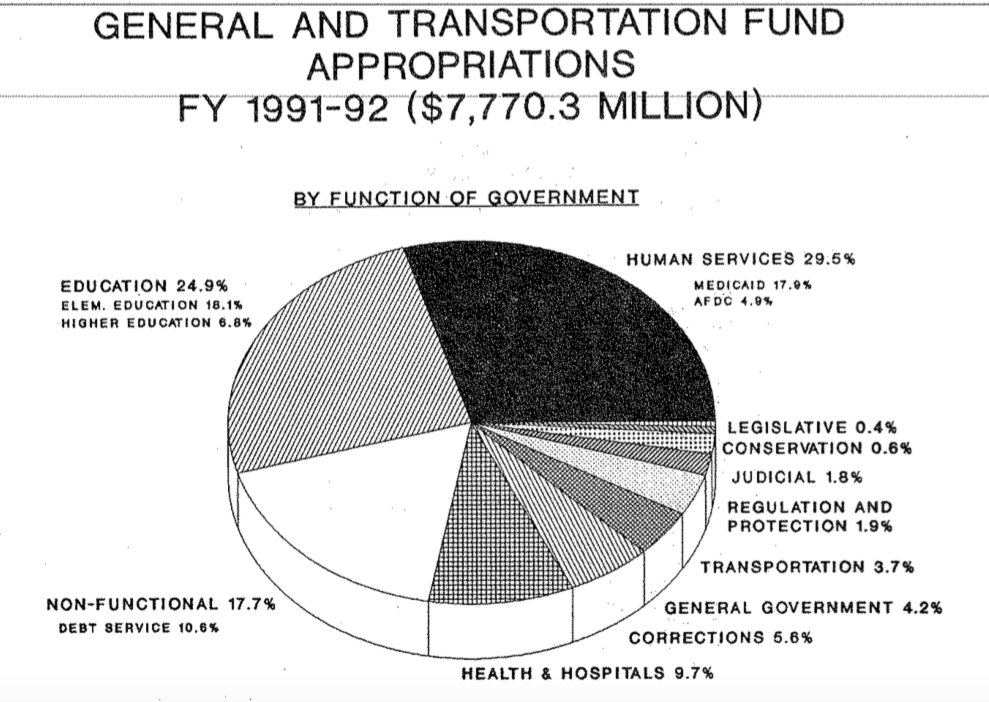

No other state in the country has instituted a state income tax since Connecticut took the leap in 1991. Connecticut’s budget grew from $7.7 billion in 1991 to roughly $20 billion per year.

So where did all the income tax money go?

According to Yankee Institute’s study on the income tax entitled Where Has All the Money Gone? The 25th Anniversary of Connecticut’s Income Tax, the money largely went to three areas: non-functional government spending, welfare, and the Department of Correction.

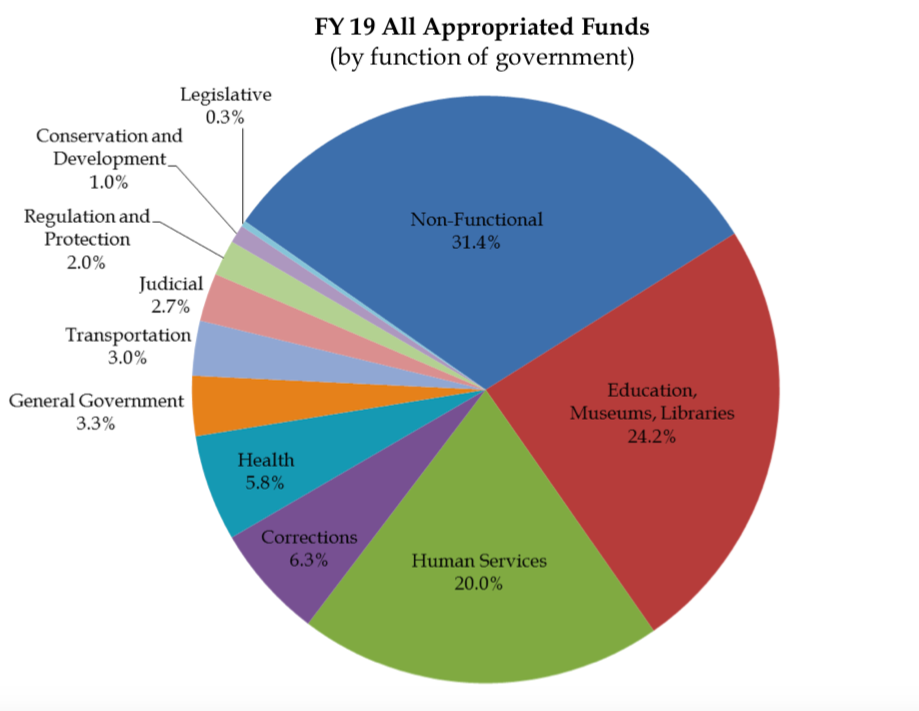

- “Non-functional” spending by state government saw the biggest increase since passage of the income tax, growing 174 percent over inflation between 1991 and 2014. This spending category includes pension costs, retiree benefits, debt service, and some payments to municipalities. Debt payments make up a large share of the non-functional spending increase, according to the study. In 1991, Connecticut had $11 billion in outstanding debt. By 2014, it had increased to $22 billion. As of 2017, Connecticut had $25.5 billion in long-term bonded debt, according to the state’s financial report, with an additional $48.9 billion in unfunded liabilities for pensions, OPEB, and other worker benefits. Nonfunctional spending was 17 percent of the state budget in 1991, according to the 1991-92 budget. As of 2018, nonfunctional state spending is 31 percent of the state budget, according to the Office of Fiscal Analysis.

- Welfare was the fastest area of spending growth after Connecticut passed the income tax. State spending on human services like Medicaid, the Department of Social Services and Temporary Assistance for Needy Families grew $1 billion, or 30 percent, in the three years following the income tax, according to the study. Medicaid spending alone grew 25 percent between 1991 and 1994, which amounts to $539 million in today’s dollars. During the years of state spending growth after the income tax, however, poverty in Connecticut actually increased from 6.8 percent in 1990 to 10.8 percent in 1994. Connecticut’s poverty level has hovered around 10 percent ever since. Connecticut currently spends $2.5 billion on Medicaid, which is 27 percent of the state’s “fixed costs.” Human services in general, makes up 20 percent of the state budget, which is markedly lower than the nearly 30 percent spent on human services in 1991.

- Lastly, Connecticut saw a significant increase in spending for the Department of Correction. Spending on Corrections grew quickly during the 1980s. In 1991, it occupied 5.6 percent of total state government spending. DOC costs increased to 9 percent of the budget by 2009 but has since declined along with Connecticut’s prison population. Spending on Corrections is now 6.5 percent of the budget, totaling $1.3 billion. Gov. Dannel Malloy has shut down some prison facilities to cut costs, but DOC overtime compensation for employees remains the largest source of overtime compensation for the state. In 2018, overtime at DOC cost $71.9 million. Overtime compensation is factored into employees’ pension calculations.

Oddly enough, with the increase in state spending from the income tax, Connecticut’s spending on education has actually declined. Before the income tax, education funding accounted for 31 percent of the state budget. Following the income tax, education spending dropped to 24 percent, where it has remained ever since.

Prior to the income tax, Connecticut relied on its state sales tax and the capital gains tax to fund all state government spending. Now, the income tax makes up 42 percent of state tax revenue, according to the OFA.

Although it has proven less volatile than the capital gains tax, Connecticut’s income tax is still subject to fluctuation, largely because it relies heavily on a small percentage of wealthy residents and is closely tied to gains and losses on Wall Street. Those fluctuations can lead to larger deficits or better-than-expected revenue, depending on larger, national market forces.

Ralph Ralston

September 14, 2018 @ 4:13 pm

After years and years and years of paying more and more and not be listened to by the politicians I now pay nothing to CT. because I moved. It’s called voting with your feet that I find works well when ballet votes don’t work.

John Schimenti

October 22, 2018 @ 8:11 pm

You should read a book called, All The Presidents Bankers. In it,you will see how the financial services industry influences public policy towards debt. What went on in Greece is a fine example of this. Perhaps you should plot the rise of the financial services industry against the growth in Connecticut debt. I’ll bet there is a strong correlation.

I have heard it argued that a state can either be a “cheap state” or a “value state”. Because Connecticut has such a developed economy and infrastructure, it can no longer be a cheap state. In order to be a value state, it has to leverage its assets such as its Universities, its corporate community and its transportation infrastructure to spawn opportunities that cannot be had from cheap states. Universities should offer study programs that prepare local residents for jobs that are useful to the local corporate community. Funding should be made available for research that cannot be funded privately so that a center of expertise is developed. This is what Silicon Valley has achieved. There is, for example, a shortage of CAD operators, CNC Programmers that have machining skills. The Aerospace industry in Connecticut desperately needs highly skilled young people to fill these positions. There are signs along Route 95 from companies desperate to find such people. There is no support, however, from the Connecticut Government to incubate such knowledge in its Universities. They are more worried about building basketball teams and funding stadiums.

We should also insist that our Government practice Public Banking. This is a concept where tax revenues are used to fund the capitalization of a public bank. North Dakota is the only state that has done this. This bank has never been in financial distress in over 100 years of operating and saves the state millions in finance charges.

In order to solve our problems, we need new thinking about what is important and what should be cut. Unless we invest in educating residents to possess high skills that local industry needs, and we use our own tax money to fund our debt, we will continue down the road to insolvency. Well… that’s my humble opinion!

David Kute

March 5, 2019 @ 11:43 pm

Connecticut needs to cut to the bone all entitlement money. Money is spent on welfare and entitlement programs for illegals, and people who won’t work. They have been given housing, food allotments, free medical, free education free phones and they are unaccountable for the large sums of money they receive and no one cares in Connecticut government. If we just stopped welfare there would be an exodus of these non productive people in our state. Let them go home where they came from. They refuse to speak or learn English and don’t want our values. Sure the Democrats cater to them to retain their votes. It is dangerous and counter productive to our economy. Cut welfare completely out and force these freeloading people out of our state completely. Hopefully they will go home to their parent country.

Liz

March 19, 2019 @ 4:26 pm

I guess you didn’t read the article. If you did, you would know that most of the money is going towards paying for underfunded pensions and retirement benefits for mainly white, middle aged and senior citizens. For decades, people voted for politicians who consistently kicked the can down the road, rather than properly funding these major obligations. Now all the citizen of Connecticut are paying the price for this gross negligence and greed. Blame your parents and grandparents, not the “illegals” you despise so much. Most of them work harder than you could ever imagine!

Ex-resident

July 23, 2019 @ 10:23 am

The hire to retire financial commitment to public unions and the cozy relationship between unions and politicians is all you need to know to see the problem. The parents and grandparents of the “white middle class” did not create the problem, other than being the unwitting accomplices who voted these people into office. Whether it’s national, state, municipal or local, it’s always the same story: politicians spend money, have zero respect for the tax payers hard earned income and cater to whomever facilitates getting them back in office.

Dfg

August 19, 2019 @ 6:44 pm

Obviously you don’t know exactly what’s going on

I have personally seen the abuse of food stamps and welfare in the state.

I have seen multiple individuals come in with multiple cards using them for large purchases A lot of these cars belong to other people that they have been purchased for half price which one individual had anonymously stated who used them.

The state so haphazardly doesn’t look into situations of such

These people are totally capable of working full-time or multiple part-time jobs Play the system by stating they can’t get jobs They use computers to search and never follow through on positions just to reach the minimum required searches to me state requirements

When offered interviews they decline when When they do interview they refuse to position when I heard

When they do interview they refused a position when offered

Ones that do take a job , They will refused to work more than 20 hours per week and have stated that they will lose their benefits if they do they will call out sick to make sure they don’t go over

There is a lot more to describe but it’s a big game. These people know I don’t work the system. Do some research

I’m not stating that There are not people truly in need but A large Percentage in not more than 50 percent of this populations is in favor of those who don’t want to work and just refuse to work. And government is taking a blind eye

George

October 27, 2019 @ 10:13 am

Whatever. It doesn’t matter to me anymore. I’m leaving as soon as I retire. Enjoy arguing with the empty spaces where all the people paying the taxes have left. The last election settled it for me and accelerated my retirement date by 4 years. I will retire at age 58, leave the state, and take my federal retirement income with me. I can literally sell my house at a 25% loss and make up the difference in about a year (from tax and cost of living savings). So good luck. Argue on. Folks like me have stopped listening and have or will stop paying for the largesse in welfare and public employee pensions. Have fun.

KWLVT

December 1, 2019 @ 3:20 pm

Quite a few of my friends have left the state for the same reason. I am planning to do so as soon as my kids are done with college.

Jerry Draper

July 31, 2020 @ 10:08 am

See, that’s part of the problem. You retire in CT and move. When you spend the money that originated in ct in another state, that is a zero return. You don’t trickle your ct supported retirement fund in CT.

Wes Shorts

June 23, 2019 @ 9:15 am

Is there an estimate of how much this costs the State of CT each year?

Dfg

August 19, 2019 @ 7:22 pm

Here’s a fun fact. The state is charging $.10 per bag by everyone in the state of Connecticut who purchased one however all EBT and welfare people load up their bags do not pay for them because their tax exempt which means the state is allowing to have all these bags thrown into The streets oceans in landfills Why are they not being held accountable for the bag If they’re going to allow people to generate this bag as trash because they’re on assistance then the state should be equally responsible as everyone else to clean up the mess too. they should be paying for bags also.

Oh geez I forgot this money isn’t going for that LOL is it ???

Jack Renoud

April 7, 2025 @ 8:17 am

State Sales Tax was written by Gov Oneal and one of his UCONN lackies…Howard? Can’t remember his last name…..and handed to lowelll Weicker as a last ditch effort to fund unwanted State Spending and State Workers Union Pensions….and pet projects encouraged and devised by our the General assembly… It’s at the State archives in a recorded interview with this UCONN legal lacky who wrote the legislation..He’s on record as saying such…This fellow had a copy of Saul Alinsky’s Rules for radicals on his desk at UCONN the whole time he was there…We saw it….A little communism goes a long way…