Gov. Dannel Malloy released a plan Wednesday to close a $208 million state deficit this year by offering a combination of cuts to social service programs and tax increases on cigarettes, hotels, and the state sales tax.

In his press release, the governor acknowledged that the options he presented “will be almost universally objectionable, and that there is little appetite among you or your members for making such adjustments to your budget.”

“I agree these changes are difficult and that in better economic times, with a balanced budget, none of us would put them on the table for consideration,” Malloy said. “However, I have a clear statutory obligation to provide you with a plan to mitigate the deficit.”

Malloy’s plan results in $189 million in revenue increases, coupled with $113 in spending cuts. The package of cuts and tax increases is $100 million more than the deficit requires. Malloy says this will help the legislature revise some of its cuts to the Medicare Savings Program.

One of the largest revenue generators in Malloy’s plan comes from raising the state sales tax to 6.9 percent, which is estimated to generate $81 million in 2018. Increasing the sales tax was a major part of Democrats’ budget plans during the 2017 session, but was ultimately left out of the bipartisan budget.

Malloy also included raising the hotel tax to 17 percent; increasing the restaurant tax to 7 percent; raising the tax on cigarettes again by another 25 cents; a 75 percent excise tax on e-cigarettes and an increase to the real estate conveyance tax — something that realtors have lobbied strongly against.

The governor said that the increase in taxes are necessary to avoid closing regional state agency offices, or cuts to higher education, Department of Developmental Services programs or deferring the hospital rate increases.

“If you choose not to consider additional revenue when balancing the budget, it would be difficult or potentially impossible to avoid impacts in areas such as these.”

Malloy shot down calls for major tax increases during the 2017 budget session, but appears to have reversed position in light of this year’s budget deficit.

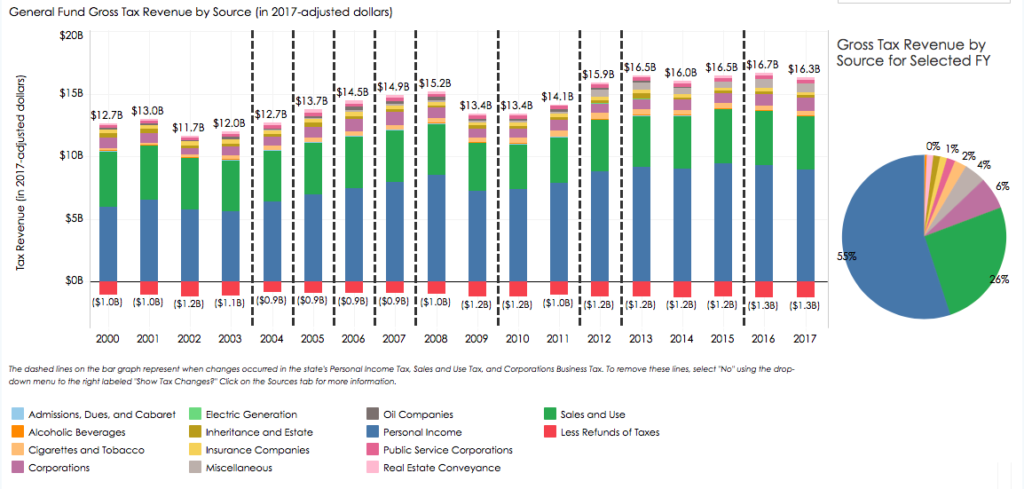

The deficit was caused, in large part, due to eroding revenue from both the state’s income tax and sales tax. Sales tax revenue fell $65 million between from 2016 to 2017, according to CTStateFinance.org. Connecticut’s tax revenue has faced consistent shortfalls despite major tax increases in 2011 and 2015.

Connecticut is left few options to reduce spending due to the SEBAC concessions agreement negotiated by Malloy, which grants state employees layoff protections through 2022 and guarantees wage increases beginning in 2020.

Despite the governor’s claim that the spending reductions don’t significantly affect social program, there are a number of cuts to programs run by the Department of Social Services, the Department of Developmental Services and the Department of Mental Health and Addiction Services.

One of the most significant cuts suggested by the governor is closing off the intake list to the popular but beleaguered Care4Kids program which subsidizes child care for low-income families. This would save the state $18 million in the first year and almost $50 million in the second year.

Malloy also proposes reducing municipal aid by another $50 million. The governor already cut Education Cost Sharing by $91 million in November when the legislature directed him to find $180 million in savings. The cuts affected every municipality in the state.

In his written statement, the governor said the budget cannot be balanced through “vague options” such as reducing overtime or reducing agency spending.

“Please understand,” Malloy wrote, “agency budgets have already been cut drastically, and cannot be significantly reduced further without deteriorating customer service levels, or abandoning programs and services that you and your members hold dear.”