The counter-intuitive fact is that Connecticut’s estate tax hurts everyone – and mostly hurts those who depend on state payments, not those who pay the most in taxes. We need to abandon it.

Proponents of estate taxes make a number of arguments in its defense. The primary claim made for the tax arises from the tax’s claimed progressivity. The theory is that if small estates are exempted from the estate tax, then the less rich will not be hurt by the tax, leaving only the rich to pay it. This, it is claimed, places more of the tax burden on those who can best afford to bear it.

This claim of progressivity is not even necessarily true on its face, because badly designed estate taxes – including those in Connecticut – tend to fall very heavily on small business owners or farmers whose capital stock in their businesses or farms might have a value higher than the minimum estate-tax threshold even if the entrepreneur’s or farmer’s annual income is relatively small.

The primary effect of these ill-conceived estate taxes is to force the descendants of small and family businesses and farms to sell those small businesses or farms – often to wealthier purchasers – in order to pay the tax.

This is nothing but an unconscionable barrier keeping hard-working poor and lower middle class strivers from working their way up the ladder of success.

Setting aside this flaw, the estate tax otherwise should, in theory, act progressively to the extent it only falls on the rich. With the poor exempted, only the rich will pay.

In fact, though – in the real world of modern Connecticut life – the estate tax does not work progressively. Here’s why.

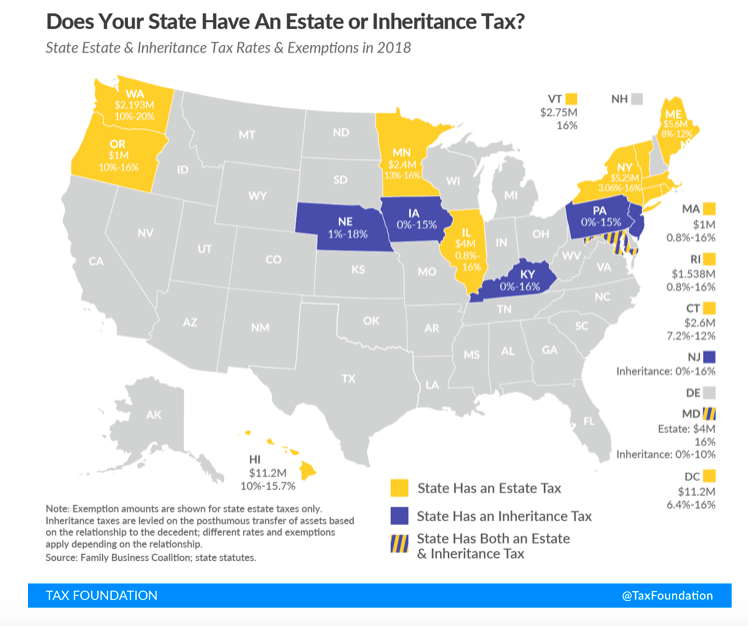

First, as of 2018 the state’s estate tax tops out at $20 million. That is to say, those who die as residents of Connecticut with total estates of more than $2.6 million pay an estate tax starting at 7.2 percent, and increasing to 12 percent for portions of estates in excess of $10,100,000. But the state has limited its take at $20 million per estate, so that the value of estates over $166,000,000 are not taxed.

That’s sort of strange, isn’t it? People with estates worth $10 million at their deaths are pretty well off, no doubt. But people with estates worth $200 million when they die are much, much richer. If the estate tax were structured progressively, then the descendent with the larger estate would pay a higher total estate tax rate, not a lower one. So what’s going on here?

What’s going on here is this: the estate tax causes the rich to move out of state – to one of the two-thirds’ majority of states that have no estate tax – before they die. This is no surprise. Someone who dies in Connecticut with $10 million in assets will have nearly $750,000 of his estate taken by the state upon his death – money that his descendants will receive if he moves to one of the 37 states without an estate tax. No matter how big an estate is, $750,000 is a lot of money.

If you could preserve a three quarters of a million dollars for your descendants just by moving, wouldn’t you? I know I would. (For the record, I’m in no danger of paying any estate tax. But I don’t begrudge those who have amassed large estates from making strategic, legal decisions to protect as much of that estate as possible for their descendants. Do you?)

The Connecticut government knows it too. If our elected officials didn’t know that estate taxes force residents to move out of state, they would not have capped the estate-tax take at $20 million. But why such a high figure?

As noted above, only those who have estates of more than $166 million are benefited by that cap. This suggests the state knows the estate tax drives older, wealthy residents to leave Connecticut, but then it thinks either: (a) that those wealthy folks won’t bother to move for anything less than $20 million, or (b) that the state doesn’t need taxpayers whose wealth is higher than about $5 million (where the estate tax due rises to $200,000) but lower than $166 million and so doesn’t mind if they all move off in their older years.

And as the Yankee Institute demonstrated in 2016, the estate tax is pushing wealthy taxpayers out the door.

As a result, the estate tax becomes even more regressive. The tax doesn’t, by and large, get paid; instead, it motivates high earners to leave Connecticut. When those high earners leave, they avoid not only the estate tax, but income, sales and property taxes in Connecticut, all of which are relatively very high. Which leaves the rest of us to pick up the difference – raising our taxes.

And when those of us who remain can’t afford to pay any more in taxes, state benefits and programs must be cut, hurting the most vulnerable residents of the state. That describes regressive taxation to a T – maybe not in design, but definitely in effect.

The final problem with the estate tax is how much it costs to enforce.

The estate tax is notoriously expensive to apply. It grosses about $175 million a year, though the figure varies widely from year to year and thus provides a poor basis upon which to make economic plans. By itself, though, this is a completely meaningless figure. What’s important to the budget, and to the state, is how much the estate tax nets, after all relevant effects are considered, including enforcement costs.

The tax is especially expensive to enforce in Connecticut because the federal estate tax only kicks in at about $11 million, so the state of Connecticut bears the whole cost of enforcement until that $11 million threshold, where in can start piggybacking on federal enforcement efforts. But by then, the state tax has grown so onerous that many wealthy taxpayers have long since headed for the exits.

In short, with the estate tax we have a tax that doesn’t gross much money in the first place, is highly volatile and unreliable even at that low level, is very expensive to enforce, and drives out untold numbers of residents who would otherwise stay in Connecticut and bear a significant portion of the tax bill.

Let’s repeal it.We’d all be better off if we did.

RUSSELL WUERTZ

August 12, 2019 @ 12:56 pm

Connecticut, the Nutmeg State, due to its soil having the nutmeg color.

Estate of Emil & Phyllis Wuertz, needs to be paid on by The Town of Madison, CT. Wells Fargo Bank, N.A. with a not valid EIN entity for their Wells Fargo Bank, N.A. holding their New Haven Trust Company gone not competent like 1000 others proliferating, and now owes me $980,000 and is not anyone to owe that kind of money. Defaulting to $2,500,000 in three months. Then again showing their general default.