Connecticut’s economic outlook is at a crossroads.

On the one hand, the Constitution State has made moderate strides in reducing its massive pension debt by $10 billion over the past several years; it has a $4.1 billion ‘rainy’ day’ fund; its gross domestic product (GDP) grew by 2.6% in 2024, which was middle-of-the-pack compared to other states; personal income also increased by 5.3% last year; and the state gained jobs. Moreover, Connecticut’s population expanded by 1.6%, a total of 57,893 residents, according to the U.S. Census Bureau.

“Connecticut has experienced an extraordinary period of budget stability, with 6 years of surpluses,” as stated in the 26-27 Opportunity & Affordability: Economic Report of the Governor, published on Feb. 5, which optimistically added, “The economy in Connecticut is also thriving.”

On the other hand, Connecticut is still plagued with affordability issues, being among the worst states for business, with high property taxes, a poor tax climate, and steep electricity rates. Due to the high taxes, the state experienced a net loss of 21,000 people between April 1, 2020, and July 1, 2023.

Meanwhile, Gov. Ned Lamont and the General Assembly are currently debating whether to bust the ‘fiscal guardrails,’ bipartisan spending reforms passed in 2017 (and unanimously extended in 2023) that proved foundational to the state’s financial recovery. Leadership, like House Speaker Matt Ritter (D-Hartford), have even urged the governor to declare a fiscal emergency and bypass the guardrails for fiscal year 2026; although Gov. Lamont voiced his concerns with that idea, saying, “This is no time to panic. No time to declare a state of emergency, but we are ready.”

Nevertheless, lawmakers are possibly jettisoning the reforms responsible for Connecticut’s economic turnaround to offset anticipated Trump administration cuts to Medicare, Medicaid, and other federal assistance. Worse, Connecticut lawmakers are not only aiming to preserve current services, but presenting new ones, like a universal pre-K program, which will cost an estimated $600 million in FY 26 and FY 27.

So, what is the state of the state economically? And how can we improve it so that families and businesses can stay, grow, and thrive here?

The 2024 Jobs Report

The Connecticut Department of Labor (DOL) emphasized that the state experienced a year of “solid job growth,” while “payroll jobs reached and sustained a new all-time high, the labor force hit a new high, and the unemployment rate stayed very low,” according to the year-end jobs report released on March 27.

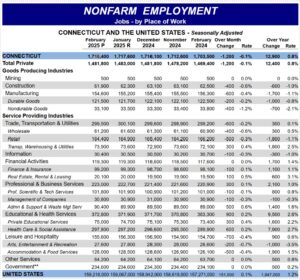

Throughout 2024, Connecticut employers added 16,000 jobs, totaling the payroll jobs to 1.718 million (See Table One). The DOL also reported the state has 1.957 million people in the labor force, with a participation rate of 65% — which surpasses the national average, 62.6%. Additionally, the unemployment rate has ranged between 3.0% to 3.3% in the past 24 months. In December, the U.S. unemployment rate stood at 4.1%.

TABLE ONE: 2024 JOBS REPORT

“With more than 1.7 million payroll jobs in Connecticut, it’s worth noting that Connecticut employers have sustained high job levels for 14 consecutive months,” said CT DOL Director of Research Patrick Flaherty. “The last time we saw this many jobs was in 2008.”

He added, “Health Care & Social Assistance remains Connecticut’s strongest industry sector and where we saw the most job gains in 2024.”

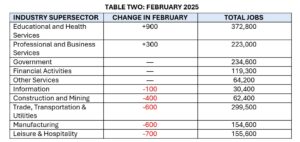

Yet, despite the job gains in 2024, the February 2025 DOL report — released in conjunction with the year-end examination — showed a decline by 1,200 in nonfarm industry positions, and a slight uptick in the unemployment rate from 3.3% to 3.4%. (See Table Two)

However, Flaherty reassured this is no cause for concern, since this is “third February in a row with a jobs decline following a January increase,” contributing the decline to weather.

The DOL also reiterated how Connecticut recovered all jobs lost during the pandemic; however, the CT Mirror reported that, after nearly 17 years, the state has “almost recovered the jobs it lost in the 2008 Great Recession.”

The 2024 GDP

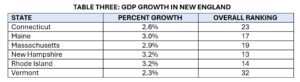

In 2024, nearly every state’s economy expanded, aside from North Dakota and Iowa, with the national average growth being 2.8%; Connecticut’s GDP grew by 2.6%, which ranked 23rd overall. This expansion was bogged down by a slow fourth quarter (which was 1.8%), according to the Bureau of Economic Analysis.

Regionally, Connecticut was bested by New Hampshire (13th), Rhode Island (14th), Maine (17th), and Massachusetts (19th). Only Vermont grew slower. (See Table Three). However, according to CBIA, the Constitution State’s “$296.6 billion real GDP accounts for 24% of New England’s $1.2 trillion economy, and is the second largest in the region behind Massachusetts ($638.4 billion).”

New England, as a whole, was middle-of-the-pack when compared to other U.S. regions, with a 2.8% GDP growth. The Far West — which includes Alaska, California, Hawaii, Nevada, Oregon, and Washington — finished with the highest at 3.4%. (See Table Four)

While Connecticut’s 2024 GDP results are not trending in the wrong direction, when compared over the course of five years, the growth has been lackluster. From Q1 2019 to Q1 2024, Connecticut ranked 44th in overall GDP expansion at 4.89%, outpacing Oklahoma (4.37%), Alaska (41.18%), 3.40%), Wisconsin (3.29%), and Illinois (3.13%). Hawaii, North Dakota, and Louisiana decreased in that timeframe.

Personal Income Growth

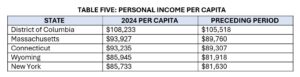

Compared to other economic indicators, Connecticut per capita personal income was one of the highest in the country, finishing 3rd overall when including the District of Columbia. (See Table Five) Yet its growth rate is a different story. In 2024, Connecticut’s personal income grew by 5.3%, which was 23rd best in the country, according to CBIA. This fell below the national average of 5.4%; meanwhile, North Carolina ended the year with the highest at 6.9%, and North Dakota, the lowest at 0.1%.

What About the Fiscal Guardrails?

Prior to 2017, Connecticut faced a budget crisis: budget deficits and cuts, exorbitant borrowing, and tax increases.

That year, a bipartisan group of lawmakers passed the ‘fiscal guardrails’ — reforms that capped spending, diverted volatile revenue into a rainy-day fund, and required that surpluses be used to pay down pension liabilities. Since enacted, the guardrails reversed decades of pension underfunding and improved Connecticut’s creditworthiness.

Moreover, according to Mariana Trujillo, Reason Foundation Policy Analyst and author of “The Case for CT’s Fiscal Guardrails,” the reforms have:

“…significantly improved budget predictability, reduced pension debt, and are expected to save taxpayers billions in interest costs. In 2016, the state employee pension fund was just 35% funded, and that plan is now 52% funded — the highest funded ratio achieved by the fund in nearly 20 years. According to your state comptroller, the anticipated pension payments have cumulatively freed up approximately $738 million in the budget annually to be used elsewhere. This is what enabled the state’s recent tax cut and could enable the servicing of your constituents’ needs.”

Overall, the state has saved more than $170 million and can save $7 billion over the next 25 years if kept intact.

While the state has paid down $10 billion in pension debt, Connecticut still faces a massive $80 billion worth in obligations. To contextualize the cost, each resident owes nearly $8,000 in pension debt, which ranks first compared to other states, according to the Office of Legislative Research.

This burden would have been worse without the fiscal guardrails. In fact, the state’s fiscal health would have suffered; unlike in 2017, Connecticut now has surpluses, reserves, and a plan to combat the pension debt.

But slight improvements do not warrant a “cheat” spending year — yet that is precisely what policymakers are proposing during the legislative session. Between $157 million for nonprofits, unemployment for striking union workers, the proposed universal pre-K program, and aggressive emissions mandates in the newly revived “Green Monster,” the government will need to boost revenue to fund all these projects, which means, more than likely, higher taxes.

What Should Be Done

Again, Connecticut’s tax climate is one of the worst in the United States. And what hurts is that residents are paying more than others, yet receiving less in return in terms of quality government services.

If lawmakers want to improve the state’s economy, altering and/or circumventing the fiscal guardrails is not the answer. Increased taxation and regulations often convince people to leave states like Connecticut. As the Tax Foundation asserts, “Taxes do affect migration and nonresident labor supply,” and “the link between state income taxes and decisions regarding where to live and work may indeed be strong.”

This impacts the local economy. Although Connecticut saw a 5.6% increase in business applications between 2023 and 2024, this “paled in comparison” to other states, according to Inside Investigator. Worse, in 2024, 86% of business leaders felt the cost of doing business in Connecticut was increasing; and only 8% believed the business climate was improving, versus 39% who said it was declining, according to a CBIA survey.

Perception can be reality — and if businesses are less inclined to open in Connecticut, this has a ripple effect: less capital means less innovation and fewer businesses; fewer businesses mean fewer jobs and more office vacancies; higher taxes mean less disposable income in one’s paycheck, which, in turn, impacts other businesses. Fewer residents and businesses also mean less revenue for the state to generate.

The consequences are cascading. But there are ways to make Connecticut more inviting economically. For instance, the state could eliminate occupational licensing, which requires individuals to pay fees and meet specific educational, training, and testing requirements to work in certain professions. These fees often impose barriers to entry, particularly for low-income individuals, and limit economic mobility.

Lawmakers could also lessen energy rates by removing costly environmental regulations that drive up electricity bills’ Public Benefits Charge, which passes along to consumers the costs of the government mandates imposed on power companies for a variety of state energy policies, including “clean” energy.

Additionally, the General Assembly could reform the passthrough entity tax, eliminate wasteful taxes and fees, eliminate estate and gift taxes, or even freeze state employee wages — since they have received a 33% increase over the past six years. (For context, this surpasses the private sector’s national average of 23% for the same period.)

To create an environment to ‘make it here,’ as Gov. Lamont has promoted, lawmakers must adhere to the fiscal guardrails and work toward reducing residents’ and businesses’ tax burdens. Otherwise, Connecticut will never reach its full potential economically — or worse, the state could return to the chaotic fiscal days prior to 2017.

That is a future best worth avoiding at all costs.