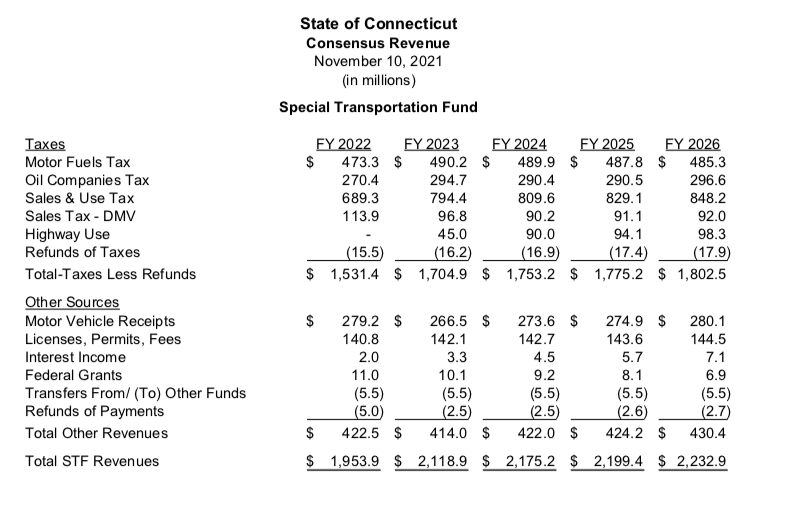

Revenue to Connecticut’s Special Transportation Fund is projected to rise this year as gasoline prices surge upward and sales tax receipts come in hotter than previously expected adding nearly $70 million to the STF this year, according to the latest consensus revenue estimates.

The Special Transportation Fund has long been an area of concern for governors and lawmakers, leading to debates over tolling Connecticut’s highways, the Transportation and Climate Initiative and the need to invest more money into Connecticut’s aging infrastructure with help from the federal government.

But while calls for more revenue streams to the STF continue, the increase in the price of oil and gasoline sent projected revenue from Connecticut’s petroleum gross receipts tax upward by more than $45 million over fiscal years 2022 and 2023.

Projections for sales tax revenue sharing with the STF also increased by $49 million over the next two years.

Combined with the new highway use tax on trucks, which takes effect in 2023, and projected increases to gasoline tax revenue, the STF will take in $166 million more over 2022 and 2023 than projections made just months ago.

The Office of Fiscal Analysis previously estimated the STF would face a $31 million deficit by 2026 but would still have $673 million on hand.

Now, with tax revenue projections growing faster than expected, it is likely that small future deficit will be wiped out and the transportation fund will have a larger balance.

While the increases are driven in part by rising gasoline prices, that price increase also hurts residents’ wallets, along with surging prices of nearly everything else, including food.

It also points to the volatility of some of these taxes. While the state’s gasoline tax and sales tax tend to be steady, the oil companies tax varies based on the price of oil, which can rise and fall quickly depending on national and international factors.

The projected revenue increases come as Connecticut is slated to receive more than $5 billion from the federal government under the recently passed infrastructure bill, which will include money for roads and bridges, trains, electric vehicle infrastructure and broadband access.

But the influx of funds could present a long-term problem for Connecticut’s Department of Transportation.

In addition to supplying matching funds for federal transportation dollars, DOT Commissioner Joseph Giulietti estimates the department would have to hire an additional 300 employees and consultants just to handle in the increase in projects, which would lead to higher long-term costs for payroll and retirement benefits.

Gov. Ned Lamont said Monday that he will no longer seek to toll Connecticut’s highways after attending the infrastructure bill signing in Washington D.C.

While the governor’s push for tolls may have come to an end, Lamont was successful in pushing through a highway use tax on trucks based on their weight and the number of miles they travel in Connecticut, which will bring in roughly $90 million per year when fully implemented.

The governor, DOT and the Department of Energy and Environmental Protection continue to push for the TCI program, which would require fuel wholesalers to bid for emission credits at auction and then sent that money to the state.

The ten-year program would bring in an estimated $100 million per year, half of which would be reserved for cities to fund “climate justice” projects, and the remaining half would be placed into a special fund within the STF to be spent on public transportation and electric vehicle infrastructure.

But the program would also come with an increase to the price of gasoline as the cost of the emission credit auctions are passed down to consumers.

The TCI program did not come up for a vote during the 2021 legislative session and, thus far, only Massachusetts and Washington D.C. have signed on for the final program, but environmental groups and some Democratic lawmakers continue to push for a vote in the 2022 session, saying Connecticut needs the revenue to supply matching funds for the federal transportation dollars.

After announcing that tolls were completely off the table on Monday, however, Lamont said rising revenue from Connecticut’s gasoline taxes will cover the matching funds, according to WTNH News 8.

With the influx of federal funds and gas prices skyrocketing, some lawmakers, including House Majority Leader Jason Rojas, say the state could potentially reduce its 25-cent gasoline tax in order to relieve the burden on working families, as Connecticut heads into the 2022 election year.