Retired Connecticut state employees will see a substantial bump to their pension payments as a result of increasing economic inflation.

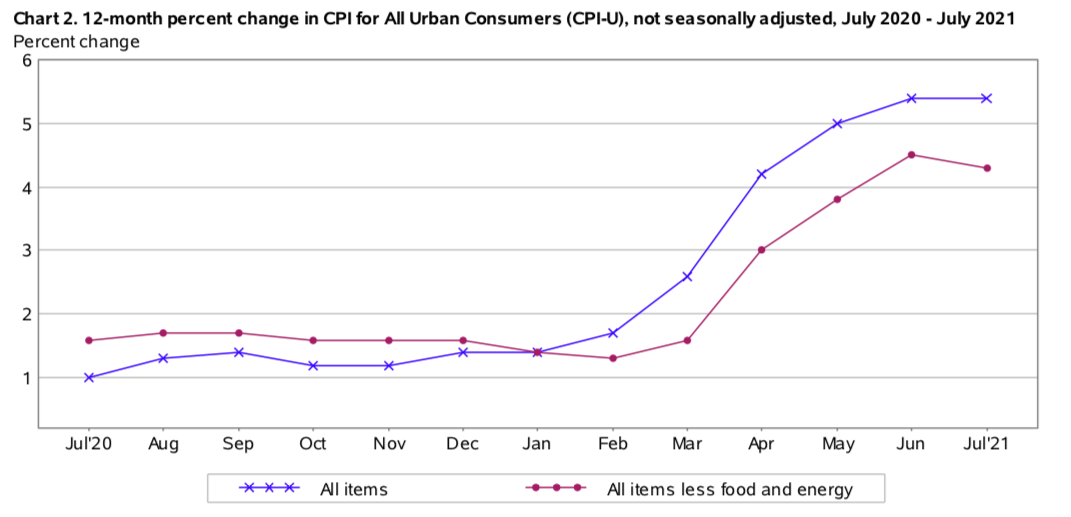

The Consumer Price Index for Urban Wage Workers and Clerical Workers – known as the CPI-W — increased 6 percent between July of 2020 and July of 2021, according the Bureau of Labor Statistics, with the price of nearly everything increasing substantially in recent months. Note: the above image is a chart for the CPI-U, not the CPI-W.

Retired state employees receive a cost-of-living adjustment every year in either January or July — depending on the employee’s retirement date – based on the CPI-W for the previous 12 months.

Because of the high rate of inflation, the July COLAs are calculated based on 60 percent of CPI-W, which translates to a bump of 3.6 percent as of July 2021.

State retirees receive minimum 2 percent COLAs per year regardless of the inflation rate and a maximum of 6 percent or 7.5 percent, depending on their retirement tier. The minimum 2 percent COLA also means that during years in which inflation was low, they still got a boost over the inflation rate.

According to the Bureau of Labor Statistics, between 2015 and 2020 there was only one year – 2018 — during which the CPI-W for July was above 2 percent. For retirees who receive their COLAs in January, the trend was more in their favor with three years of inflation increases topping 2 percent.

The year over year increases drive up the amount paid out by Connecticut’s severely underfunded State Employee Retirement System.

In 2015, Connecticut paid $1.7 billion to 49,111 retirees, according to the Comptroller’s Open Pension website. By 2020, the state paid $2.2 billion to 55,348 retirees. During that time Connecticut’s average pension payment increased 15 percent from $34.589 in 2015 to $39,887 in 2020.

For some of Connecticut’s highest paid pensioners like Jack Blechner, a former UConn Health Center physician who received $342,325.14 in 2020, the COLA amounts to an additional $12,323.70 per year. For the average pensioner, receiving $39,887 per year, the COLA increase would amount to an annual increase of $1,435.92.

Connecticut’s pension COLAs, however, are set for a change one year from now prompting concerns over a potential surge in state employee retirements.

Part of the 2017 SEBAC Agreement between the State Employees Bargaining Agent Coalition and Gov. Dannel Malloy included a provision to change the COLAs for state employees who retire after July 1, 2022.

According to the Office of Legislative Research in their analysis of a potential retirement wave, COLAs for new retirees will match the CPI-W during years it is 2 percent or less. When the CPI-W rises above 2 percent, those retirees will receive either 2 percent or a percentage of the rate of inflation, depending on how high the rate rises.

The changes will only affect those who retire after July of 2022, but according to the OLR report, historically such changes have resulted in a larger number of employees retiring before the cut-off date.

“In the past, similar planned changes to retirement benefits have triggered waves of retirements before the changes take place,” the OLR report states. “

In an effort to mitigate the potential loss of thousands of state employees, Gov. Ned Lamont contracted with the Boston Consulting Group for a report of how to increase state government efficiency.

The CREATES report noted that 8,000 employees are eligible for retirement before July 2022 and identified “200 opportunities totaling $600 to $900 million of potential value.”

**Ken Girardin contributed to this article**

Vinny

August 13, 2021 @ 6:29 pm

So of you retire prior to October 2021 and receive Your Cola 9 monthe later in July 2022 , will you receive above the normal 2 percent since inflation Is hIgh. ThanKs Vin

Lyle Scruggs

October 25, 2021 @ 4:04 pm

[your comment section will not enable me to type this in lower case] stop with the money illusion. If inflation were 1% Then the absolute COLA would be low, but the burden on the state budget and taxpayers would be growing, because inflation under 2% leads to a real pension burden increase. The best long-run thing for the state pension system is to have inflation just at or above 2%.

DARRELL HACKETT

November 3, 2021 @ 10:27 pm

When will REtirees see the 6% in pensions im tier 2

C shaw

November 14, 2021 @ 8:58 am

TO vinny, you get The first increase 9 months after you retire, 60% of CPI W.

There is also a large group if tier 1’s who receive 3% guaranteed, no inflation adjustments.

(Sorry for the caps, won’t let me shift)

Hope McKiernan

December 30, 2021 @ 2:19 pm

What is the cola for January, 2022?

Ed Finger

January 19, 2022 @ 10:41 am

Good question Hope — I can’t find the answer either.