A new study released by the Pioneer Institute in Massachusetts has a warning for Massachusetts lawmakers who may consider raising the state’s income tax rate: Don’t be like Connecticut.

Connecticut’s Dangerous Game: How the Nation’s Wealthiest State Scared Off Businesses and Worsened Its Fiscal Crisis rehashes the last two decades of Connecticut’s slide down the economic and fiscal ladder while taxes, conversely, have slid upwards.

Connecticut fiscal fortunes have nearly reversed from the start of the pandemic when the state was forecast to have significant budget deficits in the current fiscal year and upcoming biennium. The latest revenue numbers show Connecticut will end the year with a surplus and face a much smaller $2.5 billion deficit in the next biennium.

Revenue increases throughout the pandemic stemmed largely from Connecticut’s financial sector and Wall Street, while the most recent increased projection came via surging income tax revenue.

Connecticut has a $3 billion reserve fund — more than enough to cover the difference without raising taxes — but progressive leaders in the legislature are calling for increasing taxes on the wealthy again, which the Pioneer Institute’s report names as a contributing factor to Connecticut’s economic decline over the past twelve years.

“Connecticut has turned repeatedly to its wealthiest taxpayers to cover spending increases and is now suffering the consequences,” authors Andrew Mikula and Greg Sullivan wrote.

The authors highlight a quote from Gov. Dannel Malloy’s spokesman, Mark Bergman, who said the 2015 tax increase would “help pay for a transformational transportation and infrastructure system that will benefit Connecticut’s economy for decades to come.”

That prediction hasn’t come to fruition and, as Malloy and his budget chief Ben Barnes later admitted, the 2011 and 2015 tax increases went to pay for Connecticut’s underfunded pension and retiree healthcare costs. Connecticut lawmakers then considered tolling highways to fund transportation and infrastructure development.

The report points to Connecticut’s year-over-year loss of high income earners and major corporations to other states, the loss of jobs in manufacturing, finance and construction and low wage and job growth over the past 12 years.

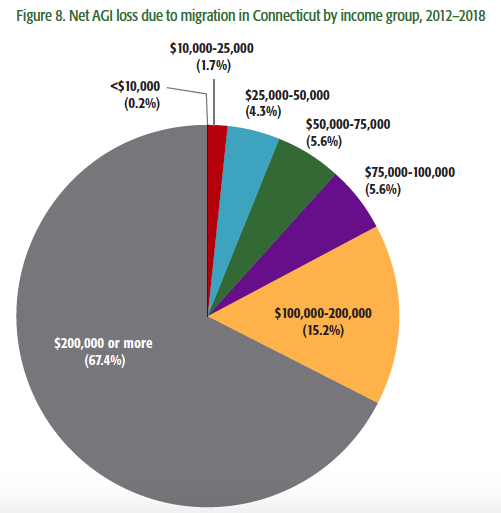

According to the study, between 2012 and 2018 Connecticut saw a net loss of $12.3 billion in adjusted gross income as residents relocated to other states, the highest per capita rate in the country outside of Washington D.C.

Despite the increased income tax rate for Connecticut’s top earners in 2015, the year saw tax revenue from the 100 wealthiest people decline 45 percent.

Commissioner of the Department of Revenue Services at the time, Kevin Sullivan, blamed the loss on declining income among that subset of taxpayers and the loss of “a handful” of those tax payers other states.

While Massachusetts also saw an outflow of $8.5 billion between 2012 and 2020, the report notes Connecticut has only half the population of its northern neighbor.

The report also highlights Forbes’ annual list of the 400 richest people in the United States, noting that in 2010 Connecticut was home to 11 of the wealthiest individuals in the country but as of the latest report is home to only five.

While Connecticut still has 17 billionaires, shifting fortunes and the loss of Edward Lampert, Thomas Peterffy, C. Dean Metropolous and Paul Tudor Jones to Florida left fewer residents on the acclaimed Forbes 400 list.

Connecticut’s economy has also increasingly shifted away from higher-paying jobs to lower-wage jobs.

Connecticut saw higher than average job losses in manufacturing, information, utilities, wholesale trade, construction and retail since 2008, and areas of job growth in sectors like hospitality and food, education, management and healthcare were all below the U.S. average, according to Pioneer’s study.

Wage growth over the last 12 years was also the second lowest in the country, just ahead of New York.

Connecticut remains a comparatively wealthy state. According to the U.S. Census Bureau, Connecticut’s median household income in 2019 was $78,833, above the national average of $65,712 but lower than Massachusetts, New Jersey, Maryland, California and Hawaii.

In 2008, Connecticut’s median household income was only lower than New Jersey and Maryland.

The latest push for raising income and capital gains taxes on Connecticut’s top-earners would essentially raise Connecticut’s rates to match New York or New Jersey.

Connecticut raised the income tax rate for its top bracket in 2009, 2011 and 2015. Critics say Connecticut’s current tax regime is regressive, resulting in lower-income families paying a higher share of their income in taxes than the wealthy.

However, Connecticut remains dependent on those in the higher tax brackets, who pay the majority of Connecticut’s income tax revenue. According to the 2014 Tax Incidence Report, the top 10 percent of Connecticut residents pay 60.68 percent of the state’s income tax revenue and that was before the last rate hike in 2015.

But that reliance top-earners can also prove volatile, with changes in wealth and Wall Street having an outsized impact on Connecticut’s budget.

“Connecticut provides a sobering real-world example of how a seemingly attractive tax-the-rich scheme can backfire badly on a state, turning rosy projections of revenue gains to real-life losses, and damaging business confidence in the process,” the report concludes.

Carolyn

January 19, 2021 @ 1:31 pm

CT’s a fiscal mess

Jim Flood

January 22, 2021 @ 10:40 am

Excellent article. combine this social migration of high wealth taxpayers with the fact that connecticut was #1 in net tax supported dept in 2019. $6,600 per capital compared with Nebraska at $19 per capital. why the controlling party refuses to look at the facts is both incomprehensible and Destructive.

Ben dim

January 23, 2021 @ 9:46 am

No one cares about the rich people

Jim Corrigan

April 6, 2021 @ 11:18 pm

Norwalk is a perfect example of CT’s decline. Allow floods of illegals and destroy all semblance of zoning. Each house has twenty people and noise is endless with revving motors. Schools go down the drain, better to drop out if you speak english. then increase property taxes so the three industries that matter in ct flourish, grass cutting, leaf collection, and adding loud exhausts to cars.