Waterbury had one of the highest increases in the percentage of residents renting apartments in the country, while Hartford, on the other hand, saw one of the highest increases in homeownership over the last ten years, according to a new report by RentCafe.

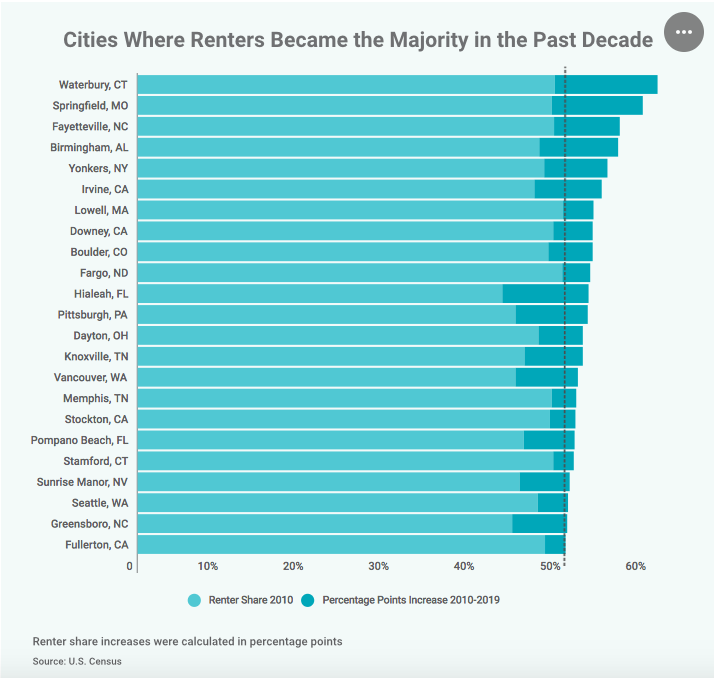

“Waterbury, Conn., saw the most dramatic change in the structure of its population,” the study says. “Renters here now make up 60.9% of the brass city’s residents, compared to 48.8% at the beginning of the decade.”

Waterbury was one of 23 cities that saw the number of renters overtake the number of homeowners based on U.S. Census figures from 2010 to 2019. The report does not include the real estate upheaval brought on by the pandemic in 2020.

Meanwhile, during the same time period, homeownership in Hartford saw one of the highest increases in the country, with a 27 percent increase in the share of city residents who owned their own homes.

The authors write that homeownership declined at the start of the decade and continued to decline until 2012 – possibly the residual effects of the 2008 recession that saw a collapse of the housing market.

Renting peaked in 2015 and in 2016 began to decline while homeownership increased “as a robust economy and low mortgage rates gave more Americans the opportunity to become homeowners,” the report says.

The report offers no specifics for why one city saw an increase in renters while the other saw an increase in homeowners.

Municipal data from the Office of Policy and Management shows that in 2010 Waterbury had a population of 110,366 and Hartford had a population of 124,775 and both had low median household incomes: $24,820 for Hartford and $34,285 for Waterbury.

Hartford’s equalized net grand list accounted for $7.7 billion in 2010, while Waterbury was $7 billion.

By 2019 – the most recent OPM data available – both cities had lost roughly 2,000 residents but median household incomes had increased by $10,000 in Hartford and $6,000 in Waterbury.

The grand list for Hartford remained relatively stable at $7.4 billion, while Waterbury dropped to $6.1 billion.

One stark difference, however, may lie in the property tax rates of both cities.

Waterbury’s mill rate increased from 41.82 in 2010 to 60 mills by 2019, one of the highest rates in the state.

Hartford has the highest mill rate in the state at 74.29 mills, but the city only assesses 35 percent of the property value on residential homes, cutting the effective mill rate for homeowners down to 37.15 mills.

Although the exorbitant property taxes for commercial property in Hartford is cited as hurting commercial growth in the city, the mill rate for residential homeowners can make it a more attractive city to purchase a single-family home.

Conversely, the lower mill rate for commercial property, including apartment buildings, means that Waterbury could be more attractive to multi-family real estate developers and renters.

According to RentCafe, the average apartment rental in Waterbury is $952 per month, compared to $1,210 per month in Hartford.

Linda Fercodini of Fercodini Properties in Wolcott says prior to the pandemic there was an increase in the number of rentals in Waterbury and that the tax rate likely had an effect on renters and homeowners.

“I think it does have somewhat of an effect on real estate,” Fercordini said. “Naturally, when a buyer is getting pre-qualified for a mortgage taxes are a big consideration. It depends on the tax situation as to how much of a house any purchaser can buy. The higher the taxes the less house they can purchase.”

I’ve been doing this for 41 years. I have been in many buyer markets, many seller markets but I never expected what we saw post-pandemic.

Linda Fercodini of Fercordini Properties, Walcott, CT

“With the taxes a little bit higher we saw a lot of people that wanted to rent,” Fercodini said. “So, they would rent, save up their money and then when they would purchase, they would purchase.”

However, the COVID-19 pandemic has changed the real estate market in Connecticut in ways Fercodini says she’s never seen before, with an influx of New Yorkers buying up property and rentals in Waterbury.

“I’ve been doing this for 41 years,” Fercodini said. “I have been in many buyer markets, many seller markets but I never expected what we saw post-pandemic.”

Fercodini says only a handful of apartments and houses in Waterbury remain on the market at this time, with people flowing out of the big cities to smaller Connecticut cities. “It’s incredible, nothing I’ve ever been through before,” Fercodini said.

The influx of new people to Connecticut may reverse a long trend of losing residents to other states and has also increased the selling price of homes in cities like Hartford, which saw a 15 percent uptick in median sale price of homes, according to REMAX 2020 housing data.

Absent the pandemic, RentCafe sees the potential for long-term changes in renting and homeownership as the Millennial Generation begins to settle down to start families and Generation Z enters adulthood and potentially searches for apartments.

“Overall, the housing trends of the past decade suggest that renting is maintaining its popularity in the nation’s large and mid-sized cities, while homeownership has and will continue to rebound,” the report said.