Connecticut had roughly half of the money needed to weather a recession in its unemployment trust fund before the COVID-19 pandemic hit the state, according to a report from the Tax Foundation which tracked unemployment claims across all states and compared them to the 2008 recession.

“Many states are woefully unprepared for the magnitude of the challenge ahead,” wrote Tax Foundation analysts Jared Walczak and Tom VanAntwerp. “Entering the crisis, 21 states’ unemployment compensation trust funds were below the minimum recommended solvency level to weather a recession.”

Connecticut had roughly $706 million in its unemployment trust fund, ranking it 44th in the nation, according to the Tax Foundation. The Tax Foundation based its figures on data from the U.S. Department of Labor and compared them to the U.S. DOL’s Reserve Ratio.

But reports from the Connecticut Department of Labor indicate the figure may have been closer to $650 million.

Neighboring states like New York and Massachusetts were in worse positions, according to the Tax Foundation’s report.

The fund needed roughly $1.7 billion to handle an economic downturn, according to a 2018 transition memo from departing Gov. Dannel Malloy to Gov. Ned Lamont, warning him of the unemployment funding issues.

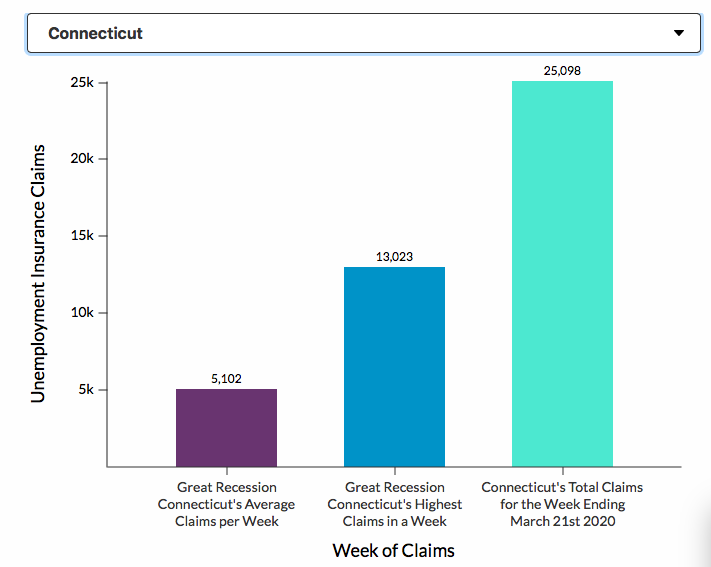

The weekly unemployment numbers ending on March 21, showed Connecticut recieved 25,098 unemployment claims, compared to a high of 13,023 during the last recession.

The unemployment claim numbers for that week are likely much higher, according to a report by CT Mirror, which reported a total of 100,000 new claims during that week.

The Connecticut Department of Labor has had to triple its unemployment staff and there is a three-week backlog to filing unemployment claims.

The sudden and staggering spike of unemployment claims during this pandemic-induced recession as compared to the 2008 recession is due to the nature of the crisis.

Gov. Ned Lamont forced the closure of restaurants, bars, hair and nail salons, gyms and other nonessential retail outlets which caused an immediate spike in claims, whereas the 2008 recession was slower to unfold.

The closure of businesses was meant to slow the infection rate of the virus. Connecticut’s total number of COVID-19 cases has jumped to over 2,500 in the past few days.

Eric Gjede, Vice President of Government Affairs for the Connecticut Business and Industry Association, says his organization has been advocating for unemployment insurance reforms for years, which could have saved the unemployment trust fund hundreds of millions.

Those reforms included increasing the minimum amount of earnings to qualify for unemployment benefits to match the threshold for other states and not allowing unemployment benefits for an individual receiving a severance package.

But with the sudden onset of skyrocketing unemployment claims, Gjede says it is too late for anything to be done.

“Theres very little that can be done right now. There’s a massive amount of claims all at once. We should have been making reforms during good times,” Gjede said. “The state is really going to have to step up on this the way other states have.”

New Hampshire Gov. Christopher Sununu, for instance, issued an executive order stating that unemployment benefits due to state-imposed business closures will not be charged against the most recent employer.

New Hampshire, however, had a full reserve for its unemployment trust fund, according to the Tax Foundation.

Gjede says that normally the increase in the state’s unemployment tax is for businesses who lay off workers in the course of normal business, but that that the staggering spike in unemployment claims is “because the government, rightfully so, has shut down a number of businesses” to deter the spread of the COVID-19 virus.

That leaves business owners and laid-off employees in a bad position through no fault of their own.

The state is going to have to be responsible for this debt, but I don’t know that Connecticut is in a financial position to do so.

Eric Gjede, Vice President of Government Affairs for the Connecticut Business and Industry Association

“The state is going to have be responsible for this debt,” Gjede said. “But I don’t know that Connecticut is in a financial position to do so.”

The federal government is attempting to bolster the economy by pumping money into banks and sending individuals and families one-time stimulus payments of $1,200 per person with an additional $500 per child.

The federal government is also offering an additional $600 per week in federal unemployment insurance payments in addition to the maximum of $649 per week in Connecticut.

The Federal Emergency Management Agency also approved Gov. Ned Lamont’s request for disaster relief, which will supplement 75 percent of state agency costs associated with combating the virus, a welcome relief when the state will face steeply declining revenue coupled with rising costs.

But that relief is not yet extended to unemployment claims, according to a press release from the governor’s office, and the White House is currently considering the state’s request for assistance in handling unemployment claims.

“I remain hopeful that our request for assistance for individuals will also be approved because this pandemic has had a significant impact on the livelihoods of so many people in Connecticut,” Lamont said in the press release. “Unlocking this assistance would mean expanded unemployment benefits for those who are out of work because of the emergency, needed food benefits, child care assistance, and a host of other critically important aid.”

During the 2008-2009 recession, Connecticut had to take out a loan from the federal government to pay all the state’s unemployment claims. That loan was repaid by businesses through higher unemployment taxes.

But Connecticut may not qualify for another unemployment loan from the federal government, short of receiving further disaster relief, because it requires the fund be solvent with one year of reserves.

“As more firms lay off employees and unemployment increases, states’ unemployment insurance taxes will rise on businesses that can least afford to pay,” the authors at the Tax Foundation wrote. “As states receive federal assistance to aid with unemployment benefits, it may be appropriate to provide some measure of relief to businesses as well, particularly to the extent that their layoffs were precipitated by business closure orders.”

That relief, according to the Tax Foundation, includes suspending or freezing unemployment tax rates on effected businesses.

However, Walczak writes that such measures would almost certainly require federal assistance.

David Carr

April 2, 2020 @ 8:37 am

Not exactly true as the Rainy day fund is at record levels and the FED The Paycheck Protection Program (“PPP”) authorizes up to $349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis so there is not exactly a need for these funds at this time, with Trillions being loaded onto the US FED DEBT . A long History of CT Wealth Tax Cuts from 1996 to 2012 will continue to hurt … As of 8/1/2019 Connecticut will have a more than $2.3 billion in reserve when the audit of the just-completed 2018-19 fiscal year is done in late September 2019 . This easily shatters the previous records of the $1.37 billion the state held as late as June 2009. More importantly, the $2.3 billion represents 12 percent of annual operating expenses, topping the 8 percent mark also set in 2009.

L.J. Budnick, Jr.

April 2, 2020 @ 9:24 am

Maybe if the state didn’t hand out unemployment checks so easily the state

might be able to solve its problem. Try winning in an unemployment hearing.

Good luck with that. The scales are tipped to the employee. Tipped might not

be the correct word. A stronger word than tipped is needed.

Unemployment funds, watch out Workmen’s Compensation Fund. That the

big one!