Amidst a severe downturn on Wall Street sparked by the COVID-19 virus and the shuttering of businesses across states to keep the spread of the virus minimal, Connecticut will face “considerable” economic fallout, according to economist Donald Klepper-Smith of DataCore Partners.

Connecticut had only just recovered from the 2008 recession, finally recovering 102 percent of the private sector jobs lost and 80 percent of government sector jobs, according to the Connecticut Department of Labor.

However, even before the COVID-19 crisis, the economy was showing signs of being on the down-swing, according to Smith.

The state recently revised its 2019 job numbers downward, tracking a loss of 3,300 jobs for the year. “All evidence says that we entered a recession starting in March,” Smith said. “But we won’t actually see those numbers until after the 2020 election, just like in 2008.”

The 2008 recession left Connecticut’s economy in a bad spot and the state’s recovery lagged the rest of the nation through the most recent upswing of the past few years. Now, with a large number of businesses forced to close and the stock market tanking, Connecticut could face a larger challenge than even the Great Recession.

Connecticut is probably going to be affected more than other states. This is exogenous shock of our generation. We’re in uncharted waters and we don’t have reference point.

Donald Klepper-Smith, Chief Economist DataCore Partners LLC

“Connecticut is probably going to affected more than other states,” Smith said. “This is the exogenous shock of our generation. We’re in uncharted waters and we don’t have a reference point.”

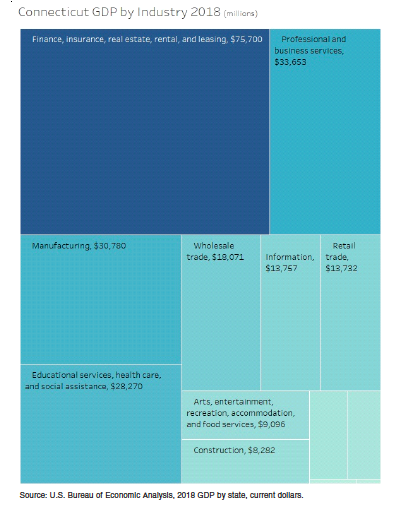

According to reports from the CT DOL, the financial, real estate and insurance sectors of Connecticut’s economy are the largest source of state gross domestic product, accounting for $77 billion in 2018.

While the effect of the downturn on Connecticut’s financial sector can be observed in the decline of the stock market, the effect on insurance and real estate is yet to be seen and most likely won’t be seen for a while.

The immediate closure of a large swath of the state’s businesses – restaurants, bars, gyms, hair and nail salons and shopping malls – has left tens of thousands applying for unemployment benefits and businesses taking in very little money, if any.

Entertainment, food services and retail combined account for $22.7 billion of Connecticut’s GDP, according to CT DOL’s figures.

For reference, according to Gov. Ned Lamont’s conference call on Thursday, the weekly number of unemployment claims during the 2008 recession was roughly 5,000 per week. Over the course of last week, new unemployment claims topped 72,000.

Part of that may be due to the nature of this crisis. The 2008 recession was slower moving in its economic effects, while the closure of businesses due to the COVID-19 virus has resulted in immediate job-loss and economic fallout.

Peter Gioia, chief economist for PGEcon LLC, says the economy is “going to have quite the shock” and we will have a short recession, but remains optimistic about the ability of both the state and the national economy to bounce back.

“The critical industries in Connecticut are not shut down,” Gioia said. “The defense industry is still producing, the insurance and financial industries are still going, the banks are open, grocery stores are open.”

Gioia says the most critical piece to mitigating the economic fallout is fast and decisive action by both the state and federal government to ensure that individuals and businesses affected by the virus still have money coming in – either through unemployment claims, federal bailout money for individuals and companies or business loans through the state.

And, he says, much of that help is already in place through state action and pending legislation by Congress.

We have a terrible situation but the basic steps to combat this are already in place or will be in place within the next six months. I don’t think people should panic.

Peter Gioia, Chief Economist PGEcon LLC

“We have a terrible situation but the basic steps to combat this are already in place or will be in place within the next six months,” Gioia said. “I don’t think people should panic.”

Connecticut’s state budget, on the other hand, may indeed experience a shock as residents start opening financial statements in April. Quarterly returns, which are usually based on investment earnings, are certain to cause big ripple effects in the state’s income tax coffers.

In 2017, as the state grappled with a growing budget deficit, lower than expected tax revenue based on quarterly filings increased the projected biennial budget deficit from $3.5 billion to nearly $5 billion – and the country wasn’t facing a recession at that point.

The economic and fiscal fallout from the downturn combined with the emergency response to the COVID-19 virus, could leave Connecticut especially vulnerable.

The state has seen lower personal income growth and job growth than other states over the past ten years and, since 2015, has seen a net loss of residents moving to other states, combined with the loss of some very high-wealth individuals and businesses.

Connecticut does have a record amount of reserve funds in the Rainy Day Fund — more than when the state faced the 2008 recession — and will likely need them as income tax revenue declines in response to the market downturn.

Although the forced closure of businesses is part of the economic and budgetary equation, Smith says Gov. Ned Lamont is taking the best action at this time.

“I think Gov. Lamont is acting prudently and is protecting public health,” Smith said. “Lives before livelihoods. We will get through this.”

And that is part of the hope being offered in a time when many see little hope and the economic and health forecasts appear dire.

“The business cycle is a part of life, recessions are clearing houses, setting the table for the next upswing,” Smith said, noting that the latest economic upswing had been one of the longest positive runs since World War II.

“We can get through this,” Gioia said. “When we bounce back, if people and businesses have basically been kept almost whole, recovery should be very fast.”

The key is consumer buying, which accounts for 80 percent of the economy. While the closure of shops and restaurants does negatively affect buying, people find other ways of getting goods and services through e-commerce.

“People are going to be creative,” Smith said.

Gioia also says consumer spending remains key to keeping the market afloat and policies enacted to keep some money coming to affected people and businesses during the COVID-19 outbreak are key to not only mitigating the damage but ensuring a strong recovery.

“All of that is going to mitigate this thing and keep consumers spending, it won’t be as much but it will be some spending,” Gioia said.

A recent report out of the Brookings Institute, found that while consumer spending is crashing in particular areas, Connecticut’s metropolitan areas were low on the list of places forecast to be most heavily affected by the virus, with the Hartford metropolitan area among the least affected of the nation.

The Brookings report noted that areas most reliant on tourism and energy would be hardest hit. A price war on oil between Russia and Saudi Arabia have added another unforeseen dimension to the market downturn, however, but noted that Hartford – like some other Connecticut areas – is largely focused on technology businesses.

The Economist notes that, for now, the recession appears less severe than 2008 because it is based largely on a public-health emergency rather than from within the financial system itself, but the ultimate test will depend on how long the crisis plays out.

Smith says this downturn has been sudden due to the onset of the virus and will likely be as long as the average post-war recession of one year but notes it could last longer than the 2008 recession, which was 18 months.

“It depends on the timeliness of the response from the federal and state governments, and how consumer confidence fares,” Smith said.

Gioia agreed that governments’ mitigation strategies are key to ensuring a strong recovery, but perhaps the biggest turnaround would be development of a treatment or vaccine for COVID-19.

“There is pent up demand. If an anti-viral treatment is developed, we could be going gang-busters by October,” Gioia said.

Nevertheless, any kind of economic downswing and job loss doesn’t bode well for the state or its residents, but that is not unique to Connecticut as fallout from the pandemic spreads worldwide.

While both the state and federal government debate how best to support those affected by the outbreak and subsequent market fall, how Connecticut weathers this storm will largely depend on the people and how they manage their daily lives, obtain goods, stay safe and, eventually, get back to work.

“We just have to suck it up and get through this,” Gioia said.

John

March 24, 2020 @ 9:01 am

Blub blub blub goes Ct but don t worry be happy there’s a whole bunch of new things to tax to keep Ct. State workers and pensions paid to date.

fred

May 8, 2020 @ 2:08 am

Yes, That’s why I left 3 years ago. No more $4k+ income tax and $4k+ House tax. Now that’s my money. It’s huge.

F Spencer

April 17, 2020 @ 12:04 am

This is my comment as somebody who moved to Connecticut in 1967 along with 4 brothers, 2 sisters, plus parents.

From a huge amount of time in just about every capacity and experience one could have including to having been a Certified Public Accountant 1982 to 2017. My father was a 35 year executive for a major, major corporation that relocated Headquarters out of Connecticut a few years ago…

If I could talk to entire State now I would say. We have always been a wonderful, wonderful state of very nice people. Sometimes Financial Brilliance and Economic Common Sense is just not always our strong point. So, now how all is going, I say really, really pull out all the stops by doing our best to get each other as happy and healthy…It is aGiven that the State is in Economic Hole…….Be Nice People Doing Good Things……Economic Disaster will not get any worse by being pleasant to each other.

fred

May 8, 2020 @ 2:09 am

Yes, That’s why I left 3 years ago. No more $4k+ income tax and $4k+ House tax. Now that’s my money. It’s huge.

G part

August 5, 2020 @ 5:00 pm

I left in 2019. Ct is a black hole.

Alex B C

October 5, 2020 @ 9:42 pm

I left the dysfunctional, greedy dump of a state in 2017. Company and all.

Wimps, losers and coddlers. If you can, get out.

Bob

October 18, 2020 @ 8:52 pm

Connecticut is in dire need of a Republican Governor much like Arkansas is in dire need of a Democrat as both are extreme failed states .

The absurd shut down in Conn where countless mom/pop businesses went under and many lost their jobs only to have the virus now go back up thus all for nothing .

Add this weak, cowardly Governor takes his marching orders from NY Cuomo .