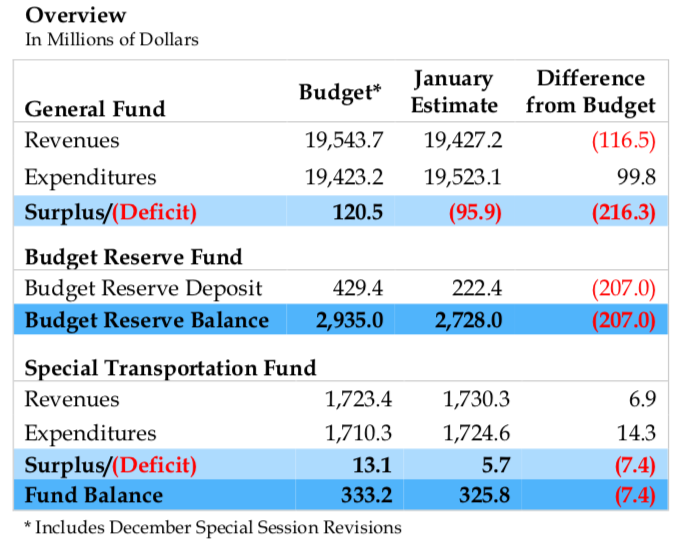

Connecticut’s current year budget deficit increased once again, rising another $66 million over the previous estimate and topping out at $96 million, according to a budget report for the Office of Fiscal Analysis.

This marks a $216 million difference between the budget, which estimated a $120 million surplus, and the reality of tax revenues and state agency costs.

According to the report, a large part of the deficit is being driven by tax refunds, which are projected to exceed budget estimates by $165 million.

“This temporary surge in tax refunds in large part is due to taxpayer responses to the recently enacted state policies such as the withholding of pension payments and implementation of the passthrough entity tax,” the report says.

The passthrough entity tax was passed by lawmakers as a way for some Connecticut businesses and individuals to avoid the state and local tax deduction (SALT) cap enacted by the federal government. However, Democrats passed a 2019 bill that skimmed some of the money that would be returned to business owners, angering the business industry.

The report also notes that state agency shortfalls have increased by more than $105 million due to state employee fringe benefit costs, adjudicated claims payouts and overtime costs at the Department of Correction and the Department of Emergency Services and Public Protection.

The state’s settlement with the Connecticut Hospital Association over the withholding of Medicaid tax refunds from the state’s hospital tax scheme contributed $20 million toward the deficit.

The increased deficit will also negatively affect the state’s Special Transportation Fund by $3.2 million, as the legislature prepares to meet in special session to hash out a new transportation bill that would install tolls on trucks.

The decrease in transportation funds is due to lower than expected revenue from the petroleum gross receipts tax, although the STF will maintain a cumulative surplus of $325 million, according to the report.

The deficit also reduces the scheduled transfer of money into the state’s Rainy Day Fund from $429 million to $222 million.

The deficiencies were partially offset by higher sales tax revenue and agency budget lapses from the previous year, but overall the state faces an increased deficit will could leave lawmakers, state departments and the governor looking for solutions.

Following the announcement of a $28 million budget shortfall in January, Gov. Ned Lamont’s budget chief, Melissa McCaw, announced that state agencies would have to tighten their belts to make up for the loss.

In a memo sent to the heads of state agencies regarding the projected $28 million deficit, McCaw wrote, “the Governor has directed that each agency head review their agency’s General Fund spending for the remainder of the year in order to eliminate expenditures that are not absolutely critical in nature. Your efforts should include potential savings in all areas of spending, including hiring and overtime, travel, contractual services and purchased commodities.”

McCaw wrote said the deficiency was tied to revenues “underperforming the budget plan” and “current expenditure trends that exceed budgeted levels.”

With the $66 million increase in projected deficits, however, those state agencies may have to tighten their belts further.

Connecticut is heading into a short session, which is primarily supposed to be used for budget corrections.

Thad Stewart

January 29, 2020 @ 7:18 am

NED, you listening? Grow a pair, cut spending, get rid of SEBAC, and stop handing out raises. Until you reel in your train wreck spending habits the state will be on its way down. YOU CAN NOT TAX YOUR WAY TO PROSPERITY!

Kasper Gutman

January 29, 2020 @ 8:00 am

When will these crazy Democrat’s realize the more you impose abusive taxation the more people and companies will leave. How about this idea, CUT SPENDING, LOWER TAXES and NO TOLLS… Get is Neddy boy?

Mark J Morth

February 1, 2020 @ 3:10 pm

SEBAC is not the problem Crooked politicians are!

Thad Stewart

April 21, 2020 @ 6:43 am

SEBAC is the problem, it was unsustainable before the ink was dry. You are obviously a union worker trying to protect his future, I get that. If a deal seems to good to be true, IT IS!

Mark Morth

February 1, 2020 @ 3:09 pm

SEBAC isn’t the problem, big government that don’t know how cut spending is. How is that before there was lotto and slot revenue from the casino’s the budget could be balanced? These corrupt politicians failed to fund our pensions for decades and now they want to punish us. If they can’t operate within their revenue they don’t deserve their position’s. The swamp in CT needs to get drained the same way President Trump is attempting to in DC.

Andy

February 4, 2020 @ 4:24 pm

Trump is the swamp. How is he doing with spending and the deficit?

Trump2020

January 29, 2020 @ 9:52 pm

Yea, so here’s a idea. Legalizing marijuana will be your revenue source to balance the budget.

Tony Piccolo

January 31, 2020 @ 3:26 pm

Why do we have 300000 people on Husky Cadillac health insurance with no accountability.?. Thought Obamacare was the place to get insurance if you needed a subsidy. This Husky Insurance situation is one of the biggest Neglected scandals in Ct.

Andy

February 4, 2020 @ 4:25 pm

Trump is the swamp. How is he doing with spending and the deficit?

Harry Brady

April 22, 2020 @ 9:34 pm

Inherited a 20 trillion deficit- i get it- Obama was handed a deficit of 10 trillion and jumped it 20 trillion unfortunately all these lib states run huge deficits-Cuomo had a 6 billion deficit in Jan 20 unrelated to covid – CT is a mess- NJ a mess- MD terrible and Hogan has done a decent job in trying to deal with it very liberal in MD – all sanctuary cities/ states paying huge amounts to illegals in a myriad of services and payments-