Democrats in the House of Representatives and the Senate may have been surprised when Republicans held a press conference on September 12 lambasting a budget provision that would tax certain grocery items, but Gov. Ned Lamont’s administration, at least, should not have been.

According to emails and text messages obtained under a Freedom of Information request, Department of Revenue Services Commissioner Scott Jackson emailed and texted members of Lamont’s administration and the Office of Policy and Management on September 6 saying DRS’s guidance on the meals tax could become “a thing,” and that he didn’t want the governor’s office to be “blindsided.”

That was the same day DRS released its guidance on the meals tax, which increased the sales tax on restaurant meals from the standard 6.35 percent to 7.35 percent, but also included common grocery store items such as popsicles, rotisserie chickens, protein bars, prepackaged salads and cans of soup.

The guidance went unnoticed, apparently, until House and Senate Republicans held a press conference six days later calling attention to it and igniting a brief firestorm in the media and at the Capitol.

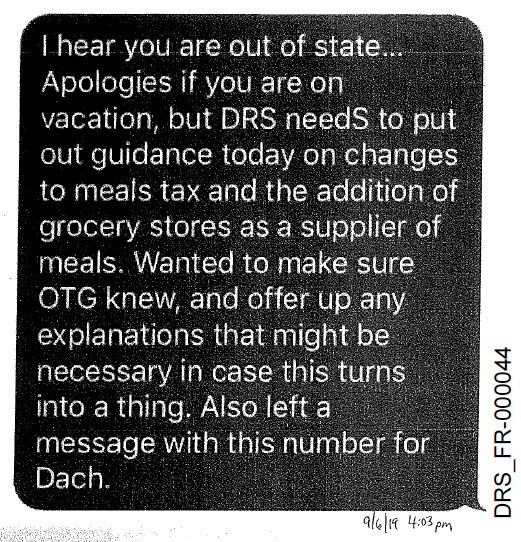

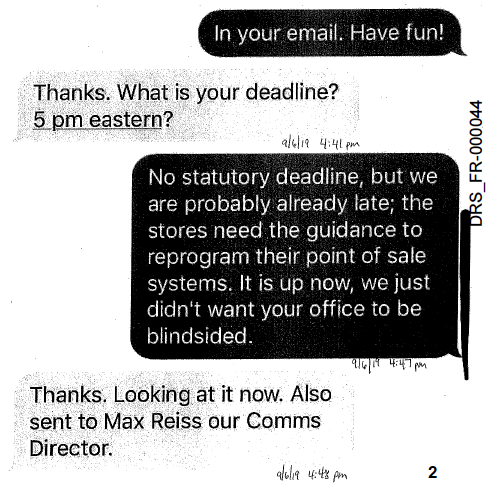

In a September 6 text message between Jackson and Lamont’s senior advisor, Jonathan Harris, Jackson wrote, “DRS needs to put out guidance today on changes to the meals tax and the addition of grocery stores as a supplier of meals. Wanted to make sure OTG (Office of the Governor) knew and offer up any explanations that might be necessary in case this turns into a thing. Also left a message with this number for Dach.”

“Dach” is Jonathan Dach, Lamont’s deputy chief of staff.

Jackson continued, “the stores need the guidance to reprogram their point of sale systems. It (the guidance) is up now, we just didn’t want your office to be blindsided.”

Jackson also emailed Harris and Dach earlier that afternoon making them aware of the new guidance and making himself available for “any discussion you see fit.”

It wasn’t until six days later that DRS’s guidance turned into “a thing,” when Republicans held a press conference announcing that certain grocery items would be taxed at 7.35 percent and calling on Democrats and the Lamont administration to own up and remove the word “grocery store” from statute.

The FOI request for all emails and documents between the governor’s office or OPM and DRS pertaining to the meals tax shows no digital communication regarding the issue between September 6 when the guidance was released and the September 12 press conference when reporters started asking questions and the governor’s staff began drafting talking points.

Speaking at the press conference, Republican Senate Leader Len Fasano, R-North Haven, labeled the tax “unfair” and “unjust.”

“The bottom line is that it’s a grocery tax on consumers,” Fasano said.

Emails show members of Lamont’s team and OPM held a call with DRS Communications Director Jim Polites and a DRS policy specialist following the press conference.

The 2019 budget added the word “grocery store” into state statute regarding the meals tax, which led to DRS issuing its guidance that certain, single-serving products sold by grocery stores — previously exempt from the tax — would now be taxed at 7.35 percent.

On the day of the Republican press conference, Lamont responded to WTNH News 8 reporter Mark Davis, saying the tax was a “fairness issue,” because restaurants were competing with grocery stores that weren’t taxed at the same rate.

The governor’s office and some Democrat legislators attempted a quick pivot to focus on the fact that Republicans hadn’t produced their own budget.

A statement released to the press by Lamont’s communications director, Max Reiss, also attempted a quick pivot. “Connecticut will have the largest rainy day fund in history and this budget maintains and grows our reserves, providing reliability and predictability for our taxpayers, businesses, and those looking to invest in our state well into the future,” Reiss said.

Lamont also told WFSB Channel 3 reporter Susan Raff, “we held the line on spending, they left me a budget that was $3.7 billion out of whack, and we solved the budget on time without raising tax rates.”

But it was clear the administration was not prepared for the public and political fallout.

OPM Secretary Melissa McCaw on September 12 sent an email saying, “I was aware of some categories such as yogurt being revisited but I do not believe OPM had an opportunity to review the final.”

The governor’s office and OPM kicked into higher gear on September 16, after Senate Democrats issued a letter calling on DRS to change its guidance on the meals tax, saying they were “shocked” at the department’s interpretation of the new language and faulting DRS for not testifying during budget hearings before the Finance, Revenue and Bonding Committee.

“This interpretation goes against the legislative intent of the new law and against the interpretation of the new law by all three of our nonpartisan offices,” Senate Democrats wrote.

That’s when OPM Secretary Melissa McCaw sent Jackson a very quick email: “Can you please call me via cell when you are free?”

The governor stayed rather silent on the issue until September 17 when Lamont announced at a press conference before a state bond committee meeting that he would be asking DRS to revise their guidelines.

“I think that DRS too broadly interpreted what was the intention of the legislature and the intention of OPM,” Lamont said. “I think DRS will go back and revisit that.”

When asked by reporters what the time frame was for releasing the revised guidance, Lamont said “we’re going to do it as soon as possible.”

Time was of the essence at that point, as the new tax rate was set to take effect on October 1, 2019 and grocery store owners had to update barcodes to reflect the tax and remain in compliance.

The documents received under the FOI request back up Lamont’s claim that they were not made aware of the changes until DRS was ready to issue its guidance.

But the six-day lag between Jackson’s cautionary warning that the tax could become “a thing” and it actually becoming one – and the 12 day lag time between the release of the guidance and OPM actually reaching out to DRS to review that guidance — raises questions as to how seriously the administration took that warning or whether the addition of certain grocery items was of actual concern before it became a public and political hot potato.

But the six-day lag between Jackson’s cautionary warning that the tax could become “a thing” and it actually becoming one – and the 12 day lag time between the release of the guidance and OPM actually reaching out to DRS — raises questions as to how seriously the administration took that warning or whether the addition of certain grocery items was of actual concern before it became a public and political hot potato.

The governor’s office did not return request for comment as to why they held off asking DRS to rework its guidance until six days after Republicans held their press conference, essentially allowing the issue to blow up.

Nicole Rall, media spokeswoman for Senator Fasano, says Republicans learned of the new guidance on September 11, one day before the first press conference, when they were alerted to the changes by Senate Republicans’ budget director and former state representative, Melissa Ziobron.

“We found out about it on September 11 and spent the day going through and reading it and making sure we were reading it correctly,” Rall said.

The 2019 budget analysis by the Office of Fiscal Analysis and OPM showed that, at least on paper, lawmakers didn’t realize that the addition of the word “grocery store” to the type of eating establishment subject to the sales tax would extend as broadly as DRS originally interpreted it.

OFA originally estimated the sales tax increase on restaurant meals would add $114 million to the two-year budget. However, inclusion of grocery items bumped that figure up by an additional $90 million.

Probably no one was more surprised than grocery store owners who had already faced a series of policy changes in 2019 that would affect them, including a minimum wage increase, a tax on plastic grocery bags and passage of a paid family and medical leave program.

Wayne Pesce, president of the Connecticut Food Association which represents grocery stores, said “I’m not sure any of us realized the breadth of items covered under the new law until DRS issued its guidance.”

A report earlier in the year said Lamont’s administration was considering a sales tax on groceries — in line with a revenue-raising idea put forward by 2018’s Commission on Fiscal Stability and Economic Growth. But the idea, which was never actually put into writing, was met with quick public backlash. The administration reportedly backed off from the grocery tax, but kept other recommendations like taxing dry-cleaning services.

Republicans called for a special session on September 18 to correct the language in the statute but that never happened.

The next day – a full thirteen days after the governor’s office and OPM was made aware of the changes by Jackson and the guidance was published – Lamont issued a press release saying DRS had revised its guidance and the tax would only apply to items sold at grocery stores that were previously subject to the sales tax under DRS’s 2002 guidance.

“I felt it was important to act swiftly, but thoughtfully and thoroughly to ensure that what was enacted was implemented,” Lamont said.

The revised guidance essentially put the issue to bed but not before Democrats and the Lamont administration had to play defense for a week, back-tracking and attempting to shift blame.

Commissioner Jackson took some political heat from fellow Democrats for issuing the guidance in the first place, as his department was accused of misinterpreting the revised sales tax law for meals.

Maybe that political heat was deserved and maybe it wasn’t, but he can’t say he didn’t warn them.

Freedom of Information documents referenced in this article are available here and here.

A third file showing budget-related conversations and a fourth file showing emails related to the Sept. 12 phone call between OTG, OPM and DRS are too large to provide online but will be provided via email by Yankee Institute upon request.

Robert Eublind

November 27, 2019 @ 6:08 pm

Big deal! It has been prior State law and DRS guidance then if you bought prepared food at a grocery (slice of pizza, bowl of soup, a sandwich) and paid for at the food court area it was taxable, while if you bought the whole pizza and took it home it wasn’t taxable. How the legislators didn’t already know this is mind-boggling.