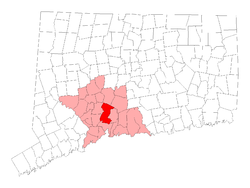

Driving through Hamden, one would never think it is a town in severe financial distress.

Hamden looks vibrant, trendy, hip and well-off. It was ranked one of the best places to live by Money Magazine in 2016 and is home to Quinnipiac University, but a look at the town’s finances reveals something quite different.

Hamden, called “The Land of the Sleeping Giant,” has a giant-sized debt problem and it’s costing town taxpayers.

While much attention has been paid to the plight of Hartford, which barely staved off bankruptcy thanks to a state bailout, Hamden’s difficulties have largely remained a problem with only regional attention.

But a study by Marc Joffe of the Reason Foundation and the Yankee Institute, which scored Connecticut’s 169 municipalities based on their 2016 financial reports, found Hamden — not Hartford — faced the greatest financial challenge of all.

Joffe used a scoring system which is actually more lenient toward municipalities than ratings agencies like Moody’s Investment Services. A perfect score would be 100. Any municipality scoring 50 or less is considered in “severe financial distress.”

Hamden scored a 25, nineteen points lower than Hartford.

Based on the town’s 2016 financial report, Hamden faces a long-term total debt liability of $784.1 million.

The majority of that debt comes from retirement promises made to employees which the town never funded. Even though Hamden moved new hires into the state-run Municipal Employee Retirement System in 2007, its legacy costs for current employees and retirees continues to grow.

Pension liabilities for Hamden’s 1,154 active and retired pension recipients make up $276 million of the town’s total debt, according to Hamden’s 2016 pension valuation.

Historically, Hamden didn’t pay the actuarially required contribution toward retiree pensions and benefits, instead letting the costs compound over time. The town also used a 7 percent discount rate for its contributions, but only received a 4.75 percent return, according to the valuation.

According to a letter from the state’s Office of Policy and Management, Hamden’s pension fund was only 10 percent funded in 2014. It’s ARC payments — which the town wasn’t paying — grew from $19 million in 2012 to $29 million in 2015.

The costs of the debt were growing faster than the town could pay, so in an effort to bolster the pension fund, Hamden took out a $125 million pension obligation bond in 2014, which increased the pension fund to 37.2 percent funded.

Pension obligation bonds are generally considered risky moves, supplanting one debt with another. The bond issuance will create savings for the town between 2019 and 2025, but afterwards the cost of the bond will outstrip any short-term savings, according to OPM’s projections.

Pension bonds also come with requirements and restrictions.

According to the letter from OPM and the State Treasurer’s Office, Hamden will have to pay the full ARC for its pensions. State law says a town can “ramp up” its ARC payment and Hamden will start paying the full ARC this year.

The ARC plus debt service on the bond was $16.3 million in 2015 and will grow to $33 million by 2022 and eventually top out at $38.8 million by 2040.

The numbers are not set in stone, however, and can change depending on the pension fund’s rate of return.

The letter also stated Hamden would have to raise its mill rate by an average of 4.6 percent every year for six years.

Hamden was forced to raise property taxes in 2016 and 2018 in order to deal with the growing costs, pushing the town’s mill rate to 47.96, one of the highest rates in the state. Hamden also had to lay off some clerical workers, and teachers were forced to take furlough days in an effort to bridge a $1 million education budget shortfall.

Rep. Josh Elliott, D-Hamden, says the town’s fiscal problems mirror the issues faced by the state.

“As with the state, the town of Hamden has been over-borrowing, without putting enough money away for pension obligations. Unfortunately, towns have much less flexibility than the state to ensure that getting out of the hole is done equitably,” Elliott wrote in an email.

The state of Connecticut hasn’t helped with Hamden’s woes either, withholding car tax reimbursements until April of this year and holding education funding flat to deal with ongoing state budget deficits.

According to Hamden Mayor Curt Balzano Leng in an op-ed for the Hamden Patch, the state has reduced Hamden’s municipal aid by $11 million over the last two budget cycles.

It isn’t just retirement costs that are a problem for Hamden; the town also has the fourth highest rate of bonded debt per capita in the state, according a report by OPM. Leng has indicated he wants to restructure some of that debt to save money.

Hamden’s credit rating was downgraded by Moody’s in December of 2017 with a “negative outlook” due to the town’s pension obligations and funding cuts from the state.

And the future doesn’t look especially bright: the costs of the pension obligation bond will continue to rise, and the state of Connecticut’s significant budget deficits threaten future municipal aid cuts — not just to Hamden, but to all Connecticut municipalities.

That doesn’t bode well for residents of Hamden. Michael Mele, a 75-year-old retired resident of Hamden, believes the burden of Hamden’s history is falling squarely on the taxpayers.

“For 30 plus years, officials have kicked the can down the road,” Mele said in an interview. “Now, it’s a financial time bomb.”

Mele points out that Hartford was just bailed out of its debt payments by the state, but he doesn’t believe Hamden could ever expect similar treatment from a state which faces its own significant financial challenges.

“No one will be bailing out the town of Hamden,” Mele said.

In reality, it will likely be town property tax payers who bail out Hamden. Although, it’s mill rate is high, it is still well below the rates of Bridgeport, Waterbury, and Hartford, which leaves room for the town tax burden to grow.

Elliott says that while it’s possible to blame government financial mismanagement, Hamden is making headway in correcting mistakes of the past.

“I know that people are really getting squeezed in Hamden,” Elliott said. “While there was just a fairly significant mill rate increase, we may now see a surplus, and while the strain will be felt by the middle class, working poor, and elderly, we are finally doing the right thing and not just relying on debt to get us through.”

Dan Garrett

August 9, 2018 @ 8:06 pm

When police officers and firemen can end employment in their early 40’s and receive pensions upwards of $60,000 and healthcare for themselves and their family for life, municipalities are crippled. Age of collection must be increased to 62 years of age or Hamden will not be able to meet its future obligations.

Elizabeth Dowd

August 9, 2018 @ 8:24 pm

Dan Garrett is 100% correct. How have the police department and fire departments been allowed to operate as they do positively crippling this town. No shame and no morals.

Marjorie Bonadies

August 9, 2018 @ 10:27 pm

Taxes in Hamden are onerous. There are twice as many houses for sale or in foreclosure than any of our neighboring towns. The Grand List has not increased in many years but the taxes will reliably increase for years to come. In many cases, the tax bill is higher than the mortgage bill. Property values are steadily dropping resulting in tens of thousands of dollars of equity disappearing.

The fiscal mismanagement hasn’t happened over night, its been 30 plus years of one party rule. With only 10.7 percent of the general population being represented by unions, it seems the remaining 90% should be able to afford to pay pensions and health care benefits but that isn’t the case. Despite not funding the pensions adequately, for which I blame the party that has been in power all these years, the town has also handed out 3% cost of living adjustments for the last 30 years. This practice has changed recently but the dye has been cast. Hamden taxpayers will continue to pay increased taxes until year 2044, when the town’s legacy pension plan should be payed off. in its place is the State MER’s plan whose costs will continue to grow and include overtime worked as part of the pension calculation.

It’s clear to me that the bleeding must stop in order for Hamden to get a handle on its expenses. Defined benefit plans need to be transitioned to defined contribution plans. It’s time for parity with the private sector. Gone are the days where the private sector made more money than the public sector but job security and benefits made up for the shortfall. Salaries are comparable but the benefits in the public sector are worth about 30% more. If nothing changes, Hamden will see mill rates will in the 50’s in the very near future.

Michael Devine

August 10, 2018 @ 12:48 am

I do agree in part but Union Busting and being anti police and fire services is a disgrace.

Michael Devine

August 10, 2018 @ 12:52 am

I hear many private sector folks go off on Unions all the time. If your private sector paycheck and benefits are so bad then maybe y’all need to Union Up. Respectfully submitted.

Thomas Alegi

August 10, 2018 @ 1:42 am

The people who have commented so far have given some background of how Hamden got into financial trouble. Hamden taxpayers are looking for new ways to solve Hamden’s financial problems. Let me suggest a new way to solve Hamden’s economic ills, “BUDGET REFERENDUM.” A referendum is the submission of law to the direct vote of the people. An example of a referendum is having citizens vote on the suggested town budget. For this direct vote of the people to occur in Hamden, Hamden’s Town Charter has to be rewritten to allow the residents of Hamden to have a direct vote on Hamden’s town budget. Hamden residents from all walks of life are asking to have a direct vote on their town budget. We can no longer leave Hamden’s financial well-being to 15 council members; it’s time for the residents of Hamden to have a real voice on how much taxes they are willing to pay.

Marjorie Bonadies

August 10, 2018 @ 11:07 am

@Mike Devine….the public can’t afford to pay the guaranteed benefits now. If we all “union’d up”, the contributions needed would have to exponentially go up. Are union workers willing to put 25-35% away per year to cover their own retirement and healthcare expenses?

Dan Devin

August 10, 2018 @ 12:47 pm

Hamden is in a more acute version of Connecticut’s death spiral. The more they raise taxes the more foreclosures and taxpayers leaving causing an increased burden on those left, requiring increased taxes…and on and on. I don’t blame the union workers for the problem. I blame the collusion between municipal unions and Democrats resulting in promises made that can’t be kept. Rank and file were lied to and the day of reckoning is coming fast. It looks like Detroit may be the model…

Patricia C Vener

August 10, 2018 @ 1:00 pm

As one of those low income seniors being squeezed out, all I can add to Mr Garrett and others’ comments is “hear, hear.”

This is not how a well developed country’s cities and towns should be behaving.

Marjorie Bonadies

August 10, 2018 @ 3:27 pm

Detroit’s pension fund was 14% funded when they declared bankruptcy. Hamden’s dropped to 10.33% before they implemented the ‘Hail Mary’ sale of pension obligation bonds.

Hamden had the distinction of being one of the most poorly funded pension plans in the country.

Marjorie Bonadies

August 10, 2018 @ 3:30 pm

Detroit’s pension fund was 14% funded when they declared bankruptcy. Hamden’s dropped to 10.33% before they implemented the ‘Hail Mary’ sale of pension obligation bonds.

Hamden had the distinction of being one of the most poorly funded pension plans in the country.

Allan G White

August 10, 2018 @ 4:50 pm

Marjorie,

Did you “kick the can down the road” by voting for the recent 44.5 M “restructuring” bond ,with a projection of 18.6M additional cost to taxpayers?

Suzan S

August 10, 2018 @ 5:00 pm

I agree with what Thomas suggested. Great idea and a start. We all know the town is in crisis, we can complain to ad infinitum. Lets create solutions. Citizen action is required to make change. Yes, lets rewrite the charter ASAP and then as suggested Budget Referendum.

Michael Devine

August 10, 2018 @ 10:32 pm

Hamden is in trouble so Hamden blames the Cops and the Firemen. Get real Hamden, you should hold accountable the Mayor(s) and the Legislative Councils who have been the ones doing this to the town. The day of reckoning is coming I saw posted, it is so lets not blame the Mayor(s) lets blame the Cops and Fireman. Hamden votes democrats into office for 30+ years and now blame Cops and Fireman for the financial mess in Hamden. The pension fund was criminally underfunded and no one was held accountable.

Ed S.

August 12, 2018 @ 12:11 am

Michael, I can’t talk to Hamden particularly, but in many places in CT, the local public-sector unions (teachers, firemen, police, municipal employees, etc.) have had an enormously outsize influence in local politics. They have the most at stake (their jobs and benefits), so they donate the most, organize the most, campaign the hardest, and so on. The result is that they were able to ring unreasonable concessions out of the mayors and city councils. What’s more, they’ve been content to see pensions be underfunded, because if they were paid more up-front, local taxpayers would see the cost immediately, instead of having it hidden on accounting books nobody in the general public ever reads. This was a deliberate sleight of hand and, their compensated service to the public notwithstanding, those who are responsible should be fingered for it.

George Levinson

August 13, 2018 @ 8:10 am

There is plenty of blame to go around but the least is the taxpayers who are suffering for the horrible situation that the politicians and the unions have inflicted on the town. Dan Garrett is absolutely correct when he focuses on the age of collection for pensioners. Every guardian who retires after 20 years puts a multi-million dollar burden on future taxpayers. Unless substantial changes are made to reduce the long term pension liability as it now exists the only solution is layoffs. Every job that is removed will save the town millions.

George Levinson

August 13, 2018 @ 8:18 am

There is plenty of blame to go around but the least is the taxpayers who are suffering for the horrible situation that the politicians and the unions have inflicted on the town. Dan Garrett is absolutely correct when he focuses on the age of collection for pensioners. Every guardian who collects early puts a multi-million dollar burden on future taxpayers. Unless substantial changes are made to reduce the pension liability as it now exists the only solution is layoffs. Every job that is removed will save the town millions. Also lets not forget health care. This year the budget is 42.9 Million and that grows every year.

George Levinson

August 13, 2018 @ 8:25 am

Sorry for the double list thing above. I forgot to mention the financial gimmicks. For years the only solutions offered have involved refinancing. bonding and overestimating revenue. In addition to the horrible financials going forward this year Hamden is dealing with a $9 million shortfall from last year. The financial gig is up.

B. Wang

August 13, 2018 @ 10:06 am

Hamden is a mess when it comes to spending. I wouldn’t blame this problem on the police and fire unions. it’s not there fault that they were able to negotiate some of the highest salary’s in state. Can’t blame a worker for getting themselves better wages benefits. Blame the politicians for negotiating / allowing these contracts to happen. I know most wont agree with this next statement but blame the voters for electing these politicians for the last 30+ years. The majority of voters that show up keep re-electing these councilmen and mayors despite the situation they keep putting us in. Time for those voters to take some of the responsibility. Everyone yells and screams all over social media when taxes / mil rate is raised and when articles like this come out but will still reelect these politicians and not show up at council budget meetings / hearings. These are not new problems in Hamden and the state; everyone has known about them for years yet we as the voters continue to keep the Democrats in control. We cannot keeping pushing debt back and keep over spending thinking we will make it up In the following years. If we want change it’s time to stop electing democrats in hamden and give the Republicans and Independants a shot at cleaning this mess up that the dems created and have allowed for the last 30+ years. The charter needs to be rewritten to give residents more of a say in the budget like mentioned above. We also need to take some power away from the major and establish a town manager position like Cheshire. Education is extremely important but we are way past the point of being able to afford what we have. We privatized the golf course and the rink to generate money for the town. Have either actually done anything but put thousands in the operators pockets and cost the town money ? The golf course has been allowed to fall apart and be mismanaged for years now. Laurel View if run properly would be generating some good money for the town every year. New Haven was able to do it with Alling Memorial. Take home vehicles for out of town employees should be a thing of the past, if you’re in a position that requires your own town vehicle you should live in town. Our finances are in big trouble now and are only getting worse. All this debt is going to come due in the future along with the crumbling town buildings and infrastructure. There is nothing in the foreseeable future that will add big money to the tax rolls to correct this problem. if anything Quinnipiac will continue to buy more property and take more money off the tax rolls and the state is going to continue to contribute less every year. We need to start budgeting with what we have.

Matiste Enrique

August 14, 2018 @ 9:33 am

I think you all need a little research into what you’re talking about. The firemen in Hamden especially just furloughed raises for almost 2 yrs and given back more than half their Holidays for next year, regardless of being away from their families and working them. It seems like every 2 or 3 years the town union agree to concessions to help bailout the town. Most unions have moved to HSA health insurance which is mostly employee contributions barring a major ailment.

The pension funds haven’t been fully funded from well back past Lilian Cayman and are the underlying problem. You don’t stop paying bills and expect them to go away. The MERS plan is much cheaper to the town and over 90% funded. The town has the option to put members in it and turned their noses to it.

The unions make up a fraction of Hamdens budget but are constantly bashed as causing the problems.

Let’s for once take a look at the BOE and actually itemize their budget. Less than 9% of residents have school aged children but they command 60+ percent of the budget. It costs nearly double the price, upwards of $17,000,to send a child to Hamden schools ranking in the bottom half of state educational levels than comparable sized towns with much higher rankings.

Lets talk about economic development. When was the last new construction or businesses that have come to Hamden aside from low-income housing. Drive down Dixwell Ave and look at all the closed and empty retail.

Nobody mentions the economic decline of the lower portion of Hamden being pushed in by New Haven and Yale development.

Nobody mentions CT being the 4th highest entitlements state.

There are much bigger issues here but you all choose to focus on the men and women who respond to your time of need 24/7/365 without a complaint.

Matiste Enrique

August 14, 2018 @ 10:11 am

@Dan – Your numbers are completely wrong. I can guarantee you absolutely NO ONE is retiring in their early 40’s and making 60k. After 20 yrs service they may make 2/3 of that at retirement. To put that into consideration, it’s less than approx. 44k of entailment benefits if you took advantage all the programs available.

@Marjorie – You’ve been part of the problem and still are. Overspending in Hamden apart from unions is the biggest problem. The politicians would never manage their money this way and be successful.

@Everyone else – If you feel they are overpaid, go put yourself in their shoes for a day. Walk up to a criminal with nothing to lose. Sit in traffic and put your back to cars while you cut another distracted driver out of theirs. Work a night/holiday/weekend shift. Work a 24hr shift. Stand in vomit, urine, feces, blood and then go home to your family with your HSA.

Or we can actual focus on curtailing frivolous spending of millions on the non-lifethreating matter the government throws away.

I (we) will personally go back to my cushy desk in my climate controlled environment and return to my paperwork (or managing properties given to me) and work on voting in new leadership.

Steve Callahan

August 14, 2018 @ 10:22 am

How about putting the employee healthcare out to bid, regardless of who might be getting kickbacks? How about listening to employee suggestions on where they can cut spending on useless equipment in each department? How about not trying to pull a fast one using the state pension as a temporary band aid and then crying about it when they slap you on the wrist? How about not giving non union personnel huge raises when asking for union concessions? How about not handing out a complimentary pension to an elected official? How about acknowledging the fact unions have made cutbacks in vacation time, sick leave and pension COLA?

Brandon Wilson

August 15, 2018 @ 4:09 pm

As someone who has worked on pension plans my entire career, this is a poster child for poor management. Benefits were agreed to, but not funded and I suspect the investment portfolio has a high allocation to equity markets in an effort to make up the difference.

The fact is that all benefits must be funded over time and the earlier you start the more flexibility you have over your 25-40 year working career to fund the benefits.

Defined benefit plans are not the problem, but they are a symptom of bad behavior and poor management of over-promising and under-funding benefits over several decades. At this point many of these programs will not meet their obligations and the people who will suffer the consequences will be the retirees.

Public pensions end up being some of the worst managed plans because there is a huge incentive for people responsible for managing the plans (elected politicians) to promise generous future benefits to appease public employees, while also minimizing the immediate financial impact by minimizing or delaying actual contributions to the plans and investing fairly aggressively.

On a societal level, well funded defined benefit pension plans are a better solution for all. This would required contributing somewhere between 10-15% of your earnings into the plan each year and investing it conservatively. The investment and administrative cost to manage these plans is lower and it provides more stable income for retirees. If you want to replace 70-90% of your pre-retirement income on your own in a defined contribution plan, the savings over your entire career are in the 15-20% range which is not cheaper, it’s just math.

Sorry to say that we should expect this story to be repeated quite a bit across the nation over the coming 10-20 years.

Marjorie Bonadies

August 16, 2018 @ 2:36 pm

@ MatIste please explain how I am part of the problem?? I got on the council in 2014 after the pension obligation bonds were voted on. I have advocated for paying the full actuarially required contribution and have asked for the pension board and actuaries to present the fiscal health of the plan every year, something that was not done prior.

Yes, I did vote to refinance 44 million of debt this year in order to not raise the mill rate above 50. It cost the town 16 million to do it. The budget would not work without it. I didn’t create these problems but I AM trying to protect taxpayers from steep tax increases in one year. We should have raised taxes by 2 mills last year and 2 this year to smooth things out but you can guess what happens in an election year.

Scapegoat

August 18, 2018 @ 8:16 am

Who gave the golf course to someone with a documented track record of mismanagement in other towns? Town Council. who then paid all the unpaid utility bills at the golf course to the tune of hundreds of thousands of dollars owed by that contractor? TC. Who then renewed his contract? TC. Why? Local boy. Who paid 300k for the building next door to the town hall, paid 50k to tear it down, and sold it to local restaurant for 150k?, TC. Who has never put health insurance out to bid, TC. But lets blame the people who we asked to come work here!

Dan Garrett

August 18, 2018 @ 8:20 am

Matiste, I wish my numbers were completely wrong as you state. Unfortunately, they are 100% correct. I have a list of all 750 retired Hamden employees. A former police union president ended employment in 2014, at the age of 44 and receives $65,779.92 as of 7/01/16. With cola or cost of living adjustment as high as 3% per year that figure is higher as of today’s date. A high ranking fire department employee ended employment at age 41, receives $70,714.68 per year. Another police officer ended employment 8/31/2012 at age 42, and receives $56,313.12 per year. And lastly, a former Hamden police officer and now mayor of a neighboring town, ended employment 8/31/2013 at age 47 and receives $64,875.84 per year. Hamden police average $130,000.00 per year, have excellent healthcare and other benefits. We must end the practice of 20 and out and face reality. No police or fire personal can end employment and receive pension payments till they reach the age of 62. These pension documents will will be brought to Hamden’s next council meeting on September 4th, I hope to see you there.

Scapegoat

August 18, 2018 @ 9:08 am

It has ended, all new employees go on the state plan for years. Except of course for the elected official recently added to the closed town pension plan, by who else? The town Council. And they had to change the town charter to do it. The biggest problem this town has sits right round that table folks, the needs of their friends will always outweigh the taxpayer.

Dan Garrett

August 19, 2018 @ 9:22 pm

Scapegoat, You’re correct. Adding another town employee to an incredibly troubled pension plan was a very poor decision by the council.

Fustrated Citizen

September 11, 2018 @ 1:53 pm

This Town needs a town manager. Someone who has an education and real life experience in business management, someone that is not politically connected and has a resume. We have for years elected incompetent “Good Ole Boys” who are in constant political debt and can’t balance a checkbook. This is the problem with this town, we elect moroons year after year and this article sums it up. Our current mayor is a complete TRAIN WRECK, he barely shows up to work and when he does he’s making side deals with department heads. Why does the Public Works Department have millions of dollars invested in equipment when they don’t need/use it. Weed the flower beds at the Taj Mahal police station or clean up the government center. The public works dept looks like a vacant junk yard! Get it together Hamden, stop blaming everyone else and fix the problem. We keep trying to fix the problem by increasing taxes how about curb spending. We can layoff 90% of the government center and it wouldn’t effect a thing. 40+ years in this town and I’m embarrassed to say I live here. Please.. stop the bleeding!!

Mark

June 12, 2019 @ 11:15 pm

I see that I’m a little late to this party, but faced with facts, I see that Marjorie Bonadies and Matiste shut up.

Tom Yi

July 8, 2019 @ 9:47 pm

We were looking to buy our first home recently while we were living in an apartment in Hamden. Our real estate agent’s first words were “You should look outside of Hamden, the taxes are very high.” Hamden’s Mill Rate (47) is 20 points higher (!) than neighboring towns like Shelton and Milford (27). So if you have two modestly priced cars (<30K) and a middle tier home (<400k) you will end up paying an extra $4,000-$10,000 a year just to live in Hamden. We decided to save our $5,000 and live elsewhere.

It would be one thing if Hamden were an amazing town. But there are barely any good restaurants for delivery, the roads are always riddled with potholes, there are virtually no public parks, the schools are only decent, and the traffic congestion is a real problem (e.g.) Town Hall (and why can't we turn right on red anywhere? Are we idiots?).

I hope the city leaders know that they are pushing young families out of the city with their excessive taxes. I'm a lifelong Democrat and Hamden convinced me that there really is such a thing as overtaxation.

Corpely.com

August 28, 2020 @ 6:15 am

Now, decades later, what has happened to Hamden? It is still outstanding, first in its class in Connecticut but, unfortunately, not because of its schools and public services but because it has the highest per capita debt of all the 169 towns in the state.

Scott

September 4, 2021 @ 11:14 pm

This town is a joke.! Its the democratic way! Tax and spend! When are the residents going to realize Democrats are the proBlem! Pro union ! Anti resident plain and simple!