Connecticut’s discount rate for its teacher pension system remains higher than most other states, according to a report by the National Association of State Retirement Administrators.

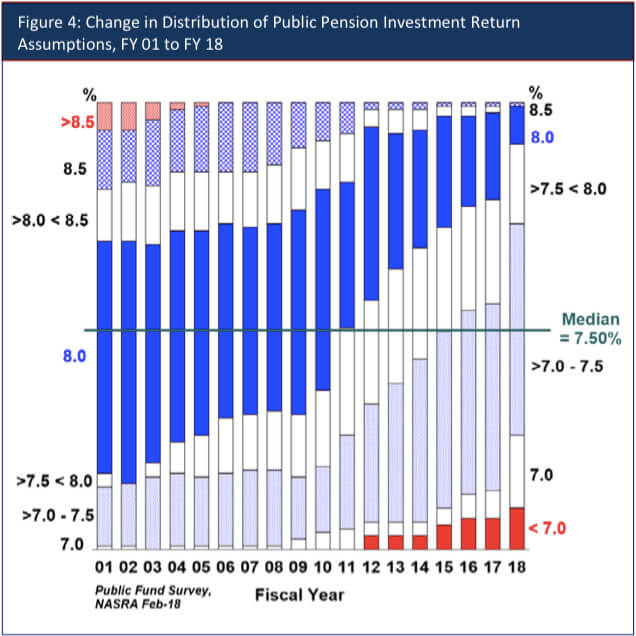

States across the nation, including Connecticut, have lowered their assumed rate of return for pension funds as investments have consistently failed to live up to expectations.

Connecticut lowered the discount rate of the teacher’s retirement system from 8.5 percent to 8 percent in 2016, but it still remains higher than most other states. According to NASRA the median discount rate has dropped to 7.5 percent.

“Among the 129 plans measured, nearly three‐fourths have reduced their investment return assumption since fiscal year 2010, resulting in a decline in the average return assumption from 7.91 percent to 7.36 percent,” the report said. “If projected returns continue to decline, investment return assumptions are likely to also to continue their downward trend.”

Discount rates assume a pension fund will earn a particular rate of return and use that assumption to discount how much the state has to pay into the pension fund.

A higher rate of return means the state can make lower annual payments — but it comes with some significant risks and hides the true extent of a pension fund’s liabilities.

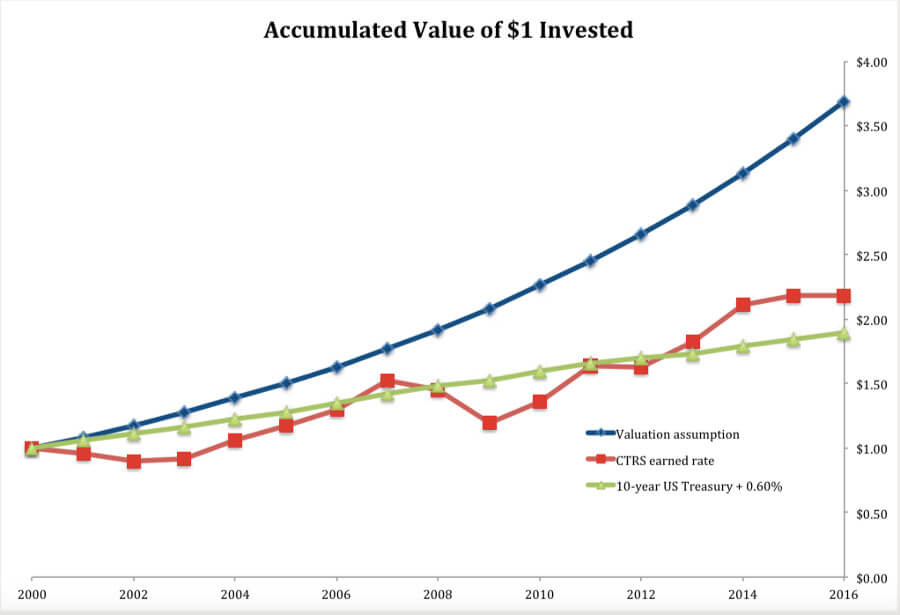

Over the past 10 years, the teacher pension fund has only returned 4.8 percent, according to a 2017 study on the teacher retirement system by Eric Halpern. This discrepancy does not bode well for the retirement fund.

According to the Center for Retirement Studies at Boston College, teacher pension costs could spike from $1.2 billion per year to nearly $6 billion per year if the discount rate is not met, a cost which is essentially impossible for the state to support.

Using Connecticut’s 8 percent discount rate, the TRS is officially calculated as only 56 percent funded, with a $13 billion shortfall.

However, according to Halpern’s study, if Connecticut calculated its funding ratio based on safer, low-risk treasury bonds, it would only be 33 percent funded.

Gov. Dannel Malloy recently called for reducing the discount rate for Connecticut’s teachers retirement system to 6.9 percent, as he did for the state employee retirement system in 2017.

However, lowering the discount rate would mean Connecticut has to pay a larger annual contribution toward the pension system. Lowering the discount rate to 6.9 percent would increase the state’s contribution by nearly $300 million, according to Halpern’s study.

Connecticut is already faced with mounting deficits, which are expected to top $4 billion during the next budget cycle. The cost of pension payments are one of the fast-growing “fixed costs” in the state budget which are growing faster than revenue.

Malloy has also proposed stretching out the debt payments for the teacher’s pension fund to prevent the costs from spiking to insupportable levels, but may face legal difficulty due to a $2 billion bond the state took out in 2008 to prop up the beleaguered retirement system.