The personal income growth for Connecticut residents was the slowest in the nation since 2007, according to a report by Pew Charitable Trusts.

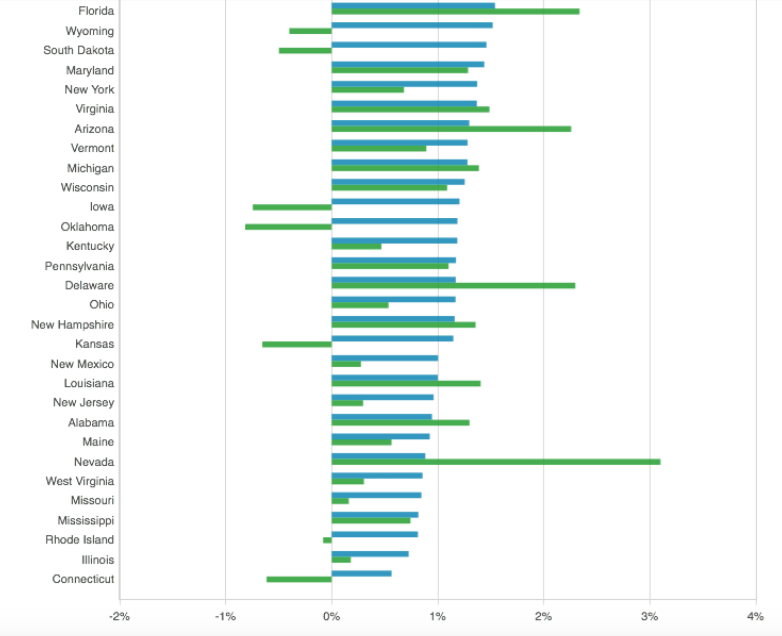

Personal income in Connecticut for 2017 actually dipped .6 percent into the negative, and the residents’ personal income growth rate since 2007 has been an anemic .6 percent. Overall, Connecticut’s personal income growth during 2017 was the fifth worst.

The average growth rate for the nation was 1.3 percent over the past year and 1.6 percent since 2007.

Connecticut’s economy has remained consistently slow. Earlier in the year, Connecticut personal income growth was slightly ahead of Illinois, but it has now dropped to last place “after year-over-year drops in personal income for three straight quarters,” the report said.

Job numbers have also been dropping for the past three months after an early-year uptick. Currently, Connecticut has only added 2,000 jobs since the start of the year, essentially remaining flat, and economist Donald Klepper-Smith of DataCore Partners has warned the state may face a recession in the future that it is not prepared to handle.

“Connecticut has been on recession watch for the last year due to tepid employment growth, increased residential outmigration, and the departure of several Fortune 500 companies, which has undermined business confidence,” Klepper-Smith said in an earlier interview.

The slow growth rate in personal income may partly explain the exodus of people leaving the state, seeking work and opportunity in places that have shown strong economic growth in the past few years. States with growing populations have also been shown to have higher personal income growth.

States like Texas, Utah and Colorado have high population growth rates, coupled with high personal income growth. Personal income growth in Utah grew by 2.8 percent over the past year.

Connecticut’s economy has been slow to recover since the 2008 recession and remains one of the last states in the nation that have not regained all the jobs lost that year. Conversely, neighboring states like Massachusetts have recovered remarkably well.

The Connecticut Business and Industry Association’s annual survey of businesses showed that only 36 percent reported that they were growing and half were remaining steady. The remainder of those surveyed said their business was shrinking.

Businesses reported that the cost-of-living, uncertainty from the state legislature, taxes and regulatory burdens were hampering their ability to expand.

The slow income growth also puts added pressure on residents in a state with one of the highest cost-of-living in the nation. Connecticut had two of the largest tax increases in 2011 and 2015, but revenues have not kept up with expenses, leading to call for more taxes and fees.

The flat personal income growth rate may not bode well for the future of Connecticut’s budget, either. Lower-than-expected income tax and sales tax figures have sparked big deficits, most recently the $5.1 billion deficit which sent the legislature into overtime and delayed the budget process by 120 days.

Forecasters are already predicting Connecticut will face a $4.6 billion deficit for the 2020-2021 biennium. The combination of declining tax revenue and growing fixed costs such as debt service and pension payments could make for another difficult budget process.

The latest budget deficit was largely mitigated through a concessions deal with state employee unions, decreased municipal aid and an added tax to hospitals, but the effects of those changes could add more pressure to residents in the future.

The concessions deal locked in some spending until 2022 with a series of raises for state employees coupled with layoff protections. The decreased revenue to municipalities may affect property tax rates for those towns and cities which don’t have enough savings to make up the difference.

Pew compiled the figures from the U.S. Bureau of Economic Analysis. North Dakota, Utah, Texas and Colorado held the top spots for income growth in the country.

This article was updated to show that Connecticut’s income growth the slowest in the nation since 2007, not in 2017 alone in which it had the fifth slowest income growth.