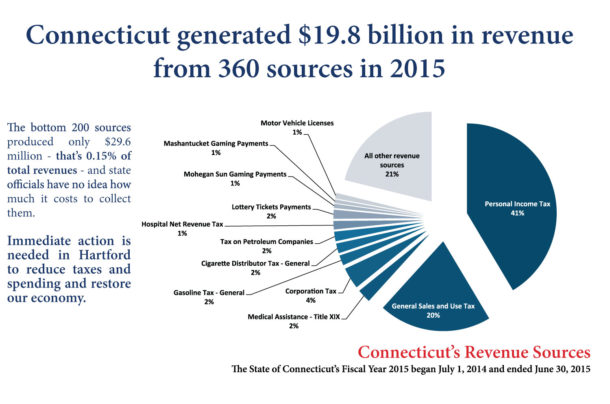

Connecticut’s 360 Sources of Revenue

(see pdf for complete list)

Look for the red line – below that line are the bottom 200 sources of revenue, which bring in only $29.6 million. That’s 0.15% of total revenue. Ask your state lawmaker to cut unnecessary taxes and fees.

Your Taxes Are High — So Why Is Connecticut Still Broke?

Connecticut residents pay more in taxes than residents of any other state. Yet our state is broke. This year, lawmakers must close a $930 million gap – and in the next two years, that number is expected to grow to several billion dollars.

Over the past five years, lawmakers in Hartford have imposed two of the highest tax increases in state history on our state’s people – compelling families and businesses to flee Connecticut.

We’re overtaxed, but some lawmakers say taxes will need to go even higher.

Even as they voted through tax increases, lawmakers also voted to cut funding for essential services like education, mental health, and help for the intellectually disabled.

So why are taxes going up while services are decreasing?

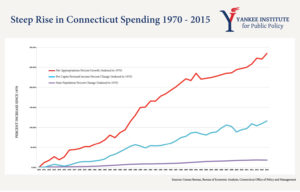

Answer: Parts of the budget are growing so fast that tax revenues can’t keep up. Most of these line items pertain to state employee compensation – including salaries, health care, retiree health care, and pension obligations.

- Connecticut taxpayers pay more for each state employee than any other state in the nation, when salary, overtime and benefits are included – so it costs more to deliver basic services.

- Government employees are paid from 25 to 46 percent more than their private sector counterparts with similar levels of education and experience.

- Connecticut has billions of dollars of pension debt – and no real plan to deal with the structural issues that caused this debt to grow.

- Years of underfunding, approved by government unions and political leaders alike, have left us with huge pension liabilities. Lawmakers and union leaders played politics with the pension fund – leaving taxpayers to make up the difference.

- The health plan offered to state employees and retirees is one of the most expensive plans in the nation.

- Even as working people in the private sector have had to pay more and more for their health care, the state’s health care plan covers just about everything and requires only small contributions from employees and retirees.

- Union leaders have made it very difficult to change the status quo.

All other states in the Northeast set employee benefits in state statute, which allows politicians to be held accountable. Meanwhile, government unions in Connecticut are allowed to bargain collectively for these benefits – and then lock those benefits into plans stretching out over several years. What’s more, if politicians don’t vote on the agreements, they automatically go into effect.

The status quo isn’t working. Structural changes are necessary to fix these problems.