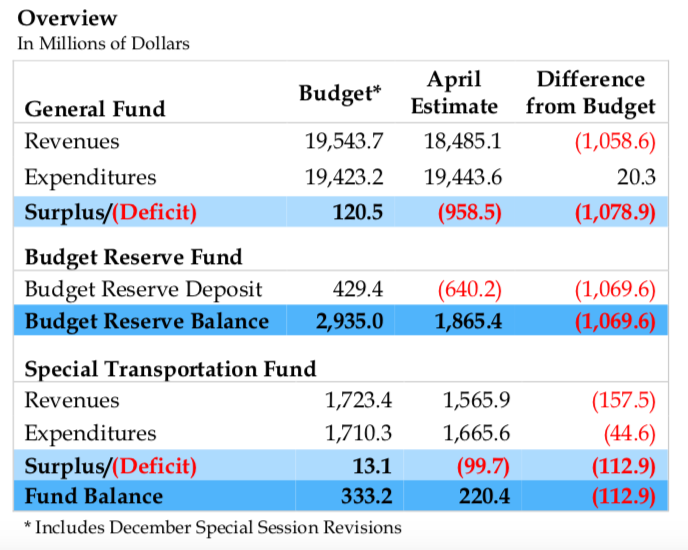

Budget numbers released by the Office of Fiscal Analysis show Connecticut’s budget deficit this year grew to over $1 billion, an increase of more than $687 million over the previous estimate.

Gov. Ned Lamont had said this year’s deficit would be roughly $500 million, with next year’s deficit reaching $1.5 billion, but the impact of the economic downturn and the closure of businesses in response to the COVID-19 pandemic has left a much larger budget hole than earlier projections.

Sales Tax revenue was the largest downward revision, dropping by $281.9 million as a large section of the economy related to hospitality services and retail has been forced to close their establishments to the public.

Overall, income tax revenue remains the largest loss, with estimated revenue coming in $490 million below budget projections. Gaming revenue is down $180 million in total as casinos have closed, and revenue to the Special Transportation Fund is down $134 million as gasoline prices hit rock-bottom and 50 percent fewer vehicles are on the road.

Connecticut currently has $2.5 billion in its reserve fund but that will not last long. The OFA says this year’s deficit will require a draw-down of the Rainy Day Fund, leaving with only $1.8 billion heading into the next fiscal year.

But the OFA wrote that because of tax filing deadline extensions the true deficit will not be known until August and further budget adjustments “are likely to be much larger than typical” and are “unknown.”

The Office of Policy and Management estimated revenue figures going forward that shows deficits of $2.3 billion in fiscal years 2021 and 2022, and roughly $2 billion in 2023 and 2024.

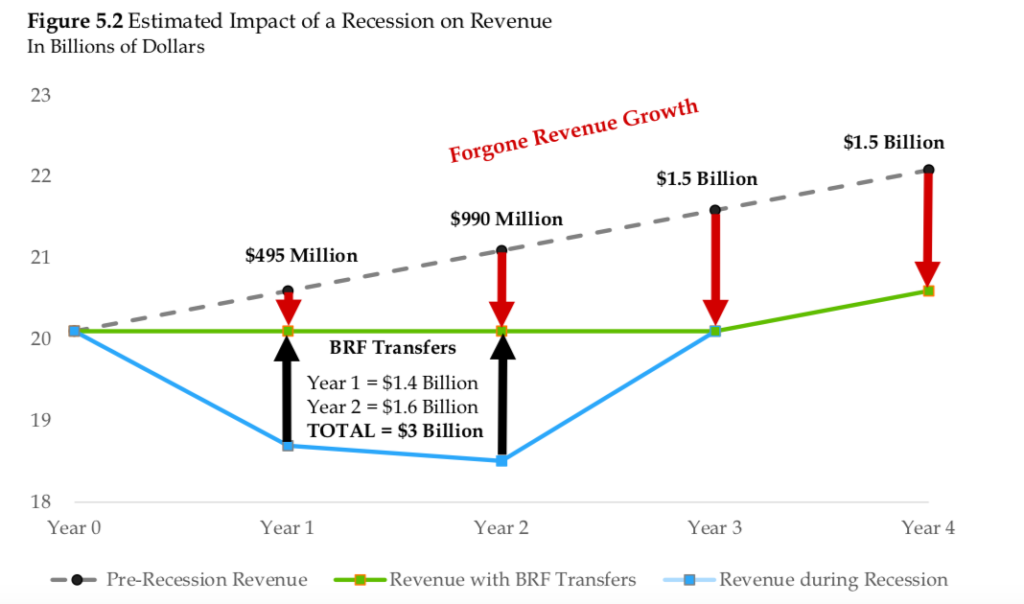

In effect, the Rainy Day Fund is likely already gone for the foreseeable future and Connecticut will be faced with escalating costs and much lower revenue.

Connecticut already faced an on-going “structural deficit” because fixed costs related to Medicaid, unfunded pension and retiree healthcare liabilities and debt costs were rising faster than revenue.

Fixed costs were projected to 4.8 percent per year, while revenues were growing at roughly 2.5 percent. That was before the pandemic.

A previous report by the OFA showed how an economic downturn results in forgone revenue, while expenditures continue to increase creating a large, on-going gap. This raises the question of tax increases or large cuts to government services in the future.

Annual payments for both state employee and teachers pensions and retiree healthcare is expected to grow from $2.8 billion this year to $4.13 billion by 2024, according to the OFA. Costs related to debt and Medicaid are projected to rise from $6.3 billion to $7.29 billion in the same time period.

Lamont closed a $1.9 billion deficit last year, largely through reaching a deal with Connecticut’s hospitals to retain some of the tax revenue related Connecticut’s hospital tax. Lamont also increased the number of services subject to Connecticut’s sales tax and increased some fees.

But large and on-going deficits of this size means Connecticut may have to revisit its long-standing labor contract with the State Employees Bargaining Agent Coalition, which governs pensions and retiree healthcare.

Gov. Dannel Malloy reached a concession deal with SEBAC in 2017 to save the state $1.5 billion per year by increasing pension and medical contributions by state employees and increasing copays for retirees.

However, the agreement also awarded roughly $353 million in raises for state employees. More than half of that raise is scheduled for July of this year. In total the annualized cost of those raises going forward is projected at $387 million per year.

The deal also awarded layoff protections for state employees until July of 2021.

Meanwhile, nearly 500,000 people in Connecticut have filed for unemployment and the state is hoping for further stimulus payments from the federal government to help with its unemployment trust fund and ongoing deficits.

That may prove to be a fight in Congress, which has already pumped $2 billion into bailouts for corporations, small businesses, governments and individuals.

Economists were initially hopeful that the economy could see a quick rebound if a cure or vaccine for the COVID-19 virus was found and stocks have been moving higher on positive reports that a vaccine or treatment is in development.

But the long-term fallout from the closure of businesses may not be so easily overcome.

Lamont said yesterday during a press conference that businesses like restaurants and small stores could begin to slowly reopen starting May 20.

Thad Stewart

May 7, 2020 @ 6:14 am

It baffles the mind, that our gubner can’t figure out that by telling everyone to stay home HURTS everyone’s bottom line, including the dumbo crats who are addicted to spending other peoples money like a drunken sailor on leave. The fact that our gubner is talking about handing out raises and instilling tolls at this point is treasonous. A reasonable and fair governor, probably would have reeled in spending, somewhat, when revenue sources were frozen by a state wide shutdown. But, no our gubner chose to keep looting the state coffers to line his and his paid for voters pockets, ABSOLUTELY SHAMEFUL! I hope the hard working taxpayers of this state wake up in November, and decide to change course, by GETTING RID OF THE DEMO cratic LAP DOG in the GUBNERS MANSION!

Mr. Darryl Street

June 13, 2020 @ 9:11 am

STATE OF CONNECTICUT

Due to COVID19 pandemic sweeping USA and killing more than 110,000 AMERICAN CITIZENS, the State and Federal Government is in State of Emergency, with huge financial crisis and significant unemployed young,middle age people.

It is time to CUT LABOR FORCE by at least 50% in viz:

1. School Teachers in State of Connecticut

2. Medical Benefits to School Teachers in Connecticut

THIS WILL SAVE THE STATE BUDGET DEFICIT AND THE MONEY SAVED CAN BE USED FOR COVID19 RELIEF WORK FOR EXAMPLE VIZ:

1. The purchase of Ventilators

2. Erection of more ICU Beds

3. Purchase of Medicines

4. Provide Unemployment benefits

GOAL : SAVE MORE LIVES, SAVE MORE LIVES IN CONNECTICUT

THANKS