Connecticut has the most underfunded pension system in the nation, amassing more than $127.7 billion in liabilities, according to an annual study by the American Legislative Exchange Council.

The study entitled Unaccountable and Unaffordable showed Connecticut’s pension system dropping below Illinois and Kentucky when its pension liabilities were calculated with a “risk-free” discount rate equal to the rate of a U.S. Treasury bond.

Connecticut’s unfunded pension liability rose from $99.2 billion in ALEC’s 2016 study to $127.7 billion in 2017, leaving the pension system only 19 percent funded.

The debt from the public pensions amounts to $35,721 per person in Connecticut, the second highest per capita debt in the nation behind Alaska.

Co-author of the study and Connecticut native, Thurston Powers, says “These figures represent a history of pension fund mismanagement and an ongoing unwillingness to pursue meaningful reform.”

Wisconsin had the best-funded pension system at 61.5 percent, but still far below the recommended 80 percent minimum.

Officially, Connecticut claims the pension fund is 47 percent funded, but the study says this figure hides the fact that states use a discount rate much higher than the rate used by private plans, inflating the funding ratio.

Connecticut traditionally used an 8 percent discount rate, but Gov. Dannel Malloy and the State Employee Retirement Commission lowered the rate to 6.99 percent earlier this year.

The change was not reflected in the 2017 ALEC study which relied on the latest valuation from the state, but Powers said it should reflect positively on Connecticut next year. Other studies have also recommended using the rate of a U.S. Treasury bond – slightly more than 2 percent – when calculating pension liabilities.

The change in discount rate was part of a refinancing of the state employee pension debt, which extended payments out to 2046 in an effort to keep the costs from spiking to unmanageable levels.

But the study says this move could potentially cause more tax increases in the future. “Because the fund will have relatively fewer assets generating investment income over the next two decades as a result of this delay, a combination of higher taxes, reduced state services, and pension benefits cuts becomes more likely in future years.”

Even after delaying the payments on pension liabilities, Connecticut’s annual contribution toward the state employee retirement system will grow from $1.5 billion per year to $2.2 billion by 2022.

The state’s payment to the teachers retirement system is expected to grow much more, potentially topping out at over $6 billion by 2032 if the state fails to meet its annual discount rate of 8.5 percent, according to the Center for Retirement Studies at Boston College.

Gov. Malloy made several attempts to alter the funding of the teachers retirement system, including forcing municipalities to cover one-third the cost of the pensions and refinancing the unfunded liabilities, similar to what was done for the state employee system.

Neither plan made it into the final budget.

The authors of the study wrote that both politicians and union leaders have a vested interest in keeping the discount rate high as it hides the true debt and allows the state to contribute less toward the pension system than it actually requires. This leaves more money available for wages and state government expansion.

“While Connecticut is the worst, this is a ubiquitous problem,” Powers said. “The pension crisis is largely created by a set of poor incentives inherent to defined benefit plans. Politicians, union representatives, and fund managers all share a perverse incentive in underestimating the pension liability.”

But the years of underfunding those pension plans is catching up with Connecticut and neither lawmakers nor taxpayers can hide from the costs much longer.

Connecticut’s pensions are part of the state’s “fixed costs” of pensions, retiree healthcare and debt service, which now comprise over 50 percent of the state budget, crowding out other state services or forcing tax increases to continue funding those services.

Connecticut has already endured two large tax increases in 2011 and 2015 but, according to Office of Policy and Management Secretary Benjamin Barnes, the increased revenue from those tax increases has not been enough to keep up with the rising pension costs.

Tax revenue has also been stagnant and, in some cases, falling below state projections, leaving large deficits which lawmakers then scramble to fix with either service cuts or more tax increases.

Although lawmakers can change teacher pensions through legislative action, state employee pensions are set through collective bargaining. The SEBAC benefits contract, first signed in 1997, was extended until 2027 through a union concessions deal Malloy made with union leaders earlier this year.

This means that lawmakers have little recourse in reforming the state employee pension system until the contract expires in ten years.

Connecticut is one of only four states in the nation to set retirement benefits through collective bargaining rather than in statute.

The study did point out some states which have made reforms to their pensions systems. Pennsylvania and Michigan have both created new defined contribution or hybrid plans for new employees or teachers.

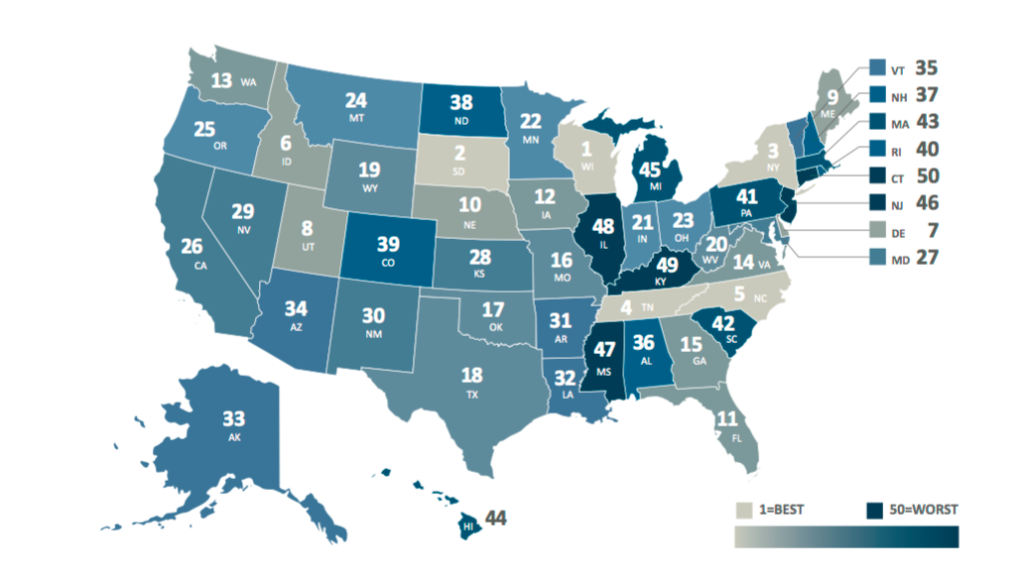

Although Connecticut ranked as one of the worst states for its unfunded pension liabilities, every state had underfunded their pensions and used overly optimistic discount rates. The total liability for all 280 state-administered pension plans included in the study exceeds $6 trillion.

“The most effective way to prevent Connecticut’s pension crisis from deepening,” Powers said, “is to remove the states ability to underestimate its liabilities by switching new hires to a defined contribution plan, as Pennsylvania has for hires 2019 and later.”

Fred

March 22, 2019 @ 8:53 am

After spending my entire life in CT watching more and more regulations and fees and licenses along with taxes continually rising more than my raises I was fed up with the financial mismanagement. But when I found out the CT state employees elite were giving themselves pensions over $100k, one over $300k. I decided I was not going to do without so a few could live real good. I lmoved. Much happier now. So who’s paying the $35k debt owed now?.